What Is A Digital Wallet?

Before we analyze the best mobile wallets, it’s crucial to review what this concept stands for. A digital wallet is an app that assists users with managing numerous payment methods. It securely stores the credit card information and various passwords, allowing you to, for example, make transactions in several clicks. Instead of having to fill in all the payment information, you get an opportunity to ask the app to automate the majority of actions. In practice, Google Pay, which is considered the best digital wallet by millions of users, is integrated with many banks and payment services, which allow it to provide payment data through installed extension interfaces.

What Makes Digital Wallets so Popular?

There are several key reasons why digital wallets are so popular. Let’s review the core motivations for considering investments in this sector. These are the things the best virtual wallets do:

1) User convenience: the first reason to use this tech is the fact that it saves time. If you have to do many transactions on different sites, a digital wallet can save time that could have otherwise been spent on filling in the information. Instead, you can do everything in several clicks. It’s especially vital for businesses and customers who are engaging in shopping daily.

2) Security: digital wallets have various built-in protections for your credit cards. For example, they tokenize the information about your payment methods while sending credentials. As a result, no one has a pathway to steal your data by deciphering information flows. Many digital wallet apps also have high-quality built-in tools for detecting fraudulent sites. This means that they can warn you about famous fraudulent sites on the Internet. Consequently, it’s safer to use digital wallets these days rather than insert all financial data in a manual mode.

3) Bonus and reward systems: some digital wallets are well-connected with various bonus and reward systems. For instance, solutions providing high-quality cashback to the average user are present on the market. Consequently, the use of digital wallets can sometimes mean that you’ll be able to save significant sums of money. Many banks offering such solutions have great partnerships that are lucrative concerning certain types of products.

4) Support for multiple currencies: modern digital wallets are notable for their ability to support multiple currencies. For example, one can combine assets in dollars and euros, as well as various cryptocurrencies. This is highly comfortable when you have to make multiple transactions because a digital wallet allows you to automate many payments or choose the most advantageous deals. All this makes digital wallets perfect for travelers and businesses.

Various Types of Digital Wallets Available

There are multiple types of digital wallets available on the market. In our opinion, it’s essential to understand them all to navigate the complexities of this field and understand the top digital wallets. So, what are the core types of technology out there?

In our opinion, several classifications are possible:

A. Classification by platform

In this case, we have three types of wallets. Mobile, web, and desktop options are the core frameworks on the market. As you can guess, each type of wallet depends on a particular platform. For example, mobile wallets work on smartphones, and desktop ones target computers. Ultimately, the core differences are between two groups, mobile/web and desktop. Desktop options are mostly targeting cryptocurrencies. In turn, mobile and web ones focus primarily on mainstream banks.

B. Classification by security methods

In terms of security methods, two types of platforms exist. Primarily, there are encryption-based frameworks. They store your credit card or cryptocurrency information online or locally and typically respond to a password. Another popular measure is to use telephone information as a core method of enforcing security. In short, these are bank-like encryption frameworks. In turn, some solutions that go beyond this restrictive model and offer more advanced security also exist. For instance, a common approach is to utilize physical keys or biometrical identification. Physical keys are especially useful, as it’s theoretically possible to recreate one’s fingerprints by accessing governmental databases or even using physiological information. They work only if you connect a key to a physical computer and then enter a password.

The reliability of such systems is almost infinite. They’re typically susceptible only to physical attacks on the owners. These systems aren’t widespread only because they’re highly inconvenient and can push you to lose your funds, as often happens with various Bitcoin accounts. Currently, dozens of accounts that were blocked are present since their owners lost physical keys or forgot passwords. Estimates show that approximately 20% of the Bitcoin in circulation is lost forever due to similar complications. For this reason, the bank-like systems are more popular these days.

C. Classification by payment nature

Another important way to classify all types of top digital wallets is by the nature of the currency they work with. In this regard, we can split them into cryptocurrency and classical currency wallets. On the one hand, we have many solutions working primarily with government-issued funds. Platforms like Google Pay are a perfect example. On the other hand, the most important advances in the sector occur for cryptocurrencies.

Ultimately, the former technologies tend to be more advanced for two reasons. The first reason is that cryptocurrencies such as Bitcoin are highly valuable assets: they’re appreciating every decade. The second reason is that the audience behind cryptocurrencies usually is anti-bank, wanting full control over their security. As a result, the key divide here is simple: traditional bank wallets are more comfortable to use but allow less configuration; in turn, crypto-wallets are known for offering many options, making them extremely secure but difficult to use.

D. Classification by universality

Lastly, we can classify top digital wallets by their universality. The majority of digital wallets target traditional currencies or cryptocurrencies: thus, they’re usable almost everywhere. Nonetheless, some wallets that focus on the more niche currencies also exist. For example, such wallets can include all types of loyalty cards and bonus programs. This type of wallet is one of the most ancient ones. Essentially, it was popularized in an offline mode by retail companies. These wallets are widespread today in online games. They tend to have diverging currencies and, as a result, it’s possible to unite them in one platform. This model isn’t popular and remains mostly insignificant because the majority of businesses try to hold their internal currencies in a closed-down mode.

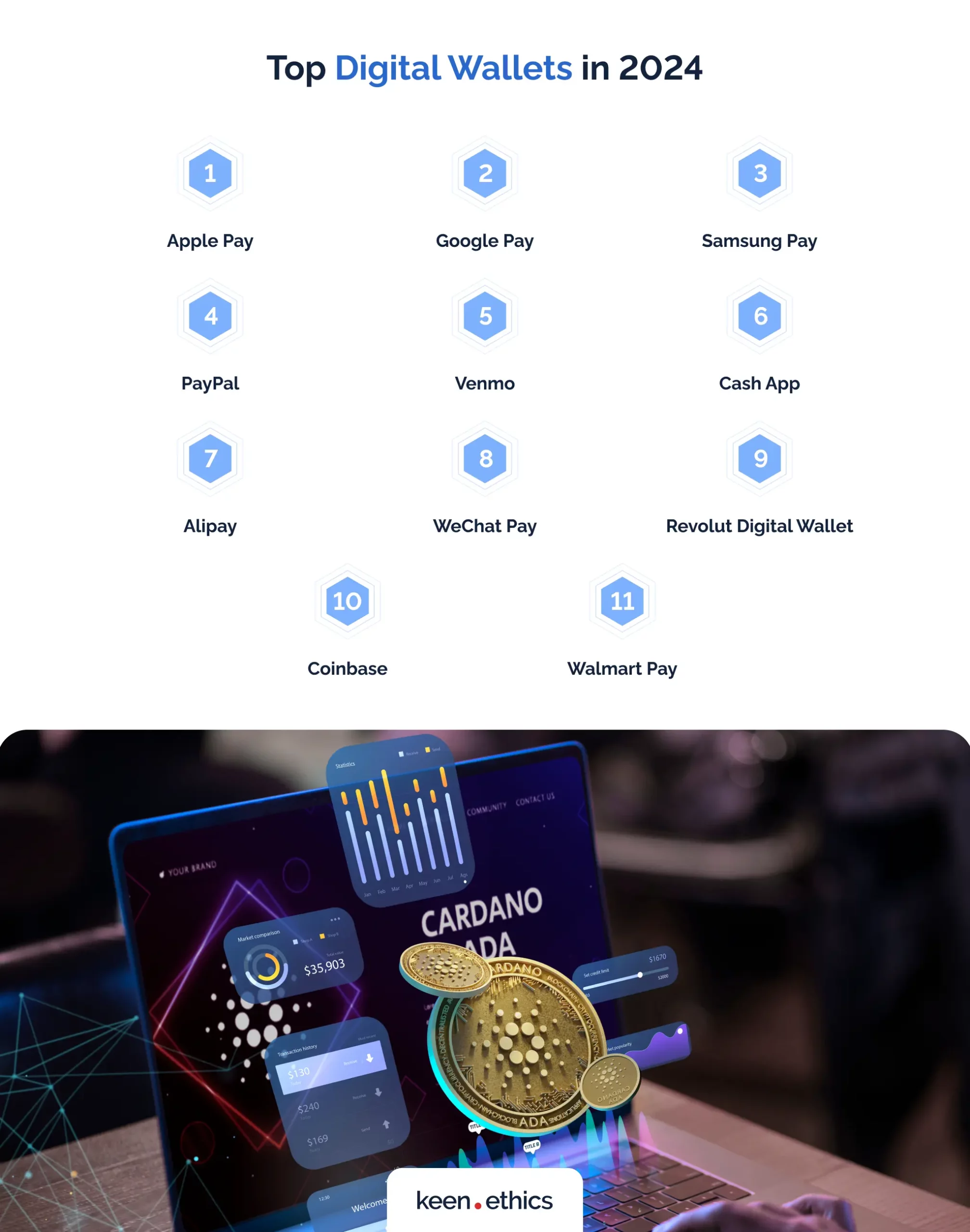

Top Digital Wallets in 2024

Now, let’s take a look at the core offerings in the digital wallet market. We can’t say which digital wallet is best. As you’ll see, many options are present out there that you should consider:

Apple Pay

Apple Pay is an in-house solution for payments created by the Apple company in 2014. Today, it’s considered one of the top digital wallets in the U.S., where Apple products are highly popular. In many ways, it’s similar to Google Pay and Samsung Pay in terms of functions. This platform allows the user to store all their credit card information for payments within one account. The users can then purchase certain wares by using NFC technology or paying via a user interface in one click.

The core advantage of Apple Pay is its focus on the Apple platform. Apple is known for its great ecosystem of various computing products. Thus, the ability to perform payments further improves the experience of its users. Apple Pay, for example, is well-integrated into the message systems of iPhones and MacBooks. One can easily send funds to some of their contacts via this approach.

We highly recommend this system if you’re actively using the existing Apple ecosystem. Apple Pay enables you to, more or less, have no reliance on the competitors’ solutions when using Apple products.

Google Pay

Google Pay is also an in-house solution for payments, which was created by Google in 2011 for its ecosystem of devices. Its advantages are similar to those of Apple Pay, making it one of the top digital wallets, too. It’s well-integrated into the ecosystem of Google software. If you’re using Gmail, Google Workspace Suite, Android smartphones, or even Chromebooks, then Google Pay is your best option. In our opinion, the system is less integrated with Google apps than Apple Pay with Apple ones. For example, there are no comfortable ways to send money between contacts. Nonetheless, it does its job well.

The core advantage of the platform lies in the popularity of Android systems and Google. The majority of the people worldwide are using those technologies. As a result, while less sophisticated than its competitors, Google Pay is much more popular. It’s integrated into almost every website and platform imaginable. All banks in Ukraine, for instance, have great integration with Google Pay. Consequently, it has the greatest capability to simplify your payments on the market.

Please note that this is an estimate based on the information provided. The actual cost may vary depending on the specific requirements and complexities of your project. Start planning your software project today with our cost estimator.

Samsung Pay

Samsung Pay is yet another platform that focuses on offering an ecosystem-specific payment framework. In many ways, its functions are similar to those of Apple and Google. What distinguishes Samsung Pay is its integration with Samsung products and its reward system. Regarding the reward system, any purchases with Samsung Pay provide you with some form of bonus that can be later redeemed to buy Samsung products. Ultimately, the core reason for the existence of this platform is to create a stricter Samsung ecosystem. The company is trying to tie its users to the native apps to prevent their smooth transition to other Android competitors such as Xiaomi.

PayPal

What is the best digital wallet? In our opinion, the one that gives you the most options. In this regard, the presented choice is highly interesting. PayPal is among the first digital wallets to ever appear on the market. It’s notable for its strong security features and lack of ties to any platform ecosystem. All this enables PayPal to have two major advantages.

Primarily, it has stronger support for businesses due to advanced encryption and, more importantly, access to more than 200 countries. Google and Apple Pay are supported only in a dozen of countries, where both companies are operating on a mass scale. As a result, they’re mostly useful for small internal transactions and heavily favor developed countries. PayPal has no problems of this kind: it’s available almost everywhere. Thus, PayPal may be the best option if you’re doing international business today. It’s not surprising why the platform had a strong cooperation with eBay in the past.

Moreover, there’s no need to worry that you won’t be able to use PayPal if you move from Android to Apple or vice versa. If one of the companies becomes bankrupt, you’ll be able to install the PayPal app on the competitor’s smartphone. For this reason, we expect PayPal to remain among the top digital wallets in the upcoming years.

Venmo

Venmo is a wallet app that is available in the United States alone. Its core capabilities are similar to those of PayPal. However, the app is notable for its social media features. You can share various transactions with your friends or even the world in general. For this reason, the app is used for small transactions between family and friend groups. Most Americans know it as an app they use to send money to friends. It’s highly popular among Millennials due to those features.

Currently, Venmo belongs to the owners of PayPal, which is the among the largest online payment apps in the world. Consequently, the platform shares many features with PayPal but tends to be much more user-friendly. Coupled with its platform-agnostic approach, Venmo is relevant since it’s simple to use and, more importantly, doesn’t tie you to an ecosystem of peer-to-peer payments. Low fees in the app are also a major benefit in the presented case.

Cash App

Cash App is notable for the insertion of features that aren’t available on other platforms or in physical wallets. Firstly, it’s once again platform-independent: you can use it almost everywhere. Secondly, apart from offering standard money transfers and money storage, Cash App also focuses on additional investment features. In this respect, the app enables you to purchase Bitcoin and other cryptocurrencies as well as invest in stock, making instant transfer of funds to other countries a reality through platforms like Ethereum. All in all, this app provides the widest set of features on the market. It includes payment options not available on the other platforms. For this reason, the growth of the app is genuinely explosive right now. It’s especially popular among users with lower credit scores, as it allows them to access financial options that banks usually don’t enable through traditional debit cards.

Alipay

Alipay is a payment platform developed by the so-called Alibaba group in China. The Alibaba group is renowned for the online webshop Taobao, which is commonly referred to in the West as AliExpress. As a result, Alipay is among the best platforms if you want to buy something from the core Chinese retailers with great transaction speed. It’s highly relevant for those types of transactions in China these days. Many people use Alipay for ecommerce. The majority of the features Alipay has aren’t novel: they’re similar to what other platforms provide. Ultimately, the core distinguishing feature of Alipay is its strong integration with the existing trading platforms in China.

WeChat Pay

WeChat is another Chinese competitor for Alipay. The core features of the app are similar to those of other platforms. It provides transaction assistance and credit card storage. What’s unique about it is the integration with WeChat, one of the most popular social media apps in China. For this reason, it’s similar to Venmo and Apple Pay: the platform allows a seamless integration with the existing social media.

Ultimately, all this makes WeChat second in terms of popularity within China. WeChat integrates many other features such as file storage into its platform, making it the best media framework for everyday activities. As a result, small businesses like the app and use it for payments in their operations because all parts of their supply chains utilize WeChat for communication. It’s also important for family transactions in China due to strong integration with various forms of chats. WeChat is one of the core platforms behind the tremendous reduction in reliance on physical card model in China.

Revolut Digital Wallet

Revolut is a European online bank that allows its users to work with numerous currencies. In 2024, it created its full-scale digital wallet. In many ways, the core advantage of the platform is its integration with Revolut’s bank database. It can help you easily navigate several European currencies. Consequently, the platform, while not unique, offers a perfect tool for travelers in European countries due to its integration with one of the most revolutionary bank platforms.

Coinbase

Coinbase belongs to the subtype of cryptocurrency wallets. It’s a wallet for storing information about the most popular types of crypto assets. In this respect, the platform is known for strong levels of user freedom. To a great extent, users are directly responsible for their security on this platform. One can control their keys and data related to various cryptocurrencies there. Today, the platform is highly relevant in the market since Coinbase also collects a lot of information on divergent cryptocurrencies. As a result, it’s one of the best platforms for all types of analytical tasks.

Honorable mention: Walmart Pay

Walmart, one of the largest retail networks in the world, offers its options for digital payments, too. Walmart’s mobile payment service is notable for several features. Firstly, it focuses on QR codes rather than NFC mobile payment. Secondly, the app has many gift cards focused on Walmart specifically. All these features help the customers improve their shopping experience during the visits to the stores of the company. The users get to save significant amounts of money during the payment process. Ultimately, the only downside of the app is its focus on Walmart: the software has extremely limited functionality outside of the corporation stores. Its absence of contactless payment function is an especially notable gap. Google Wallet may be preferable if you’re not used to shopping at Walmart daily.

Keenethics team can help you with this goal!

Electronic Wallets vs. Bank Accounts: Understanding the Variances

Now that we know what’s the best digital wallet, let’s review the functioning of this technology. Electronic wallets and full-scale bank accounts may seem similar at first glance. After all, electronic wallets offer their users an opportunity to store payment information and even pay for different services. However, the real goals and capabilities of bank accounts and electronic wallets are highly different. Electronic wallets exist to simplify the lives of the average user. In this regard, their goal is to make payments online as easy as possible. Consequently, they cut corners on many important features that banks have.

Ultimately, banks can do many more things than other services on the market. Firstly, they allow you to earn interest on your funds. Many high-yield accounts triple the amount of your funds in several decades. Secondly, a vital factor to consider is that bank accounts often feature proper protection for your funds from the government. Various investment and payment programs in electronic wallets don’t provide opportunities of this type. Lastly, bank accounts enable you to take on long-term loans, such as mortgages. Hence, their goal is to help you make significant long-term decisions in your everyday life.

Benefits of Using the Top Digital Wallets

Which digital wallet is best? The one that fits your needs. Many significant benefits to using the top digital wallets these days exist. Here are some of the core aspects to consider:

1) Saving time: most digital wallets help you save a lot of time during purchases. For non-business users, this means they can speed up online purchases and minimize mistakes. Regarding business users, digital wallets greatly accelerate the process of buying supplies from different vendors.

2) Increasing fund security: many digital wallets help tokenize your information. As a result, the probability that criminals would have the capability to steal your funds lowers significantly. Today, it’s less safe to purchase something without digital wallets than with them.

3) Contactless payment: another core feature of various payment frameworks is their focus on contactless payment. You get an opportunity to use tools such as NFC, paying for everything with your smartphone.

4) Expense tracking: many digital wallets have features for tracking your expenditures. If you need to control your fund flow, a digital wallet can be a perfect option for you. Some of the more advanced ones even have blocking features to prevent compulsive buying.

5) Better integration of your smartphone ecosystem: various wallets contribute to the integration of the smartphone ecosystems. By installing the wallet app of your smartphone vendor, you get access to many other core features offered by them.

6) Getting rewards: lastly, various wallet systems offer certain rewards to their users. In practice, this means you can obtain significant bonuses for using those wallets. Samsung goes as far as to offer smartphones of the company if you’re active enough with your purchases.

Cons of Digital Wallets

There are also some issues with digital wallets that you should actively consider while using them. What is the best digital wallet app? The one that contains a minimum of those problems from your standpoint. In our opinion, they include the following elements:

1) Limited capabilities: many digital wallets limit your banking abilities. If you have accounts in multiple banks, they don’t solve the problems with their management entirely. Consequently, these platforms enable better conditions only for payments.

2) Security risks: yes, digital wallets have tremendous protection capabilities. For instance, they include strong tools for advanced tokenization. However, no technology in human history proved to be perfect. Digital wallets will eventually be hacked. Why is this so dangerous? They store information about all the key credit cards of the users. Therefore, even a small hack can lead to tremendous data loss and, potentially, major attempts at stealing funds from the clients.

3) Limited vendor acceptance: numerous vendors don’t accept many digital wallets. Regrettably, many places still use outdated credit card machines or even cash. As a result, you can’t rely on those payment services everywhere. In the majority of cases, NFC devices work well only in urban environments.

4) Fragmentation of the market: there are too many digital wallet solutions. Consequently, this challenge exacerbates vendor acceptance even further. Often, you may have to use several digital wallets. For instance, purchases on AliExpress can push you to consider Alipay. This approach creates great security risks, as smaller wallets may have less powerful protections.

5) Information collection risks: most digital wallets collect a lot of information about their users. Hence, even if no major security breaches occur, you still face the risk of giving away your information to third parties. Why is this so problematic? The digital wallet holders can easily sell your data to advertisers, who will use it to target you. Yes, this information is anonymized, but some users may want to avoid such attention for personal reasons.

A Guide to Selecting the Best Digital Wallet

In our opinion, the process of selecting a digital wallet isn’t complicated. Which is the best digital wallet? Several significant characteristics in them greatly assist with selecting the correct platform. Here they’re:

1) Look at the coverage of the platform: does it work well abroad? Does it work well in your country? Try to choose the platform that covers the majority of your needs. In this regard, PayPal and Google Pay are the best frameworks. Ultimately, this is the most important aspect to consider: all other aspects are additional at best.

2) Review the additional features: many additional features such as payments or investments can be useful for you, too. In this respect, certain platforms are widespread enough in some regions to consider using them. Cash App is highly popular in states like Texas, US. Venmo is generally relevant within the urban environments of the United States. Both apps have great payment features and even offer great investment options. While coverage remains the core factor, it’s useful to go for such apps when you can.

3) Analyze compatibility: it’s also essential to focus on the integration features. Many modern platforms have great integration capabilities with smartphone ecosystems. Apple Pay or Google Pay are perfect examples of these platforms. Using them, you can greatly simplify the usage of the core apps proposed by the relevant companies.

4) Security levels: lastly, you should also look for the security track record within your app. Most apps on the market are strong in this respect as there’s pressure from government regulators. Nonetheless, we recommend using the more mainstream platforms at this stage because they have better track records and receive more attention from the governing agencies.

What Are the Best Digital Wallet Companies?

In our opinion, a clear top 10 digital wallet list exists. Here are the core producers of the presented digital wallets:

1) Google: Google is behind Google Pay, which is the most widespread digital wallet app in the developed world. The enterprise has access to the top digital technologies in the world. Consequently, it produces the safest digital wallet app in the world.

2) Apple: Apple is the developer of Apple Pay. The company is a top hardware corporation. As a result, it also has great specialists for enhancing security and adding advanced features for digital wallet apps.

3) PayPal: PayPal Corporation, the owner of PayPal and Venmo, is among the oldest companies in the digital wallet business. Therefore, it’s the most knowledgeable one in this sector, in our opinion. This company doesn’t offer the most convenient service in terms of use ease, but it provides the greatest coverage on the market.

4) Alibaba: Alibaba is among the largest retail businesses in the world. It’s the key online retailer in China, for example. Consequently, the business has created the best ecosystem for online purchases in Asia. Ali Pay is a component of this payment system.

5) Tencent: Tencent is a Chinese social media giant, which owns platforms such as WeChat and QQ as well as numerous computer and mobile games (like League of Legends and Honor of Kings). In this regard, it uses its chat program, WeChat, as a basis for WePay, the second most popular payment platform in China.

What Are the Costs Associated with Top Digital Wallets?

Ultimately, the key source of additional costs associated with top digital wallets involves various fees. Our banking systems are full of diverging transaction payments. Consequently, many of them affect the wallet sector, too. Here are some top costs associated with this technology:

• Transaction Fees

• Merchant Fees

• Currency Conversion Fees

• Withdrawal Fees

• Inactivity Fees

• Premium or Subscription Services

• ATM Fees

• Chargeback Fees

Conclusion

To summarize, digital wallets are an extremely promising technology. In many ways, they have revolutionized payments online and are transforming everyday retail payments, too. Ultimately, the sector is worth it in terms of investment right now. Why? High-quality payment solutions don’t cover many countries. We’re seeing a tendency towards the appearance of complex wallet apps with social media and investment management integration. Thus, your solution can easily become the next Cash App in your country.

FAQs

What should I do to set up a digital wallet on my phone?

In this respect, your actions are relatively straightforward. You should choose the app you like the most. For example, it can be PayPal. Then, your goal is fairly simple: you can install it from the available app store, register your account, and connect the existing credit cards. All those actions are user-friendly: most apps have great user guides within them. After that, you’ll have to activate a chosen app after seeing some integration widgets.

How do mobile wallets and digital wallets differ?

Mobile wallets are notable for their strong integration of the advantages that modern mobile platforms possess. For instance, they enable you to use technologies such as NFC. Their goal is to help you with simplifying daily transactions in shops or various public services, such as transportation. In turn, digital wallets usually focus on transactions online. They’re more advanced in terms of functions and typically enable more configuration for international transactions. A strong example of a mobile wallet is Apple Pay. In turn, PayPal is one of the best digital wallets, which is highly popular among companies that work with the international market.

How can one get a digital wallet?

As mentioned before, you can download a digital wallet from the app store of your mobile device producer. Another option is to register on the site of the relevant corporation, such as PayPal.

If you mean the development of a digital wallet, then a suitable option is to hire a custom development company. We at Keenethics, for instance, can help you in this regard due to having more than 8 years of experience developing various digital solutions.

Can someone hack into my digital wallet?

Regrettably, yes. Firstly, no firm is protected against interventions in its software from malignant actors. Thus, there’s always a risk that someone can break into the existing systems. Big companies like Google, however, are safer: even if a hack occurs, they have fail-safe measures that will prevent damage to your funds. Secondly, an issue of personal failures concerning safety also exists. You can accidentally reveal your password through a keylogger virus, for example. Consequently, our recommendation is to use additional security features, such as two-factor authentication.

Ultimately, the largest degree of danger is coming from the cryptocurrency sector. There, hacking is a common issue: hence, you should be especially careful with data storage. Our recommendation here is to combine complex passwords, physical keys, biometrics, and two-factor authentication where available.