Are you interested in the health insurance software? This article will answer all your questions regarding it!

Patient-centric systems based on insurance are the foundation of healthcare in the majority of countries across the world. Hospitals tend to rely on insurance companies to make money. A person without insurance also encounters tremendous financial risks during their lifetime. In this light, any errors in calculating insurance compensations can be devastating for all involved parties. What’s the best way to reduce errors and maximize comfort for all potential users? We believe the best approach is to use tools capable of minimizing the issues. Health insurance software is a perfect solution: computing devices are centered around calculations, which are the central activity for many insurance-oriented tasks. Risk assessments and the calculation of compensations are all time-consuming. Modern software is capable of helping with it. In this article, we’ll look at the key types of relevant apps and the key factors one needs to consider while developing such projects.

What is Software for Health Insurance?

Before we transition to the full-scale analysis, it’s essential to first look at the definitions. So, what is software for health insurance? Software for health insurance is a computer app designed to manage and ease various processes related to health insurance. It helps insurance companies streamline their operations. What are those? Some key tasks involve enrollment, claims processing, eligibility checks, billing, and customer service. Risk analysis is also a common factor: actuaries are essential for insurance businesses. And what about the key features to include in the relevant software? The software typically includes features like member management, policy administration, premium calculations, and reporting capabilities. In short, health insurance software is so crucial because it assists specialists with the majority of tasks that they encounter in their everyday work.

Main Health Insurance Software Types

Now that we have a general understanding of health insurance software, let’s review some key types of apps that exist in the health insurance software development practice:

Claims-centric software

The first group of apps that materialize in health insurance product development includes software for processing claims. All insurance organizations and hospitals face those requests daily. The relevant app simplifies many processes for the involved specialists. One can use advanced databases and record information in the cloud, minimizing the risk of data loss. Modern claims software is notable for its ability to automate many common requests and simplify the more complex ones by providing detailed forms for the workers. We believe it’s among the key ways to save time for the experts. Why? The workers get an opportunity to worry less about the potential errors: apps can prevent them. Since many insurance companies have strict rules about the number of acceptable errors, that’s a great way to decrease the everyday work-related stress.

Agent management tools

An agent management tool software is a computer app designed to assist in managing and administrating insurance agents or brokers. It offers a centralized platform for tracking and monitoring agent activities. The relevant tasks can include the following factors: sales performance, commission calculations, and licensing compliance. The software typically includes features like lead management, appointment scheduling, document management, and performance reporting. Modern insurance organizations work with numerous individuals or businesses (as in the U.S., where the majority of insurance is corporate). Tracking them via traditional HR tools is challenging. Agent management solutions can, once again, automate many of the tedious tasks related to everyday interaction with health insurance software.

Policy management apps

Many hospitals and insurance organizations base their financial activities upon a clear set of rules. The problem with them is that the number of rules tends to be large. Companies must create hundreds and even thousands of policies to account for all situations. Policy management apps exist to solve this problem. They allow organizations to sort the policies according to their characteristics. Another vital function is the ability to search for key information by typing in some policy details. Policy management apps are vital because they allow users to save time for searching and updating data. It’s a perfect substitute for inefficient paper-based systems, which lead to the appearance of many obscure and even informal requirements.

Lead management frameworks

Many people are interested in the services of particular hospitals or insurance networks. However, there’s a major problem: not everyone decides to start using certain offerings upon seeing their advertisements. To solve this problem, it’s crucial to understand what features are necessary to attract users. Lead management frameworks or CRM (Customer Relationship Management) are central to this goal. So, what’s a lead management CRM? A lead management CRM in healthcare is like a smart organizer for hospitals or healthcare organizations. It helps them keep track of potential patients and categorize their information. The software collects details about people interested in their services, such as contact information and medical needs. This assists healthcare providers with keeping track of people who contact them, scheduling appointments, and making sure they follow expert instructions. Such an approach ultimately results in reinforced patient engagement, enhancing the overall healthcare experience and boosting the income of a hospital.

Data analysis tools

Health insurance product development can benefit from in-depth analysis of user-related data. Why is that so? A major characteristic of insurance management companies is that they, in one way or another, tend to target the majority of the people. Why is that so important? Managers must analyze a lot of data to understand how to sell products to relevant groups. The reasons for visiting healthcare facilities are diverse among many people. Data analysis tools are of interest because they simplify the processing of the collected information and ensure compliance with standards such as HIPAA. Where an entire team was necessary for analyzing data in the past, now one specialist can process as much within the same period. Revised information, in turn, offers the decision-makers more opportunities for making high-quality strategic decisions. Moreover, such decisions are much more detailed than in the past as they consider the interests of more potential customer groups.

Risk analysis tools

All insurance organizations face a major problem: their activities are risky. For instance, mistakes in the claims analysis or the presence of coverage for events that are too likely can lead an insurance company toward bankruptcy due to excessive payments. To prevent such situations from happening, one needs to analyze risks well. What are some key factors modern apps include in their analytical frameworks? These tools look at things like patients’ medical records, their age, and past insurance claims. They use this information to figure out how risky they’re and figure out how much they should pay for insurance. Why is this important for businesses in the insurance sector, for example? They help insurance companies make informed decisions and mitigate risks while offering competitive and cost-effective plans. The relevant firms can spread the finances among several policies to ensure safe and all-encompassing coverage.

Benefits of Developing Health Insurance Software

What are the benefits of health insurance software development? Here are some of the key factors one needs to consider:

1) Enhanced efficiency: developing health insurance software allows for streamlined and automated processes. Many employees hate manual tasks, paperwork, and administrative burdens. Health insurance software is essential for removing boring tasks and providing an environment where workers can focus on something more creative. In the end, these tools lead to improved operational efficiency and faster turnaround times for tasks such as policy administration, claims processing, and enrollment.

2) Improved customer experience: a well-designed health insurance software can offer a user-friendly interface for policyholders. This approach enables easy access to policy information, claims tracking, and customer support. Why is this important? In the past, many insurance-oriented activities were paper-based. This approach used to create major problems. For instance, a big issue for clients was the use of complex legal language in the key documents. Even insiders admit major concerns regarding clarity. Insurance apps solve this problem once and for all: they allow a person to see all the details of their plan in a comfortable dashboard.

3) Accurate and timely data management: what’s the key problem for many healthcare and insurance organizations? They have to analyze tremendous amounts of data. In the past, one had to, more or less, accept a compromise, only reviewing the most complex information. With dedicated software, health insurance companies can efficiently manage vast amounts of information, including policyholder content, medical records, and claims data. Why is this important? Accurate data is the foundation for assessing risks and settling claims in a way that pleases everyone.

4) Powerful claims processing: health insurance software enables seamless claims processing, reducing errors and delays. What’s the key advantage of such tools? They enable the insurance companies to create complex rules and scenarios that allow encompassing the majority of possible situations on the market. In this way, office-based specialists are no longer necessary to provide a high-quality analysis of the main data.

5) Regulatory compliance risk reduction: health insurance software can incorporate compliance features, ensuring adherence to complex regulations and standards in the insurance industry. This reduces compliance-related risks, ensures data security and privacy, and helps avoid penalties or legal issues. As mentioned previously, one can create complex scenarios: legal issues are a great fit for those scripts.

6) Data analytics and reporting for improving knowledge: developing health insurance software provides opportunities for robust data analytics and reporting capabilities. Insurers can gain insights into market trends, customer behavior, and risk analysis. Why is this important? Such an approach enables them to make data-driven decisions, improve business strategies, and develop competitive insurance products.

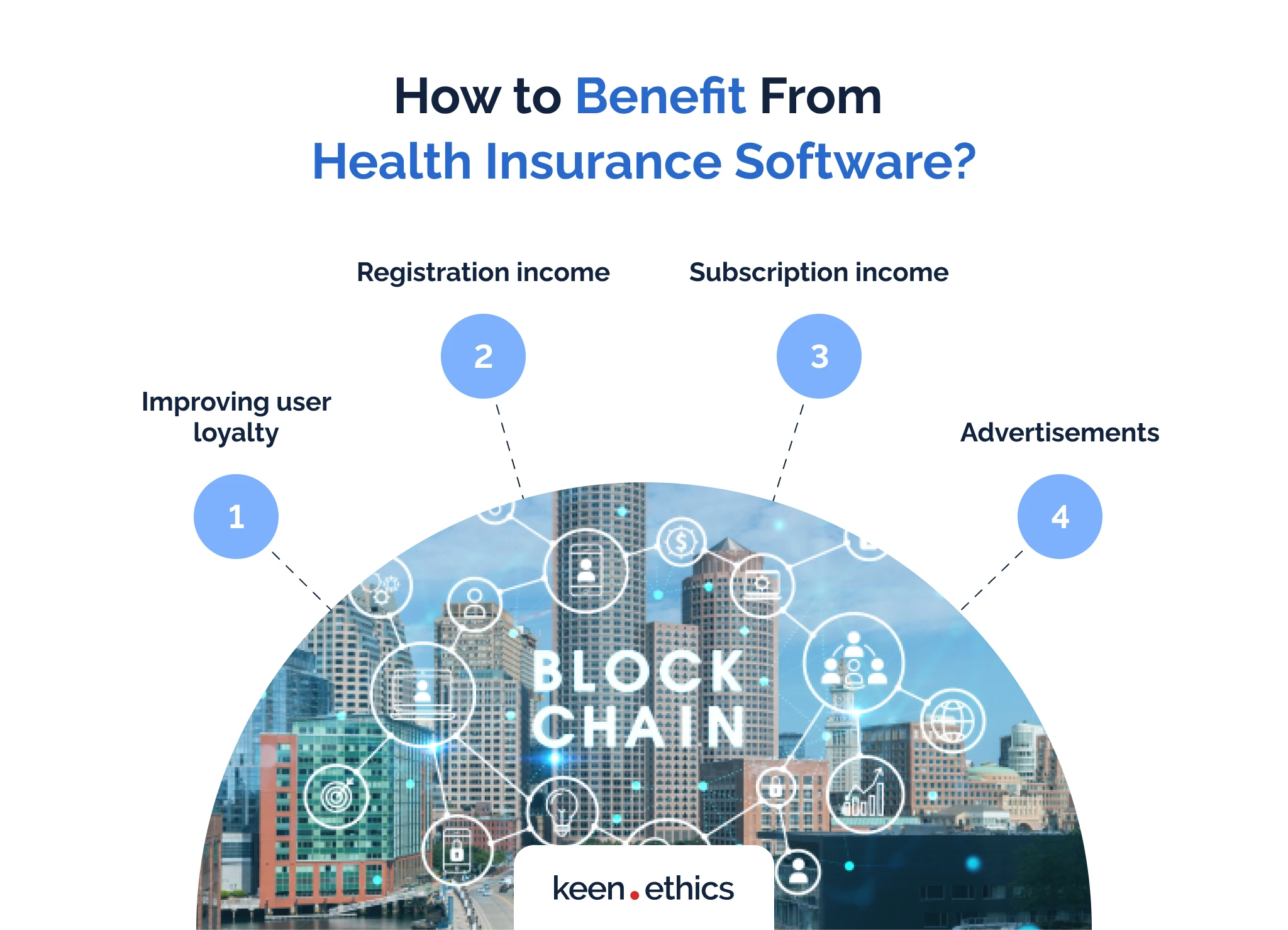

How to Benefit From Health Insurance Software?

Health insurance software can offer users several major benefits. What are those? Let’s review why one should invest in the health insurance product development process:

Improving user loyalty

Companies capable of earning the largest sums are the ones that know how to maximize the loyalty of potential customers. Many people are ready to stay with a particular brand for generations as long as it provides high quality. Marketing specialists openly promote the need for developing multi-generation product loyalty. The key problem for the insurance sector is the lack of clarity. Many insurance programs tend to be obscure. With the advent of health insurance software, we finally get an opportunity to solve this problem. Apps can offer all the key information in a user-friendly format. The more proactive you’re at using this data, the better.

Registration income

The first important way to earn funds on healthcare insurance software is by investing in registration fees. When the users visit your platform and buy one of the plans, you can ask them to pay a registration fee. In this way, you can monetize the unique, high-quality service your company delivers.

Subscription income

Another vital way to monetize healthcare insurance apps is to offer great subscription plans for customers. You can, for example, provide an exclusive package of insurance options for the clients. This approach may attract numerous potential customers to your platform. The ability to get exclusive deals and easy-to-use insights into the key information will likely be attractive to potential clients.

Advertisements

Promoting potent advertisements is the final way to earn funds on healthcare insurance apps. You can offer non-intrusive presentations of other products that may interest the clients. In this regard, a viable option is to deliver targeted advertisements that present hospitals dealing with the specific problems of the client. Simultaneously, abstain from low-quality content (for instance, cryptocurrency Ponzi schemes or pay-to-win video games). The only thing it can show is that your service isn’t trustworthy. When you promote health insurance software, a vital factor is to be as serious as possible. For many people, insurance represents one of the most important aspects of their lives.

What Should You Consider When Developing Health Insurance Software?

In the medical insurance software development process, it’s essential to consider several key aspects. Here they’re:

Difficulty of development

The first major aspect of developing health insurance software is its complexity. Such projects aren’t simple: they include advanced calculations. For this reason, it’s essential to never understate the potential costs and development time for such projects. You should be ready for long investments and similarly long development before creating a product that reflects your needs and goals.

Customization

A big aspect for many users is the ability to customize information. For example, offering people diverging insights into data is a good idea. Some people may want to see a brief description of the key information. Others may want to see an in-depth analysis. The more options you offer to the customers regarding customization, the better.

Cloud vs. on-premise

When developing health insurance software, you must consider whether it will be cloud-based or on-premise. Cloud-based solutions offer scalability, flexibility, and accessibility from anywhere with an Internet connection. On-premise solutions provide more control over data and infrastructure, but may require higher upfront costs and maintenance.

High-quality UX design

Integration with existing systems and third-party apps is crucial for seamless data exchange and workflow optimization. The software should have well-defined APIs and support interoperability with electronic health records (EHR) systems, claims processing platforms, and other healthcare IT frameworks. Additionally, user experience (UX) design should prioritize ease of use, intuitive navigation, and streamlined task completion for insurance staff and policyholders.

Maximization of security

Health insurance software deals with sensitive personal health information (PHI), making security and compliance critical. The software should implement robust data encryption, access controls, and regular security audits to protect PHI from unauthorized access or breaches. Compliance with industry regulations like HIPAA (Health Insurance Portability and Accountability Act) is essential to ensure the privacy and confidentiality of patient data.

In addition to these points, other considerations when developing health insurance software may include scalability to accommodate growing user bases, data backup and disaster recovery mechanisms, performance optimization for high volumes of data processing, and ongoing support and maintenance for software updates and bug fixes.

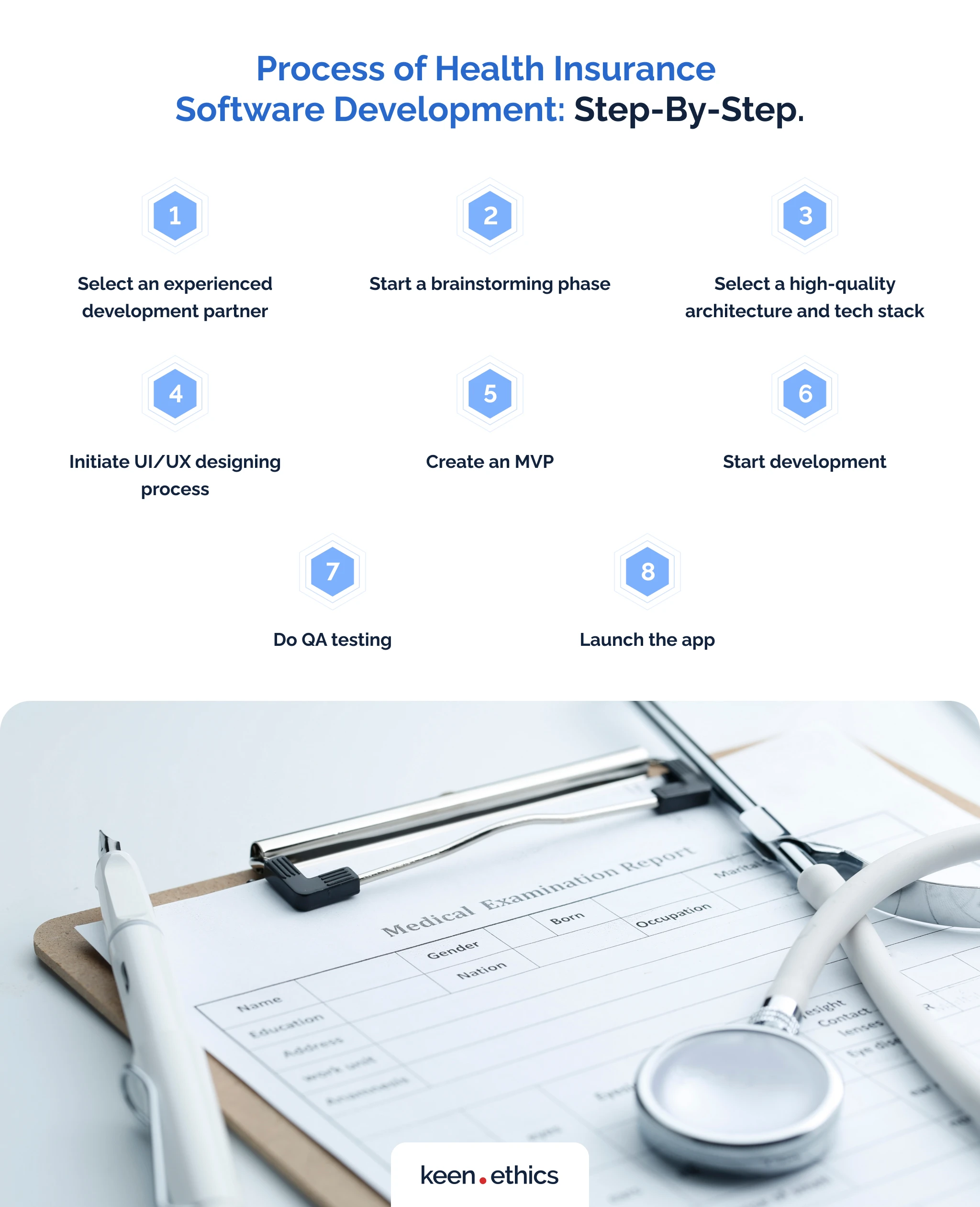

Process of Health Insurance Software Development: Step-By-Step

Here are some critical steps you must consider while investing in health insurance software development.

Select an experienced development partner

The first step is selecting a reliable technology partner based on their expertise, experience, and reputation. Health insurance product development requires the highest level of expertise. If you’re interested in development, don’t hesitate to address us: Keenethics has experience developing multiple products related to the healthcare sector. And what about other steps? In this regard, you should determine the cooperation model. Multiple models exist on the market: among them are options such as outsourcing, hiring a dedicated team, or working with an in-house development team.

Start a brainstorming phase

We recommend working on certain projects only if you have a specific idea in mind. Still, it isn’t enough to have an idea: to succeed; one needs to combine many ideas into a framework that functions for the end customers. What should you do at this stage? In our opinion, the following steps are essential for success:

1) Collaborate with stakeholders to define project goals, requirements, and functionalities. Many individuals working in non-IT sectors tend to have dangerous misconceptions about these technologies. Always consult your tech partners to understand which ideas make sense and what approaches are illogical and should be changed, even if you see them as rational.

2) Conduct market research, analyze competitors, and identify target users. Another crucial factor is the market analysis. You need to understand three things about your product: who will buy it, who your competitors are, and what niche minimizes competition for you.

Select a high-quality architecture and tech stack

It’s not enough to have advanced code. The tech stack is often what determines how well an app can help customers. Node.js, for example, is perfect for web apps. C++ is much more potent in the desktop sector. We recommend consulting specialists to determine what technologies fit your needs the best.

Initiate UI/UX designing process

What are the steps you need to consider here? Let’s review the things we can recommend to every health insurance software developer:

1) Create intuitive and visually appealing user interfaces. The easier, the better. Many people judge by the first appearance: your app has to be impeccable to attract maximal attention.

2) Develop wireframes, prototypes, and user flows to establish an efficient and user-friendly design. Excessive testing doesn’t exist. Creating a user interface from scratch is a bad idea: wireframes can show you what elements will likely attract users as much as possible.

3) Ensure seamless navigation, accessibility, and responsiveness across different devices. Many people are disabled: since individuals with disabilities seek advanced insurance options, giving them a way to use your app is essential.

Related Services

UI/UX DESIGN AND DEVELOPMENT SERVICES

Create an MVP

Before starting full-scale development, a potent choice is to create a minimum viable product. The idea here is to see your solution in action. Focus on the core features you want to deliver, create a minimum product, and provide it to the customers for testing. In this way, you’ll know if further development makes sense at all.

Start development

What’s at this stage? In our opinion, the following steps are crucial:

1) Develop the software following an iterative and agile approach.

2) Break down the development into sprints, build core features, and continuously test and integrate functionality.

3) Collaborate closely with developers and stakeholders to ensure alignment with requirements.

Do QA testing

Medical insurance software development is a field where developers frequently have no space for errors. Problems with insurance software can lead to, for instance, missed payments. Such issues are likely to discourage many people from using your service. To guarantee the maximal attention of the clients, quality assurance is essential. What should you do at this stage? Firstly, conduct comprehensive testing to identify and resolve any bugs, errors, or performance issues. Secondly, perform unit testing, integration testing, system testing, and user acceptance testing to see if your app works in real-life scenarios. Ensure the software functions as expected and meets quality standards, and success for your project will be likely.

Launch the app

What are the steps to consider at this level? Here are the key factors you need to review:

1) Prepare the software for deployment by configuring servers, databases, and network settings.

2) Set up a staging environment for final testing.

3) Once approved, deploy the software to the production environment, ensuring a smooth transition from development to live operation.

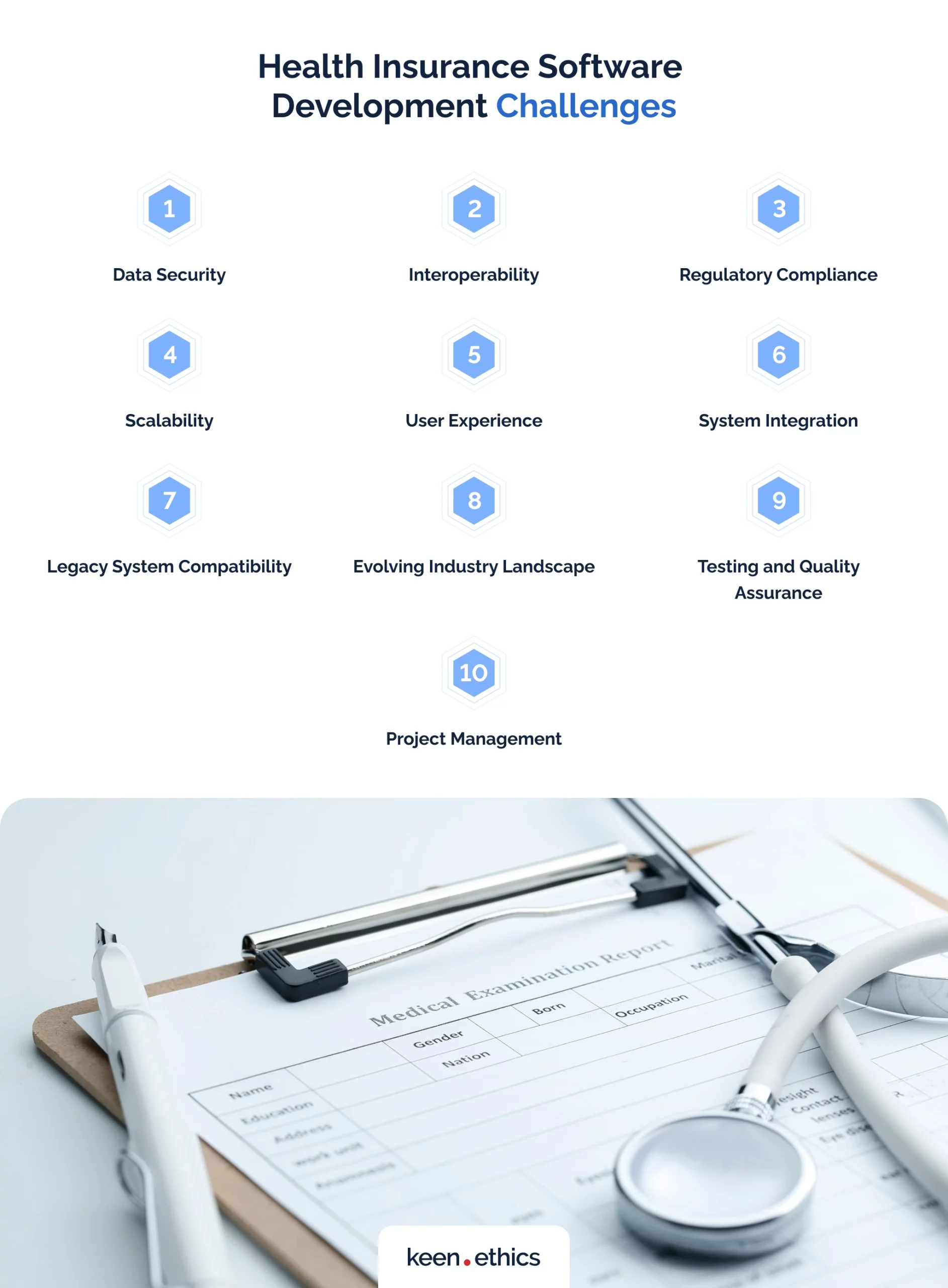

Health Insurance Software Development Challenges

Health insurance software can bring about many long-term challenges. Here’s the list of the aspects that may be problematic for your company:

1) Data Security: protecting sensitive personal health information (PHI) and ensuring compliance with data security regulations, such as HIPAA, can be a major challenge. Many hackers are constantly improving their social engineering and vulnerability analysis to start devastating attacks against businesses, as professional security companies note.

2) Interoperability: integrating with existing healthcare systems, electronic health records (EHR), and other third-party applications can be difficult due to varying data formats and standards (such as HL7). Regrettably, a situation where every state and even county has its frameworks is common.

3) Regulatory Compliance: adhering to industry regulations like HIPAA and ACA (Affordable Care Act) and keeping up with changing compliance requirements is challenging and time-consuming. One should be prepared for constant changes: every government tries to adjust the laws according to ideology. It’s common to encounter multiple large-scale reforms in a decade.

4) Scalability: a significant challenge is to design a software solution that can handle many users, data, and transactions without compromising performance and response times. You need to work with professionals who not only know how to program, but also develop via frameworks that allow numerous concurrent connections. We at Keenethics, for instance, are confident about delivering such services because we work with one of the most scalable frameworks for the web, Node.js.

5) User Experience: creating an intuitive and user-friendly interface that meets the needs and expectations of both insurance staff and policyholders is challenging. One must carefully consider workflows and usability. Multiple stages of analysis are essential: we at Keenethics have a complex UI/UX audit for this goal.

6) System Integration: ensuring smooth integration with various internal and external systems, such as claims processing platforms, healthcare provider networks, and billing systems, can present technical challenges. They’re often written in different programming languages and use diverging standards, making development complex.

7) Legacy System Compatibility: integrating with older, legacy systems with outdated technology or limited compatibility poses challenges and requires additional effort for seamless data exchange. Some companies have code from the 1990s and even the 1980s: you should be prepared for excess expenditures if you want to integrate such systems.

8) Evolving Industry Landscape: keeping pace with advancements in healthcare technology, evolving regulations, and changing market dynamics requires continuous adaptation and updating of the software solution. One needs to constantly analyze the market if they want to succeed.

9) Testing and Quality Assurance: thoroughly testing the software solution across different scenarios, data sets, and user interactions to ensure stability, accuracy, and reliability is a significant challenge. An insurance app with major bugs is likely to repel the users: no one wants to lose insurance due to some interface bug, for example, preventing them from automatic prolongation.

10) Project Management: managing timelines, budgets, and stakeholder expectations throughout the development process is a challenge. This aspect is especially difficult when dealing with complex requirements and multiple stakeholders. It’s not enough to have experienced developers. One should also think if leadership for them is good enough.

Related Services

NODE.JS DEVELOPMENT SERVICES

Conclusion

To summarize, insurance app development requires you to consider many issues. There are different types of apps and features. Development is also a major challenge because you must consider appropriate tech stacks and proper leadership. If you’re interested in outsourcing a project to a firm that knows how to solve these problems, don’t hesitate to contact us. We have multiple years of experience in developing projects in fintech and healthcare.

FAQ

Why is a custom healthcare insurance app important?

A custom healthcare insurance app is critical because it caters to the unique needs and requirements of the healthcare insurance industry, improving efficiency and user experience.

Why invest in healthcare insurance apps?

Investing in healthcare insurance apps boosts operational efficiency, enhances customer experience, streamlines processes, and enables improved management of policies, claims, and data.

What features are crucial for healthcare insurance apps?

Key features for healthcare insurance apps include policy management, claims submission and tracking, provider network search, customer support, and secure data storage.

What is crucial for a high-quality healthcare insurance app development?

High-quality healthcare insurance app development requires thorough planning, adherence to industry regulations, user-centric design, robust security measures, and rigorous testing.

Contact us to get a free estimate of your project!