Finance management for healthcare is essential. Here, we look at the key ways to adopt HIPAA.

HIPAA-compliant (Health Insurance Portability and Accountability Act) credit card processing is a vital framework for many businesses in the healthcare sphere. Countless organizations deal with personal client information that, if leaked, can damage their reputation. For example, a leak about the patient’s psychological state may result in the client losing a job. Companies failing to consider this factor risk encountering massive lawsuits. For instance, CommonSpirit Health, an American non-profit healthcare network, now faces a lawsuit because it failed to prevent a leak of personal information during a ransomware attack. This article reviews the key practices for processing credit card data in a law-compliant manner. As you’ll find out, only focusing on several vital pieces of advice can make the experience of using a healthcare payments processor safe.

HIPAA-Compliant Credit Card Payments Processing

HIPAA-compliant credit card payment processing requires a focus on several practices. Firstly, one should generally use the newest technology in all their key activities. HIPAA-compliant payment processing requires companies to close as many software-related gaps as possible to guarantee patient security. An un-updated piece of software creates tremendous risks due to the constant attempts of hackers to find vulnerabilities. One of the notable protection frameworks is PCI DSS (Payment Card Industry Data Security Standard). A company wanting to secure credit cards should focus on this approach as it dictates the key standards for software. Secondly, a major investment is necessary for the encryption of patient data. HIPAA-compliant frameworks prohibit one from storing the key patient data in plain-text files (regrettably, some cases of such negligence were present in the history of software firms). It’s crucial to use at least vP2PE (and preferably more complex technologies) encryption for the files with the customer payment information.

Thirdly, a major factor is to store all the client data in a safe location. You should use a server with full-disk encryption (apart from separate file encryption) and a clear separation of access rights. Cloud services also work as long as they adhere to common standards. A server under your control is essential because it enables the monitoring of all activities. Modern systems record most actions happening in the servers. This means the owners can track any suspicious activity. Lastly, a major factor is potent authentication and authorization features. Here, several measures are essential for HIPAA-compliant payment processing. One should invest in password protection for online accounts and two-factor identification. The more layers of authentication exist, the better for the customers as you raise the chance of finding a fraudulent account.

Importance of Secure Credit Card Payment Processing

Secure credit card processing is essential for several vital reasons:

1) It protects the customers against fraud and data leaks. Such events are hurtful for the clients: they lead to the loss of funds or even the publication of personal information about certain diseases. HIPAA-compliant payment methods reduce the probability of customers being hurt by such events;

2) It protects the firms against legal challenges and reputation damage: any data leak is a major sign of the firm incompetence. Personal data leaks often result in lawsuits for healthcare and non-healthcare companies. Recent information showed that Memorial Health System faced significant reputation problems and a lawsuit after a ransomware attack. Many more reports of similar kinds appear in American publications. Regarding non-healthcare examples, Sony faced an 11-million-dollar lawsuit after the 2011 data leak on its console network.

3) It helps uphold customer loyalty: in the world of common data leaks, customers are likely to see a company that maintains a strong level of security as a market leader. If you want to avoid trouble and attract many customers, a focus on HIPAA-compliant credit card approaches is essential.

Best HIPAA-Compliant Credit Card Processing Practices

Current industry standards show a set of potent methods for ensuring customer safety. Let’s look at the four best HIPAA-compliant credit card processing practices:

Select a high-quality payment processor

The first factor to consider is an investment in HIPAA-compliant credit card processing services. In this regard, the key players in the industry are well-known. They include PaymentCloud, Host Merchant Services, Helcim, Square, and Dharma Merchant Services. Paypal and other popular services aren’t HIPAA compliant officially. This means that you should be careful with investments in such platforms. The most potent businesses in the sector work specifically around the issues of HIPAA compliance.

Find Payment Terminals that Support an EMV chip

Another vital standard to consider is the presence of EMV (Europay + MasterCard + VISA) chip support. EMV chips are a protection technology available in most modern credit cards produced by organizations such as Visa. Not every payment processor, however, supports the technology in question. You should search for terminals working with EMV chips: HIPAA-compliant credit card processing isn’t possible without them. The producers of terminals highlight this characteristic and speak about it openly, so finding the key technology shouldn’t be difficult.

Make Sure to Utilize vP2PE

HIPAA promoters invest major funds into developing high-quality technology to support the legislation. The key approach of this type is vP2PE. This technology is an encryption algorithm working point-to-point (it encrypts both sides of transactions). Devices and software with support for the framework are available for purchase and download on the Internet. We recommend considering this type of compliance as soon as possible because HIPAA demands a focus on it. A lack of vP2PE is a sign that a system isn’t HIPAA compliant.

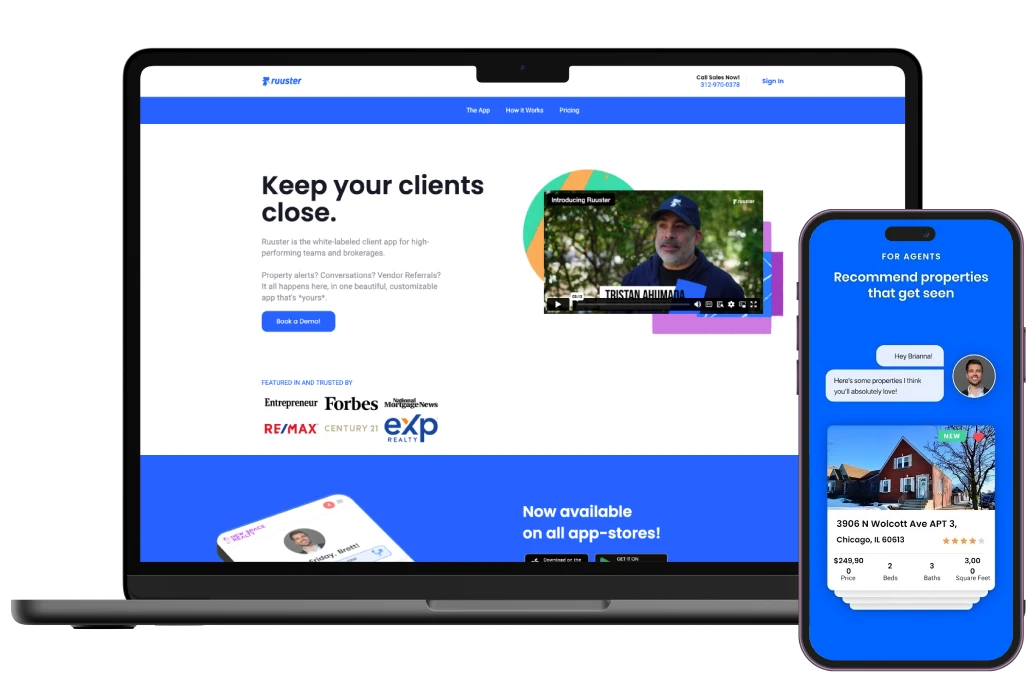

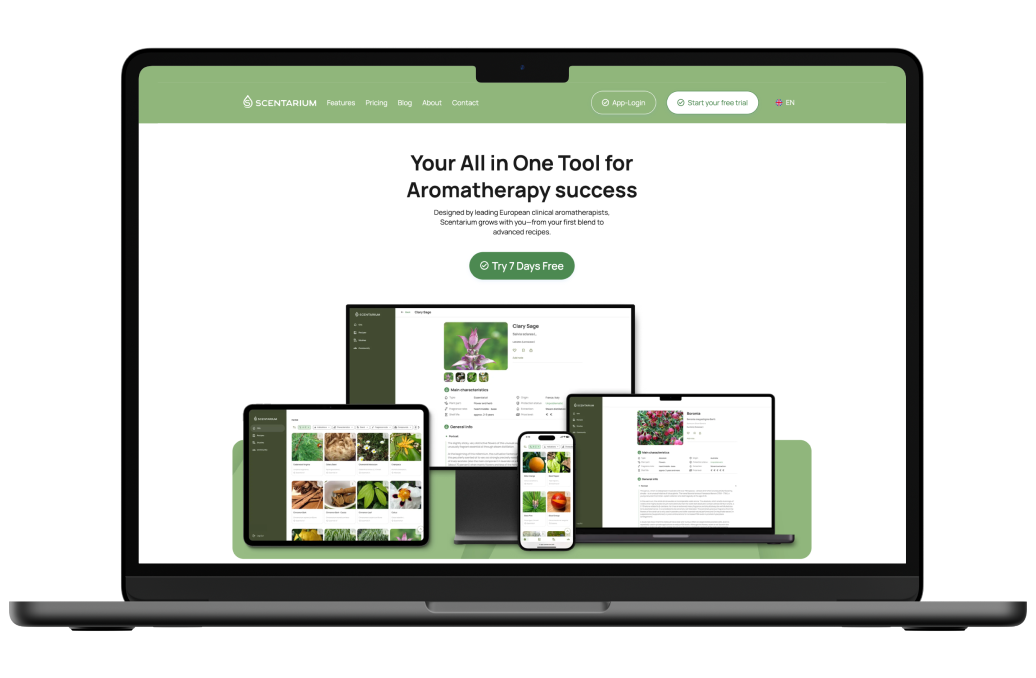

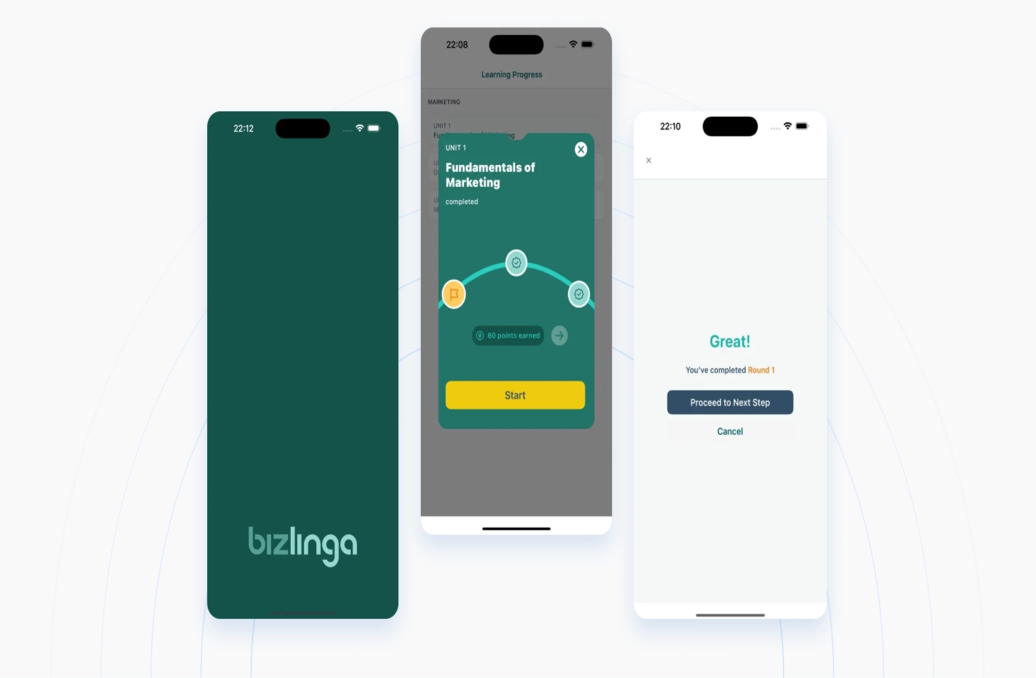

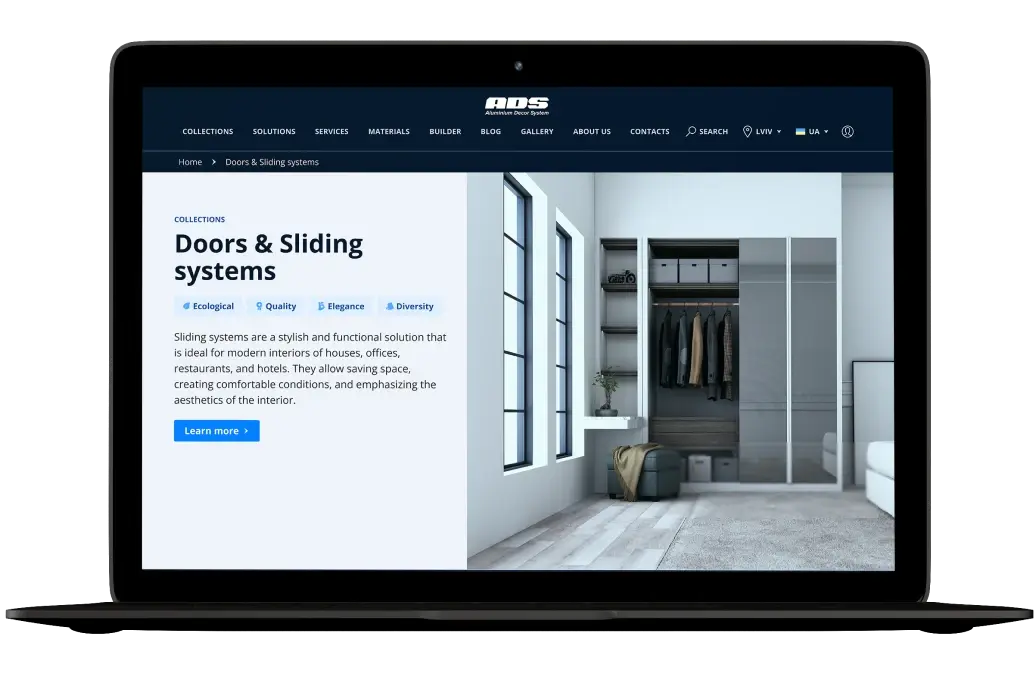

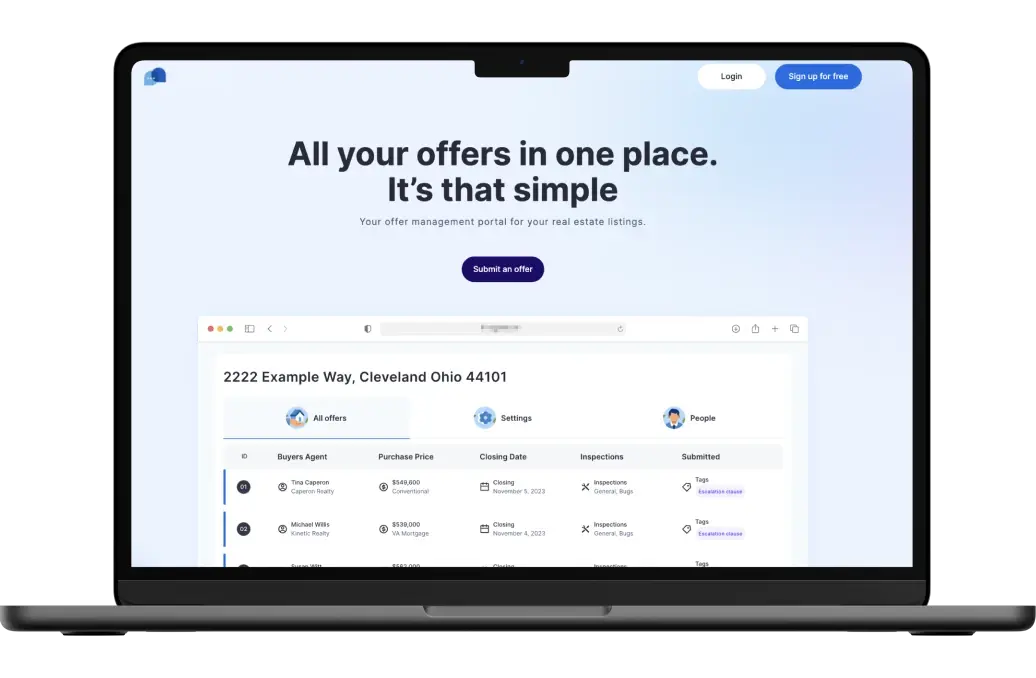

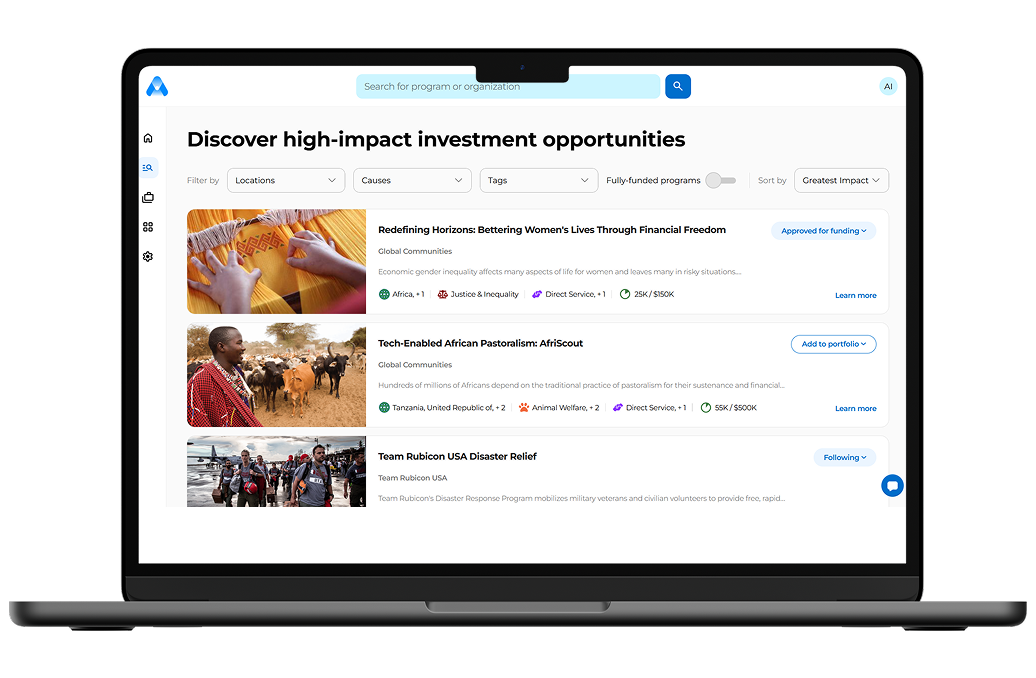

Create Your Custom HIPAA-Compliant Solution

We have listed the best HIPAA-compliant credit card processing companies and services above. They aren’t enough if you work with sensitive information capable of ruining the customer’s reputation. The companies such as Dharma Merchant Services use the HIPAA frameworks. HIPAA, however, doesn’t provide ultimate security: users should go beyond this platform. To achieve this, it’s crucial to create your custom HIPAA-compliant software. In this regard, the best choice is to address some companies dealing with custom solutions in the healthcare sector and beyond. Our company, for instance, has experience in both healthcare and fintech, having the ability to create HIPAA-compliant software for your business.

How to avoid violation penalties in HIPAA payment processing?

Certain actions can lead to major penalties for violating the key HIPAA payment processing standards. To avoid them, you should focus on several goals:

Don’t use standard payment platforms such as PayPal

We know it’s convenient to pay via platforms such as PayPal. Millions of people across the globe use them to promote their businesses. The problem with these platforms is the lack of focus on HIPAA compliance. Their goal is to promote everyday transactions rather than hospital-related ones. According to the existing laws, they don’t have to be HIPAA-compliant. In this light, the platforms are likely to collect information HIPAA prohibits. Instead, your goal is to utilize payment platforms that care about HIPAA and work with the healthcare field. We’ve mentioned some of them, such as Square or Dharma Merchant Services.

Use internal encryption and minimize the amount of personal data collected

Another vital step for HIPAA compliance is the minimization of information you collect and internal encryption. The best HIPAA-compliant credit card processing focuses on adherence to the standard itself and the healthcare facility owners’ common sense. You must invest in HIPAA adherence and additional rational frameworks in this regard. Your hard disks should receive full-scale encryption. All payments must occur solely via two-factor processing. In ideal conditions, it should be two-sided, with both the customer and the operator of the relevant hospital having to confirm the transactions. Your servers, in general, should also have robust security measures. It’s crucial to split the access rights and create as many authentication and monitoring frameworks as possible. Establishing common sense standards for the employees is also important: for instance, they should understand that downloading unknown files from emails is dangerous. All key pathways for ransomware are predictable: you should close them as soon as possible.

Monitor the existing HIPAA Rules

When installing something new to the servers of a healthcare company, for example, it’s crucial to focus on constantly monitoring the rules. HIPAA sometimes changes due to the new demands from the average consumers and the legislators. In this light, one should be careful with the regulations of this type because a service that’s HIPAA compliant can lose its status one day. When installing new equipment or software, you should be careful not to violate HIPAA-compliant medical payment processing. Our recommendation is to always consult with the experts before any changes. Some experts should also monitor the overall status of the HIPAA rules to guarantee their service is within the regulations. Changes are, more or less, inevitable.

Data security standards to be followed when processing card payments

It’s crucial to focus on several types of measures while working with credit card payment:

1. Maintaining the Payment Card Industry Data Security Standards (PCI DSS): the details of this standard are available online, and many companies in the payment sector already follow it. Your service should focus on fulfilling them as much as possible to guarantee you can promote a safe environment for the users;

2. Implementing encryption and token-based frameworks: another vital data security standard is the focus on encrypting your software. We’ve already mentioned the vP2PE. Using the PGP and hard disk encryption for the presented goal is also a good idea.

3. Doing regular software updates: the current data security field is a massive battlefield. In it, criminals of various kinds fight with developers to create a maximum number of breaches. A HIPAA-compliant payment processing system requires a focus on constant updates. If you want your framework to be secure, it should have the newest software.

4. Training employees and having strong access control: countless breaches occur due to the lack of attention from the workers. An encrypting software can enter your system via spam email or social engineering in a public chat. To prevent such attacks, you should teach the workers to download the software only from safe sites and never open any suspicious links. Moreover, one must focus on offering a complex authorization system in your internal servers. The workers should have different access levels, and no one must completely control all information. In this way, even if the data leak occurs, you can limit it to some non-vital aspects.

If you’re interested in further information on healthcare data security, we have a great material titled “Healthcare Data Security: The Overview of Challenges and Safety Measures” on this topic. One can find it via the following link: https://keenethics.com/blog/healthcare-data-security

Conclusion

To summarize, our readers should consider the maximal customer security while using payment services. If you don’t, the financial losses are, more or less, inevitable due to lawsuits connected to data leaks. The healthcare industry brings about tremendous revenues in the current conditions. It’s not enough to offer health services, however. You should also care about customer privacy to guarantee the continuity of your businesses. Modern states care more and more about privacy: PCI DSS and HIPAA are only the beginning. We’re likely to see much more standards in the upcoming years.

Common Questions About Healthcare Payments & HIPAA Compliance

What frameworks are HIPAA compliant?

HIPAA-compliant firms adhere to a wide set of privacy standards used in the HIPAA legislation. They should use the complex credit card chip and transaction standards to achieve this status. Usually, HIPAA-compliant companies build their entire business around it. Firms such as Payment Cloud and Helcim provide HIPAA-compliant services.

Do all payment processors have to follow HIPAA?

In the current conditions, not every payment processor should follow HIPAA. You mustn’t trust platforms like PayPal while promoting healthcare services. It’s better to seek a dedicated HIPAA-compliant company for this goal.

Are credit card companies HIPAA-compliant?

No, most companies of this type don’t have to be HIPAA-compliant according to the legislation. Still, they must adhere to standards for chip security, for example, that connect with HIPAA.

Are credit cards within the Protected Health Information category?

Yes, they are. One can use credit card data to track the status of a patient. You shouldn’t leak this vital information to anyone.

In this case, don’t hesitate to contact us: our company knows how to help.