Are you interested in developing a secure payment gateway? If yes, this article will answer your questions.

Every business relies on the customer’s payment. For this reason, it’s crucial to have a payment gateway that is as comfortable as possible. Many people no longer use cash for payments. It’s clunky and uncomfortable to count every penny. We’ve all been in situations when a sales assistant makes mistakes with it. Let’s not forget the Internet, too: cash is impossible to use there. That’s why society needs online secure payment. In this article, we review payment gateways and study how to integrate them safely. This framework is crucial because payment gateway security prevents privacy problems.

What Is a Payment Gateway?

Payment gateway is a technology for electronic payments (credit or debit cards). It allows businesses to accept electronic payments from customers. The idea behind such a system is simple: it bridges the merchant website and the payment processor. A payment gateway is a ‘middleman’ simplifying the transfer by automating most processes concerning credit card information. Why is it so important? A secure payment gateway, for example, allows the customer to put their credit card into a scanner and pay without cash.

How Do Payment Gateways Function?

Payment gateways don’t require anything complex to function. Let’s look at the whole process from the standpoint of a customer, Jack, who buys a product online. He wants to buy RAM for his computer from some web store. After selecting the ware with a consultant, Jack goes to the checkout page. The individual reviews his purchase list and approves it after seeing the price. Then, Jack puts his credit card data into the special form provided by the website, which acts as a secure payment gateway. The software checks the information on the card. If it’s correct, the payment gateway sends the data to the bank, asking for the transaction. In most cases, no problems occur, and the payment processor receives positive feedback, informing the customer and the vendor about the successful transaction.

The Purpose of a Payment Gateway for Businesses

Comfort is one of the main reasons businesses integrate a payment gateway. Without such software, processing any credit card payments fast would have been impossible. If we recall Jack from the preceding section, he would have had to wait a lot for transaction approval. A secure payment gateway removes the need to contact banks directly, saving time for everyone.

Some other reasons for using payment gateways exist too. Firstly, they prevent errors, which may be inevitable with direct payment. Even an in-depth Internet search shows that almost no errors appear in payment gateway systems. Secondly, such systems prevent fraud by having access to banking databases. An average secure payment gateway can review addresses and card codes. This means the technology in question saves a lot of time for the average user.

Secure Payment Gateway Integration Methods

Multiple ways exist to create a secure payment gateway. Here are some of the most widespread approaches. We’ll review them all from the standpoint of Jack. Let’s imagine he wants to buy a processor this time from some hardware store:

A. Redirecting to the payment website

In this case, the whole process is basic. Jack selects the product and goes to the checkout. After he reviews the ware list, the vendor redirects him to the secure online payment gateway. There, he can enter all the key data and perform the payment. We’ve already discussed how the whole process goes. The idea here is that the vendor doesn’t integrate any payment processing elements into the site, outsourcing it to the outside service instead.

B. Integrating the payment form

The user experience mentioned above can seem quite scary for some individuals. This means most sites work with payment gateway integrations in different ways. Regarding payment form integration, Jack doesn’t have to visit other websites. Instead, he needs to fill out a form on the store website. It collects all the data relevant to the payment gateway, processes it, and sends the information to the payment software. This method is beneficial because it integrates the payment process into the store design.

C. Integrating a site within site via the IFRAME

Some sites also integrate a secure payment gateway directly into their design. From the standpoint of Jack, it looks this way: he goes to the payment page for his processor, and the gateway appears to be integrated into the site. Instead of going to it via redirection, Jack can fill in the data on the other site within the vendor’s store. This means that a site appears within a site in this case. For this goal, we need an IFRAME. This technology allows putting one webpage into the other, displaying them simultaneously.

D. Using a payment gateway API

Lastly, it’s possible to integrate a payment gateway directly into the website. For this, we need an API, a set of instructions that allow configuring the relevant software. Regarding Jack’s user experience, the process is similar to IFRAME integration. Integrating the secure payment gateway interface into the website is also possible. The difference is that the site owners have full control over the data. Such an arrangement is perfect for collecting high-quality statistics.

How to Make the Payment Gateway Secure?

There are multiple ways to guarantee the long-term security of a payment gateway:

Using SSL

SSL, or Secure Socket Layer, is an encryption framework used everywhere. The idea behind it is simple. During the first website visit, the server (a computer on the vendor’s or payment gateway side) establishes an encryption code with the client’s browser. Then, a series of third-party certificates (special encryption codes) ensure that the same person uses the established authentication code during the website visit. This approach is vital for online secure payment because it prevents identity theft.

Adhering to the PCI standards

The modern banking industry has clear standards for the processing of financial data. For example, all credit cards have to feature multiple layers of protection, such as CVC and access codes. The key idea here is to choose the payment gateway adhering to all the standards. Services such as Mastercard or Visa don’t work with companies that fail at integration. If you have some worries, ask your potential partner company if the secure payment gateway is standard-oriented.

Tokenization

We all do repeated transactions on some sites. The worst practice, in this case, is storing the credit card data in plain text files. If someone breaks into your servers, that’s a perfect invitation to massive data theft. Tokenization prevents this problem. It encrypts the credit card data and creates a special sign, or token, which the clients can later reuse for other purchases. If someone breaks into the payment gateway servers, all they’ll find is the encrypted (and unbreakable) user data.

Using Phones for 3D Security Authentication

Most credit cards have a connection to users’ phones. This means they can take part in the security process. How does this work? After the user confirms their credit card data, they’re redirected to a website that asks them to enter a separate security code. The secure payment gateway sends this security code to their smartphone. Sometimes, new frameworks ask for fingerprints or facial recognition. The idea here is simple: even if someone steals credit card data, 3D security makes it impossible to buy anything without a telephone. After all, you need to enter a code first.

Are you interested in a secure platform?

Try out our Node.js service!

6 Steps for Online Secure Payment Gateway Integration

If you’re reading this article, you’re likely interested in establishing a secure payment gateway in your firm. Let’s look at the six steps that can help integrate a secure payment gateway:

Step 1. Analyze the current situation

Above all, we recommend you look at the situation in your business. What problems with security does it have? What lacunas need to be closed? The more information one collects, the easier it will be to transition to the next steps.

Step 2. Plan your project

Once you know your problems, it’s easy to understand what’s necessary for the site or business. In our case, the issue may lie in the absence of a secure payment gateway. Create a clear plan for solving this problem. It should have organizational steps and a definite selection of software and partners. Let’s look at the potential items to include in the plan below.

Step 3. Outline how the integration will work

The primary element of your plan is the analysis of the way the integration will work. What to include here? Choose the platform for the integration and how you’ll integrate the payment gateway. We recommend looking at several service providers to guarantee a high quality of choice.

Step 4. Selecting a good tech stack for the integration

Every integration requires some programming. This means you must write code with minimal vulnerabilities and maximal speed. What to do? We recommend Node.js because it’s a web-specific language taking many of its characteristics into consideration. The best idea is to consult programming specialists: they’ll offer you some high-quality options.

Step 5. Implement the online payment gateway and test it

Once you have chosen all the integration elements, it’s time to implement them. Ask your programming specialists to integrate the secure payment gateway into the relevant site. Once you have it, start testing every aspect of the software integration. The more information you have, the better. Imagine as many situations the users may encounter as possible.

Step 6 (optional). Support your system and let it evolve

Once you have developed the integration, it’s time to review the user feedback. For example, if someone doesn’t like the redirection option, a better choice is to use site integration. Try to make the payment gateway integrations as comfortable for the users as possible. The more potential issues experts review, the better.

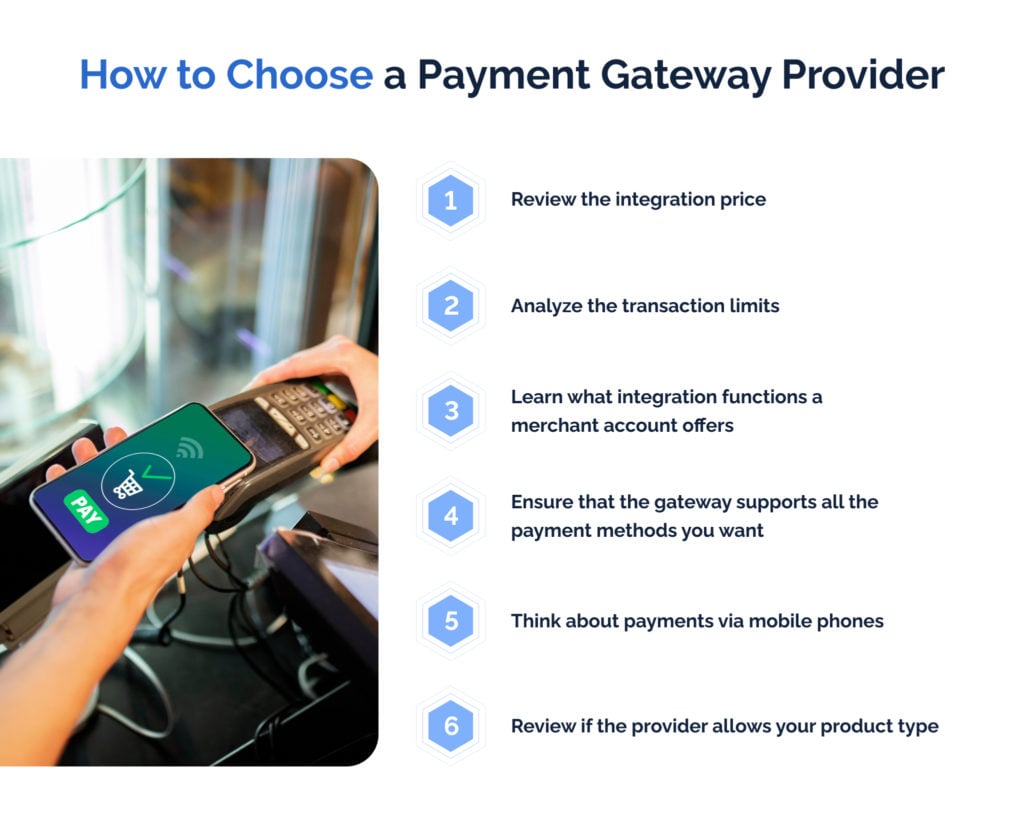

How to Choose a Payment Gateway Provider

Many security aspects depend on your ability to choose a good payment gateway provider. Let’s see some steps capable of helping you choose a good one for payment gateway integrations:

Review the integration price

Most services have some price for the integration. You should look at different services before making a full-scale choice. Our recommendation here is simple: analyze as many providers as you can.

Analyze the transaction limits

Every website has its limits for transactions. Some stores provide low prices for the services. Others sell large-scale wares, requiring significant investments. Different payment services have diverging transaction limits. Before you integrate a payment gateway, learn as much about them as possible.

Learn what integration functions a merchant account offers

You may have some specific ways to integrate the payment provider into your site. Perhaps, you would like an API. If one isn’t attentive, the choice can be problematic as the payment provider won’t give access to necessary tools. You should always review the relevant partner’s capabilities before accepting them. Don’t hesitate to contact the providers directly and ask their support department for help regarding these questions.

Ensure that the gateway supports all the payment methods you want

A major factor in gateway support is the ability to work with various payment methods. Not all payment providers work with the frameworks that are of interest specifically to you. Once again, one should first contact potential partners and analyze their responses. Most services are rather upfront about their capabilities.

Think about payments via mobile phones

Many customers are buying everything via smartphones today. Integrating a payment gateway may require a focus on this aspect. Look at the capability of your provider in this regard too.

Review if the provider allows your product type

Different providers work with diverging product types. For instance, most online payment gateways focus on relatively small wares that cost less than 5000 dollars. They may include everyday wares such as dishwashing machines and personal computers. But what if you’re selling cars? Many payment gateways can refuse to work with you because of their price and special regulations assigned to them. In this light, the best option is to focus on specialized ware providers.

List of Payment Gateway Providers

Do you want to know what payment providers work on the market? Let’s look at them:

Stripe

Stripe is a payment gateway with simple access to the API of the platform. It’s among the most popular frameworks for payment in the world. The key characteristic of the platform is its focus on strong analytical tools. The users get the breakdown of all the transactions fast. The API-based technology also involves several tools that prevent fraud regarding the security of payment gateways.

Related services

STRIPE API INTEGRATION SERVICES

PayPal

PayPal is also one of the world’s largest and most popular payment gateways. Its features aren’t as advanced concerning statistics as in the case of Stripe indeed. Where PayPal wins is the price of service per transaction, which amounts to 0.10 dollars. Simple integration is also another strong framework for the platform. Since many people use PayPal for payments, it can attract customers as a transaction method.

Related services

PAYPAL API INTEGRATION SERVICES

Amazon Pay

Amazon Pay is of interest for combining many user-friendly choices. It offers a personalized account with high-quality statistics for the vendors. More importantly, installment pay is available for the customers via the platform. Amazon Pay isn’t the cheapest approach to business, but it does one thing well: the gateway attracts many users via its buy today/pay later framework.

Authorize.net

Authorize.net is a low-cost payment provider targeting small businesses. Its key features include integration into the maximum number of platforms. Authorize.net, for example, is notable for easy smartphone integration. If you’re interested in maximal coverage, this service is the best way to ensure the security of the payment gateway.

2Checkout

2Checkout or Verifone is a platform notable for its modular approach. The users can choose different types of payment-related options for their companies. This factor allows for saving funds on unnecessary features. Another interesting feature is a strong dashboard: it’s almost as advanced as in the case of Stripe.

Custom Payment Gateway Integration

What is a secure payment gateway? It’s the payment gateway covering a maximum number of potential security issues. Every site has its unique security needs. For this reason, taking some outside solutions isn’t an option. We instead recommend focusing on the custom payment gateway integration. Such a choice will guarantee the payment platform is integrated in a way that considers the unique features of your site. Custom payment gateway integration also enables you to choose the overall design of your site. In short, you get better customization and security.

Benefits of Secure Payment Gateway Integration with Keenethics

Integration of payment gateways via Keenethics is a great choice for your firm. Two key reasons exist for this conclusion. Firstly, Keenethics works with some of the best online development platforms, such as Node.js. Our experts know how to develop sites. Secondly, we have participated in the development of several banking-oriented projects. This means we know how to work with fintech (financial technology) on the web.

Conclusion

All in all, an integrated payment gateway is a vital element for modern product-oriented websites. We’ve reviewed the main ways to integrate those platforms and their primary characteristics. This information should be sufficient to help you make a reasonable choice. We have one crucial recommendation: be attentive and analyze every feature available.

FAQ

What do we need payment gateways for?

Payment gateways are frameworks that allow interconnecting banks and users during purchases online.

How to create a custom payment gateway integration?

The best option is to hire a set of professionals for this goal.

How do payment gateways function?

When you buy something, the payment gateway analyzes your payment data and sends it to the bank. Automatic verification then enables the platform to secure some payments.

What are the products accessible in payment integration gateways?

Every platform has its own set of products. You should learn it from the providers.

What are the ways of integrating payment processors?

You can use redirection, site integration, APIs, or internal interfaces.

What is the average cost of payment processor integration?

It all depends on the developer’s cost and the integration complexity. In Keenethics, one hour of software developer’s labor costs between 25 and 50 dollars.

Do you want a high-quality integration of payment gateways on your site?

Our company can help you with such custom solutions.

Our company can help you with such custom solutions.