RPA in finance is your chance to boost productivity. Learn all that you need to know about this technology in this article!

RPA in finance extends automation into the banking sector. Why is it so important? In our opinion, the reason is simple: it liberates the workforce from tedious, monotonous tasks and transitions it towards the processes requiring more thinking. For example, the appearance of Automatic Teller Machines allowed banks to transfer many specialists with Bachelor’s degrees into risk analysis or loan services. In this article, we’ll look at the benefits of the technology and even some use cases of utilizing RPA for finance. We hope this article will serve as the ultimate guide regarding all the intricacies of the involved technology.

What is RPA in Finance and Accounting?

To understand the impact of RPA in finance, we first have to review the essence of the technology. RPA, or Robotic Process Automation, is a technology that automates repetitive tasks using software robots. This innovation aims to mimic human actions, such as data entry. RPA works with diverging industries ranging from engineering to sociology and even literature studies. Ultimately, the reason for using RPA is prosaic: it enhances efficiency and reduces errors by quickly processing monotonous data-related tasks. All this frees up human resources for more valuable objectives.

As one can guess from the definition above, RPA, or Robotic Process Automation, has the capability to revolutionize Finance and Accounting. How exactly? It streamlines many repetitive tasks, as mentioned above. Software robots help reduce workload regarding data entry and invoice processing. These robots can also proceed with more complex tasks these days. For example, RPA for finance deals with credit risk calculation or the analysis of insurance payouts. For financial professionals, RPA means more time for strategic analysis and decision-making. It’s a game-changer in automating routine operations and accelerating financial processes. In the future, more and more banking sector workers will have the opportunity to move towards financial analytics.

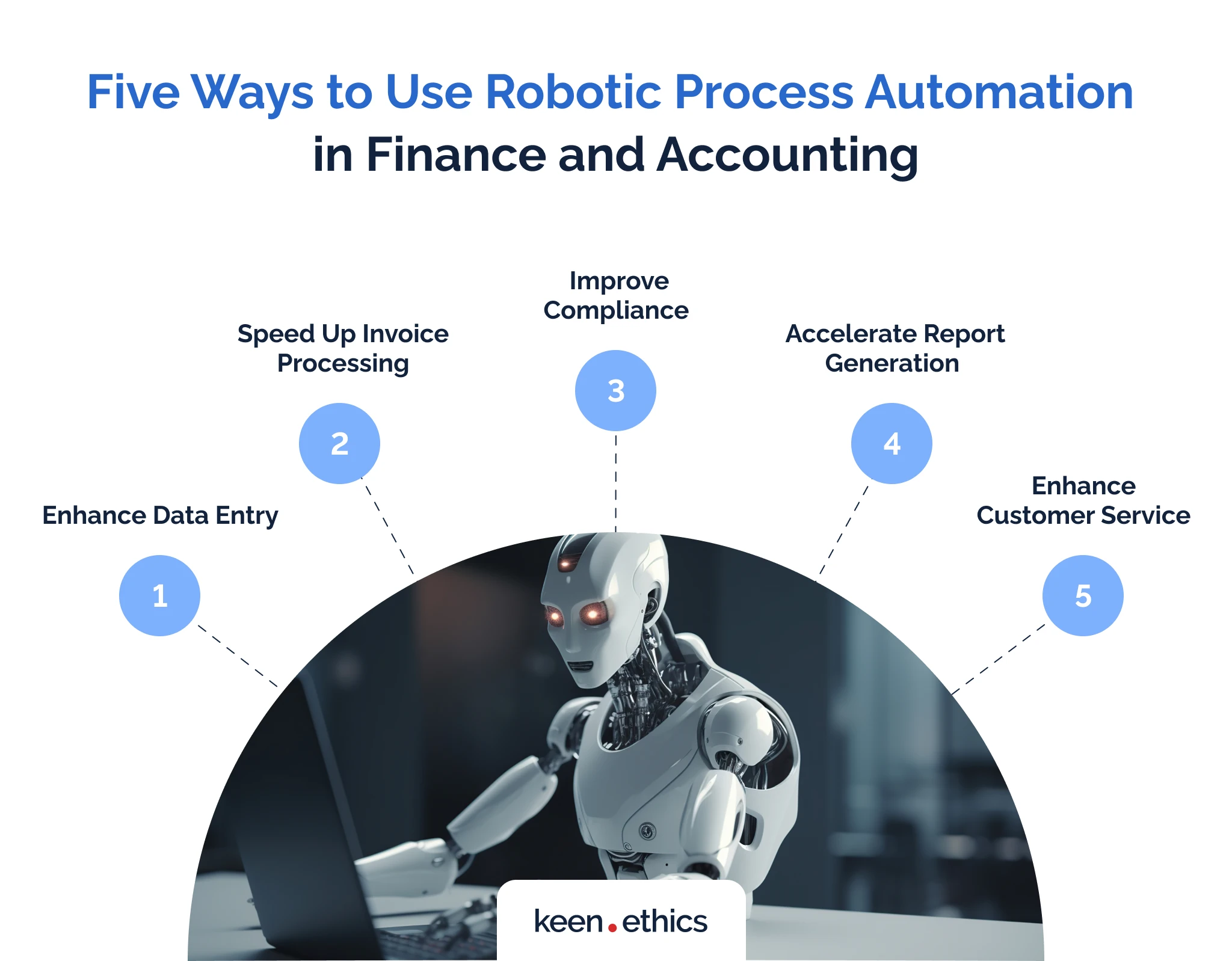

Five Ways to Use Robotic Process Automation in Finance and Accounting

How can RPA boost your firm? Let’s look at the key ways to use this technology:

Enhance Data Entry

Data entry is one of the core problems for modern banks. Many types of financial transactions have complex data entry forms that can confuse even experienced professionals. This issue is so severe that banks regularly lose tremendous funds due to problems with data entry. As a staff writer for Ars Technica, Timothy B. Lee, reported in his article, Citibank lost 500 million dollars due to incorrect data entry in 2021. Due to the complex UI within a loan calculation app, a subcontractor in India entered an incorrect sum for some interest payments. The judiciary system refused to offer compensation to the bank. This is where RPA in finance shines. RPA streamlines tedious data entry tasks, ensuring your financial records remain error-free. This means the best way to use RPA in finance is to assign it to data entry tasks. Due to being automatic, these tools will have no problems filling in the correct fields as long as you give them proper instructions.

Speed Up Invoice Processing

Data entry touches upon the users of financial services, too. How exactly? When performing invoice payments, these individuals must enter vital data to proceed. RPA in finance solves this problem once and for all by making many relevant steps automatic. For instance, a good RPA can connect your accounts in different banks to pull the right credentials and require no manual entry. The bank workers also don’t need to do anything with the payments: the automatic tools can check every aspect of the transactions. For instance, RPA tools may review if the banking accounts have no connection to illegal activities. In the past, this processing had to be done by the banking workers. With this approach, only the most unique cases will receive the attention of the specialists. Ultimately, RPA allows one to automate invoice validation and payment. This ensures swift transactions and optimizes cash flow management. Modern users no longer have to wait several days for transactions. It’s possible to send cash between multiple countries in minutes now.

Improve Compliance

A significant problem with many traditional accounting systems in the banking sector is that they require manual analysis of all supporting documents for the clients. For example, any documents relating to the enterprise rights of the clients used to require manual checks that could take weeks to complete. To approve a loan for a business, one had to collect a tremendous number of documents. This paperwork was problematic for the bank workers and the business professionals because one party had multiple documents to analyze, and the other had to collect them from various state organizations. Tracking compliance was difficult in those conditions. This problem opened a path for diverging illegal activities. Proper manipulation of the documents was enough for tax evasion or money laundering. With the rise of the Internet, many documents are now online-based. Banks can now check most of them via the official databases available on the Internet. This means the majority of compliance tasks are now open to automation. Instead of having the experts check everything manually, you can use the relevant APIs to quickly review all the data from the key websites. In this respect, RPA helps maintain compliance by systematically tracking and documenting financial processes, ensuring adherence to regulations.

Accelerate Report Generation

A common request for many financial services is the generation of reports. For instance, government organizations tend to require the breakdown of all financial activities of a person over a certain period to offer employment or some privileges. The majority of the information about financial activities is stored within the banks in an organized manner. This aspect makes the information easy to automate. All one has to do is store the data digitally and let the robotic assistants review the key points. In this light, a strong use case for RPA is to generate comprehensive financial reports. Why is this so advantageous? RPA in accounting is extremely fast, being capable of providing actionable insights for informed decision-making.

Enhance Customer Service

Faster information processing ultimately enables enhanced customer service. Firstly, you can use RPA to swiftly resolve inquiries, ensuring a seamless financial experience for clients. If you generate reports or analyze invoices fast, your banking specialists would require several minutes to answer the client’s requests instead of multiple hours or even days. Secondly, modern developments in AI are notable for their ability to enhance RPA. It’s possible to create assistants that answer diverse user questions based on large language models (LLMs). While this technology is yet to be implemented massively, modern innovations enable chatbots to produce realistic human-like text. The preceding year saw the rise of ChatGPT, which, while not without disadvantages, delivers extremely coherent answers to most human questions. Yes, such models can hallucinate and, thus, require the attention of the experts to limit incorrect answers. Nonetheless, they represent a revolution leading to a new wave of robotic process automation in finance.

How RPA Transforms Finance and Accounting

Robotic Process Automation (RPA) is a game-changer in finance and accounting. The reason for this assertion is simple: the technology offers profound transformation without demanding technical expertise.

Error reduction

One of its most significant advantages is error reduction. RPA meticulously handles data entry and transaction processing, ensuring financial records remain accurate and reliable.

Reducing time waste

Moreover, the automation of the key tasks is notable for reducing the time spent on low-complexity objectives. RPA doesn’t just enhance accuracy and efficiency; it also ends in substantial cost savings by reducing the need for manual labor. The banks promoting RPA can dedicate a significant part of their workforce to complex analytical tasks rather than something simple such as data entry. In the past, the work of competent individuals with Bachelor’s degrees was wasted on these objectives. Additionally, RPA is critical in ensuring compliance with regulatory standards, a cornerstone of the financial industry. With precise data extraction and rapid report generation, RPA empowers financial executives to make informed, data-driven decisions.

Improved customer service

Lastly, improved customer service is another benefit, as RPA enables faster response times and better product delivery. Robotic process automation in accounting reduces the need to generate reports automatically. In this way, you can rapidly inform the clients about certain changes in their work. RPA is also agnostic concerning the field it functions in. Its adaptability ensures the technology is tailored to meet specific needs of finance and accounting processes, providing flexibility in implementation.

Summary

In summary, RPA’s impact on finance and accounting is transformative because the platform in question can perform the following activities:

- simplifying operations;

- reducing costs;

- improving accuracy;

- remaining accessible to an educated but non-technical audience.

How to Implement RPA in Finance & Accounting?

What are the steps necessary to implement RPA in finance and accounting? This article reviews the key information you need to consider while using this technology. You must follow twelve steps to achieve maximal success with this innovation.

Planning and Preparation

The first thing to do while implementing RPA in finance and accounting is to plan the implementation process and prepare for it. Configuration isn’t as difficult as deciding if certain innovations make sense and should be implemented. Here are the key steps you need:

Assess and plan

Begin by conducting a thorough assessment of your existing financial processes. Identify tasks sharing three characteristics: being repetitive, rule-based, and time-consuming. For example, many types of data entry for loans belong to these activities. They’re the most open to automation because modern RPA tools are notable for their ability to substitute human labor. Once you have a list of tasks to automate, develop a roadmap for RPA implementation, outlining goals and expected outcomes. If you don’t know what tasks are perfect for automation, a good idea is to contact professionals. For instance, specialists at our firm, Keenethics, know how to analyze which tasks require RPA in finance and accounting.

Choose the Right Processes

Select processes that are well-suited for automation. As mentioned above, they should be rule-based, repetitive, and time-consuming. Common candidates include data entry, invoice processing, reconciliation, and report generation. These tasks can be automated without compromising quality or compliance.

Select the Right RPA Software

Once you know what processes can benefit from full-scale automation, a good idea is to look at the market for solutions to your problems. Ultimately, your goal at this stage is to choose an RPA platform that aligns with your organization’s needs and budget. Ensure it offers user-friendly features and scalability for future growth. Popular RPA tools include UiPath, Automation Anywhere, and Blue Prism.

Design and Development

Upon deciding what software to use, it’s time to configure it. Many development companies deliver services to help with task automation. In this respect, we recommend collaborating with RPA developers to create automation workflows. These workflows should mimic the steps performed by human operators. Focus on designing efficient and error-free processes. To do this, you have to find a business partner with a strong emphasis on testing the solutions. The more you test, the lower the probability of fatal errors ending in financial problems for your firm.

Testing and Validation

As we’ve mentioned above, finding a firm with strong testing capabilities is crucial. Rigorously test the RPA solutions in a controlled environment. Verify that the bots perform tasks accurately and reliably. Ensure they comply with all regulatory requirements. One of the key reasons to use bots is to reduce the probability of errors. It’s impossible to know if they can do this unless you test their capability to perform tasks without major errors.

Integration

Integrate RPA into your existing financial systems seamlessly. Ensure the bots interact with databases, ERPs, and other software used in your finance and accounting processes. The compatibility factor should, in this light, be a major aspect during the choice of RPA software. Some platforms may be advanced and even feature AI but fail regarding integration.

Addressing Job Loss and Staff Training

Yes, RPA decreases the labor time expended on average tasks in finance. Nonetheless, they don’t remove the need for the human workforce completely.

The real impact of RPA

It’s reasonable to compare modern automation tools to large factory machines: they do many things themselves, but they can’t think. You must train your finance and accounting teams to work alongside RPA bots in this situation. They should understand the principles behind this technology and know how to configure it in different situations. Encourage them to monitor the bots’ performance and address any issues promptly. There’s also a psychological component one should tackle to maximize the efficiency of those systems. A vital factor is emphasizing that RPA is a tool for enhancing their productivity, not replacing them.

Training and neo-Luddites

Neo-Luddite (anti-automation) ideas, as Sunil Manghani, Professor of Theory, Practice & Critique at the University of Southampton, notes, are becoming increasingly popular due to the rise of automation tools such as AI. To avoid the sabotage of RPA in finance and accounting, you should outline the new tasks for the workers and show they’re needed and valued. Otherwise, there’s a risk of encountering resistance in the form of distrust toward RPA or even direct attempts to damage the output of those systems.

Execution and Optimization

Once you’ve prepared and installed the RPA bots in your firm, it’s time to monitor them attentively. In this section, we look at the steps you should consider while utilizing this technology:

Monitoring and Maintenance

Continuously monitor the RPA bots to ensure they’re performing optimally. Regularly update and maintain the automation workflows to adapt to evolving business needs. Firstly, this is necessary because compliance processes tend to change significantly. Secondly, constant monitoring is crucial to ensure no malware or random unaccounted errors disrupt the ability of your app to function.

Data Security

A big problem for all technologies centered around computers is their long-term security. Yes, paper-based approaches are slow and require more effort to preserve the information. Nonetheless, the only way to steal the data from a paper archive is to directly access storage. This isn’t so difficult with online data: you only need to enter the right computer server.

Using this vulnerability, some countries, such as North Korea, fund whole armies of hackers to steal funds from Western banks. The damage is tremendous: the Wall Street Journal reports North Korea has stolen 3 billion U.S. dollars in cryptocurrency this way. This means you have to implement robust data security measures to protect sensitive financial information if you want to avoid the massive reputation damage coming from all computerized approaches. Ensure RPA processes comply with data privacy regulations such as GDPR or HIPAA. You should also consider additional methods: installing encryption and utilizing advanced firewalls. Regarding robotic process automation for finance, the more security tools you offer, the better.

Scale Gradually

A big mistake some firms make is simultaneously implementing as many RPA tools as possible. Why is this a bad idea? The implementation process can become overwhelming: you must test too many tools. Our recommendation here is simple. Start with a few automated processes and gradually expand your RPA implementation. Collect feedback from your finance and accounting teams to make improvements. Implementing an RPA within two years but without major errors is better. Remember: there’s no such thing as excessive testing.

Use Performance Metrics

Many firms think RPA in finance and accounting will benefit them by default. In the majority of cases, the assumption is correct. The problem is that firm owners don’t define the exact way to calculate the positive impacts of new technology. This means they can’t know the full influence of robotic process automation in finance and accounting. We recommend you define key performance indicators (KPIs) to measure the impact of RPA. Monitor metrics like cost savings, error reduction, and process efficiency to assess the success of your implementation. The more factors you measure, the higher the probability of succeeding at the long-term reduction of errors.

Go for Continuous Improvement

Technologies tend to change all the time. This means innovations created two or three years ago may already be outdated. In this light, we recommend fostering a culture of continuous improvement. Encourage teams to suggest enhancements to existing RPA workflows and identify new automation opportunities. Don’t forget to upgrade your RPA frameworks to ensure they have the latest security updates.

Generally, this guideline should be sufficient to promote an efficient approach to RPA in finance and accounting. This structured method divides the implementation process into planning and preparation, followed by execution and optimization, ensuring a clear path for successful RPA integration in finance and accounting.

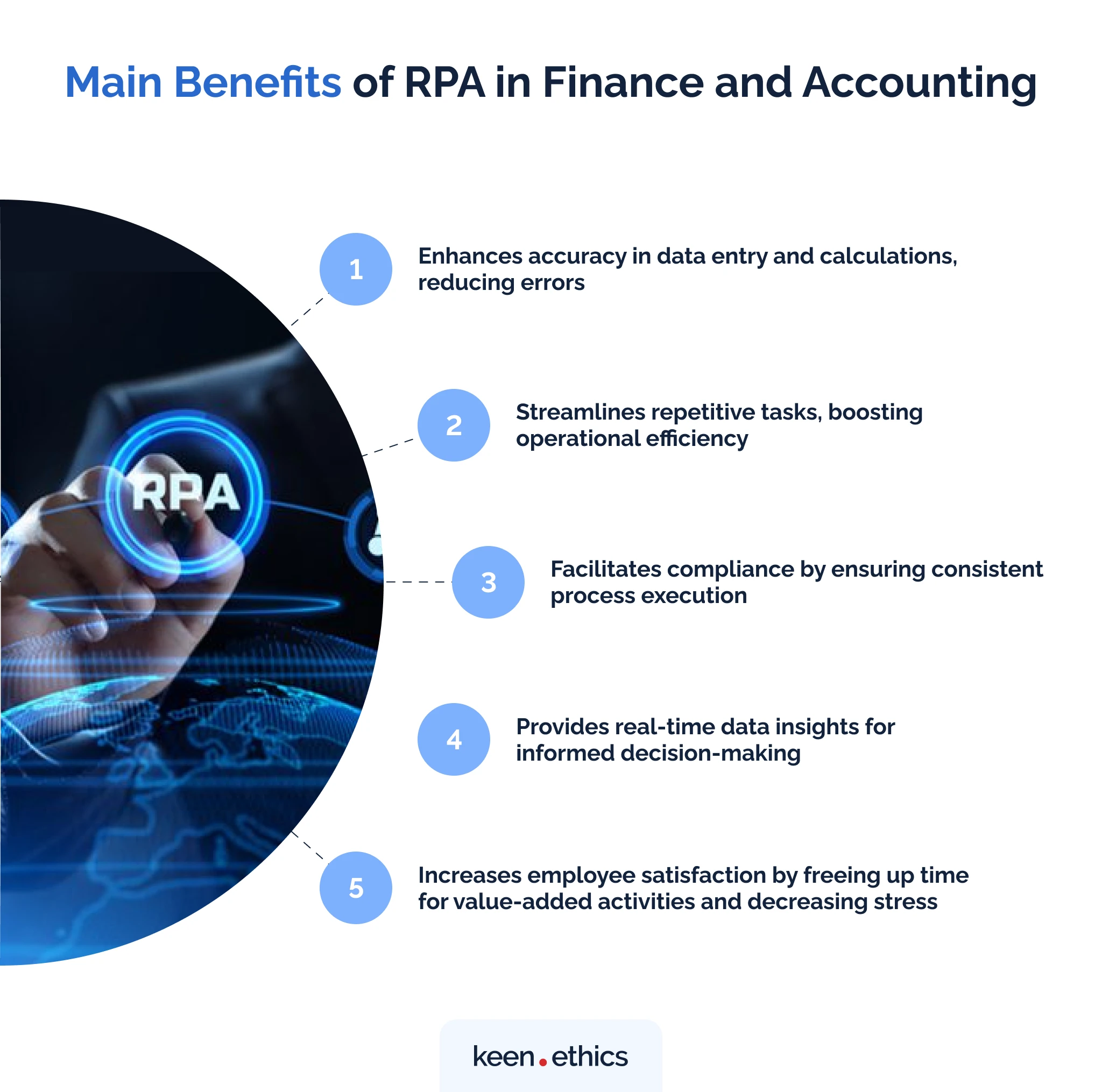

Main Benefits of RPA in Finance and Accounting

So, what are the key reasons to invest in RPA in finance and accounting? Here are the key issues to consider:

Enhances accuracy in data entry and calculations, reducing errors

The first reason to use RPA in finance and accounting is the ability to use those systems for improving data entry and calculations. A common problem with the paper frameworks in accounting is that they require an excessive focus on human labor. This creates a massive issue for the traditional systems. Firstly, human labor is slower than that of specialized machines: humans are good at general problem-solving, but machines can outcompete them in particular tasks. Secondly, a major issue is that humans are prone to errors. Machines can be programmed to perform everything according to an algorithm. This algorithm, generally, should be logically incapable of making errors in properly defined tasks. RPA in finance is expensive to implement, yes. But, simultaneously, the expenses make sense because they bring long-term benefits. Data entry errors and calculation problems inevitably result in massive reputation damage for many companies. We’ve already mentioned some cases in the presented review. If you want to avoid financial losses, RPA is a perfect tool.

Streamlines repetitive tasks, boosting operational efficiency

What’s the key reason why people make errors in the process of doing financial and other calculations? Apart from the lack of experience, it’s also crucial to note that many errors result from repetitiveness. Monotonous tasks disrupt the ability of a person to concentrate and often lead to mental exhaustion. One of the best ways to rest after physical activity is mental exercise. In turn, physical activity is the best approach to resting after a mental task. The South Korean government has greatly increased the time dedicated to physical wellness among its students to boost scores as the country faces major problems with the lack of physical activity. This is crucial to help curb not only the wave of physical ailments that befall the students due to the lack of exercise but also the massive wave of depression spreading in the country.

RPA has a socially meaningful function. It doesn’t only bring about more profits; it makes society healthier by allowing workers to engage with complex tasks. For example, a bank teller can now transition towards analytical tasks of greater complexity thanks to machines. RPA will make this aspect of transforming diverging tasks more widespread, pushing even more individuals towards interesting analytical jobs. All this will increase operational efficiency by allowing the banks to make more advanced decisions regarding issues such as giving out loans.

Facilitates compliance by ensuring consistent process execution

Most countries have strict demands for financial organizations functioning within their economies. In the U.S., there are many laws that make it hard for local banks to do certain things. According to Investopedia, a good example of the regulation is the Dodd-Frank Act, which appeared after the 2008 financial crisis to curb the negative processes that led to one of the largest economic upheavals in the history of humankind. Regulations provided by such laws tend to be complex and, as a result, may be confusing for the average worker. Many of them require one to fill out many diverging compliance forms. All this is utterly problematic if a person is tired or has limited experience. RPA for finance and accounting removes this problem once and for all. How exactly? If configured properly, it fills in all the relevant documents and checks if the information within them corresponds to proper standards. Since the inability to adhere to regulations represents a major danger for banks in the sense that it may lead to large fines, one should seriously consider the idea of installing high-quality RPA frameworks in their business.

Provides real-time data insights for informed decision-making

Banking, just like any business, is about rapid decision-making. The companies capitalizing on the new market trends are the most likely to win and gain major profits. In this light, the inability to obtain advanced data is a recipe for disaster. A company without access to high-quality information is akin to an army without access to proper operational data. RPA helps overcome this problem. Robots can collect data from multiple sources and process it immediately. RPA for finance and accounting is notable because it solves the problems of the modern financial sector. Why is this so important for business? It gains an opportunity to make choices based on up-to-date information. In cryptocurrency markets, a common situation is that the time frame for buying the currency is extremely limited. Fluctuations influence the sums that are in the million-dollar range within mere seconds. This means the only way to protect the funds of the customers and boost the revenues of a bank is to have up-to-date information. Without it, the investment risks grow at a tremendous rate.

Increases employee satisfaction by freeing up time for value-added activities and decreasing stress

A big problem with monotonous tasks is that they, as mentioned before, destroy the mental health of the workers. If you have to add customer information every day, you’ll eventually burn out due to the tedious and repetitive nature of the work. Obviously, such an approach ends in major dissatisfaction among the workers. They feel alienated and stressed. Even high income can’t resolve the problems for them altogether. Many people prefer work-life balance to the grueling work schedules that slowly but steadily disrupt the long-term health of the employees.

Work becomes satisfying when it has something beyond the monotonous component. It must have a strong intellectual incentive to be a good influence. In this light, RPA is one of the best technologies on the market. It removes the need to perform repetitive tasks, such as those of a bank teller. In turn, the workers get to concentrate on the more analytical tasks. We’ve already mentioned this aspect from the standpoint of operational efficiency. However, there is also a strong moral content to the presented discussions. RPA is liberating from the standpoint of worker well-being: they remove some jobs but open the path for more fulfilling tasks.

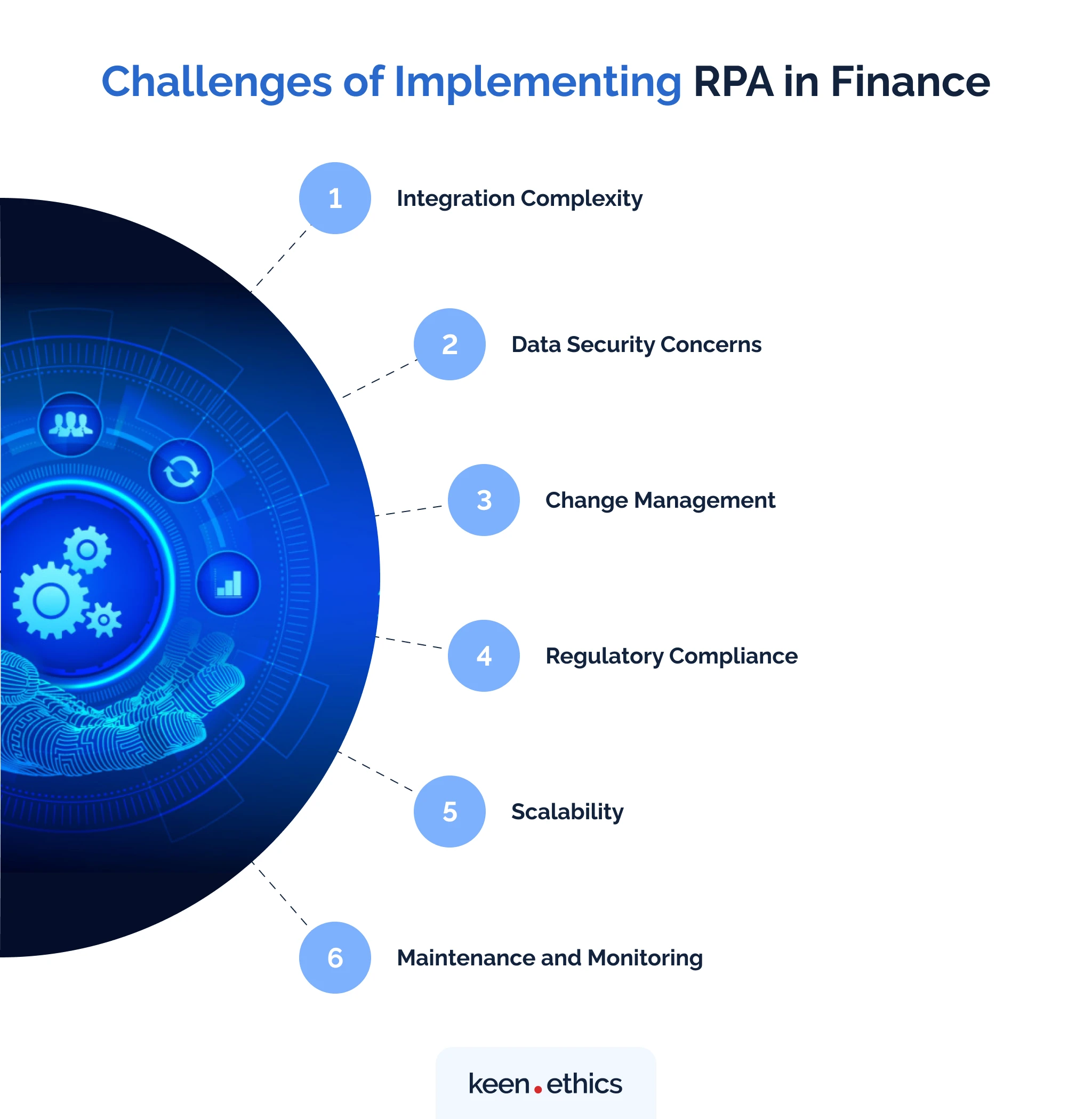

Challenges of Implementing RPA in Finance

RPA in finance also brings about major problems. Here are the key issues you need to consider:

Integration Complexity

Integrating RPA into existing financial systems is a difficult task. It requires a meticulous evaluation of current processes and frameworks to ensure compatibility. Different RPA tools must also interact with various legacy apps, databases, and platforms. Addressing these integration challenges demands thorough planning and custom development to establish a cohesive automation ecosystem. In many cases, the wish of the management to install an RPA platform may eventually lead to the remake of an entire IT framework of a business.

Many companies perform certain calculations using legacy code. In Ukraine, it’s not uncommon to find software from the 2010s and even the late 2000s. In the Western Europe, old computers from the 1990s and 2000s are sometimes being used for banking services (especially, by state-affiliated organizations). Integrating those old systems is counterproductive and even dangerous from the security standpoint. Lack of updates will make them progressively more difficult to use and push the users towards massive security risks. The only approach is to fully remake old systems. In this light, we recommend integrating RPA and accounting only when your IT segment is more or less up to date.

Data Security Concerns

Given the sensitive nature of financial data, ensuring its security is paramount. RPA bots must adhere to stringent data protection standards. This involves encryption, access control, and robust authentication mechanisms to safeguard sensitive information. Any breach can result in significant financial losses and damage business reputation. If you decide to create an RPA bot for the financial sector, one aspect should be clear to you: the development of these tools must be continuous. It’s not enough to hire a team to develop such a tool and then leave it as is for many years. Constant maintenance and testing for new potential errors are essential. Modern RPA tools may endanger the long-term safety of the user data, and, in this light, any compromises on security are unacceptable. To achieve major success, one must stay forever vigilant in this sector.

Change Management

The introduction of RPA can evoke resistance from employees who fear job displacement. We’ve already mentioned a neo-Luddite tendency in the modern economy. If you fail to explain the essence of the RPA change, massive protests against the technology (mostly covert) are inevitable. How to solve this problem once and for all? You should, above all, be a good communicator. The goal is to show that the RPA tools are about automating routine tasks to free up time for more valuable, strategic work. Effective change management is crucial to mitigate this negativity, too. It involves transparent communication, education, and retraining programs to help staff understand RPA aims to enhance their roles.

If your organization has enough resources, we even recommend offering written guarantees to the workers that they will obtain different tasks from your organization with the advent of RPA technology. Guarantee stable employment, and many people skeptical of the innovation will eventually flock to it. What scares people about such innovations is the potential for instability they bring. Give people stability, and they will view the innovations positively.

Regulatory Compliance

Financial institutions are subject to stringent regulatory requirements that are continually evolving. Implementing RPA while maintaining compliance is an ongoing challenge. It requires monitoring and adapting automated processes to ensure they align with the latest regulatory changes, minimizing the risk of non-compliance and associated penalties. We’ve mentioned that RPA helps maintain compliance because human operators lose track of the regulatory frameworks. RPA in finance and accounting works well with no major regulatory changes. It’s great for stable legislation with a long history.

Simultaneously, these frameworks fail when there are periodic changes in the laws. Why? Because they require the constant reconfiguration of the relevant frameworks. Another problem is that RPA tools can’t configure themselves automatically. There must be human input for this factor. This makes those platforms prone to major errors based on the inattentiveness of humans. How do we solve the problem once and for all? You should test a lot. RPA systems save money in the long-term scenarios, but you should be ready for short-term disruption.

Scalability

As businesses grow, RPA solutions must adapt. Ensuring the scalability of RPA implementations is challenging, particularly when considering factors like increased transaction volumes, additional processes, and expanding service offerings. A well-defined scalability strategy is essential to accommodate growth without disrupting operations. Keenethics can solve this issue once and for all. We have major expertise in Node.js and JavaScript technologies. They’re notable for one significant factor: those platforms are great for scalability. If you want to create an app with maximum stability and the ability to promote it among many users, you should look towards the RPA solutions presented by Keenethics. Our knowledge of scalable technologies will enable you to achieve great results.

Maintenance and Monitoring

RPA systems, like any technology, require regular maintenance and monitoring. Ensuring that bots operate effectively, handle exceptions, and remain up-to-date with process changes demands dedicated resources. Maintenance includes addressing issues, updating scripts, and optimizing bot performance. Monitoring guarantees that RPA processes run smoothly and that any anomalies or errors are swiftly identified and resolved, preventing disruptions in financial operations. Remember: one error in the maintenance process can end in massive security breaches. The more you try to control, the better.

Use Cases for RPA in Finance and Auditing

RPA (Robotic Process Automation) has emerged as a powerful tool for financial institutions, helping them automate and streamline various processes. Some common use cases of RPA in finance and accounting are:

Account Payable/Receivable

RPA can be used to automate the processing of invoices and vendor payments. This helps reduce errors and save time. Many modern banks, such as Quantic in the U.S., actively use RPA tools for processing invoices. Moreover, they go even further and offer their customers an opportunity to use various items for processing such data. Quantic has, for example, developed a payment ring with the help of BankWise, a major leader in the RPA market.

Bank Reconciliation

RPA automates the reconciliation of bank statements with transactions in accounting systems. Using this feature, you will detect and resolve discrepancies quickly, saving time and effort. In this light, the data analytics tools mine the key knowledge easily. Robocorp, a firm specializing in RPA development, offers bank reconciliation services as one of the specific use cases for the presented technology.

Financial Reporting

RPA can be used to automate the process of generating financial reports such as balance sheets and income statements. This helps ensure accuracy and reduce the risk of errors. As a Ukrainian company, we can note that implementing this feature is all-encompassing in our country. Banks such as Privat or Monobank offer their users an opportunity to generate financial reports at the press of a button.

Compliance

RPA can be used to automate compliance-related tasks such as KYC (Know Your Customer) checks, AML (Anti-Money Laundering) checks, and regulatory reporting. This helps ensure businesses meet their regulatory obligations. Some companies, such as Encompass, which specialize in the KYC process, note it tends to bring many long-term benefits to clients. They get to understand which groups of clients need to be targeted. Moreover, this technology allows one to realize if there’s a demand for additional security tasks.

Audit Trail

RPA can be used to create and maintain an audit trail of financial transactions, which can help ensure transparency and accountability. A common problem for many banks is that they don’t have full insights into their core transactions due to storing data in paper format. With RPA for finance and accounting, there’s a chance to create a framework that doesn’t require one to spend too much time seeking the key data. Instead, the tools will collect the data themselves. All you have to do after installing them is generate reports in automatic mode.

Fraud Detection

RPA can be used to detect potential fraud by analyzing large volumes of financial data and identifying patterns that may indicate fraudulent activity. This helps prevent financial losses and protect the organization’s reputation. The aspect of the technology is especially potent in light of major advances in AI. We already use AI tools for analyzing errors in our texts (as in the case of Grammarly). It’s not illogical to consider the possibility of such a technology for checking various income statements. An algorithmic AI can, for instance, review if the transactions are periodic to determine what type of activity they represent. The earlier you use AI in your banking service, the better.

The Evolution and Future of RPA in Finance

The evolution of Robotic Process Automation (RPA) in finance has been remarkable. Initially, RPA was deployed to automate repetitive, rule-based tasks such as data entry and reconciliation. Its ability to quickly reduce errors and enhance efficiency made it a valuable asset for finance and accounting teams.

As it matured, RPA process automation for accounting expanded its capabilities. Machine learning and artificial intelligence were integrated, allowing bots to handle more complex tasks like fraud detection and predictive analytics. This evolution empowered finance professionals to focus on strategic activities while RPA handled routine processes.

Looking ahead, the future of RPA in finance is promising. Advanced technologies like cognitive automation and natural language processing will enable bots to handle even more intricate financial tasks. We’ll likely see advanced customer support bots and tools that understand how to enforce proper regulatory compliance. The role of RPA in finance will continue to evolve, offering greater agility and adaptability to meet the evolving demands of the financial industry.

How Keenethics Helps with Robotic Process Automation in Finance and Accounting

Our company, Keenethics, can assist you with creating a full-scale RPA for finance and accounting. We have experience in creating multiple products for the banking and finance sector. Various development options are available to our clients. On the one hand, one can choose simple algorithm-based robotic process automation in finance and accounting. On the other hand, Keenethics understands how to work with modern AI. This means we know what to do to create complex products aimed at predictive analytics and even custom support (via modern large language models). If you want to try out our services, don’t hesitate to contact our firm. We’re ready to deliver a free estimate of your project costs and analyze the viability of your business idea.

FAQs

What is RPA in finance?

Robotic Process Automation in finance and accounting is the application of software robots or “bots” to automate repetitive, rule-based tasks and processes within the financial industry. These tasks involve data entry, transaction processing, reconciliation, and report generation. RPA technology enables organizations to upgrade operational efficiency, reduce human errors, and increase the speed of financial operations. It allows for 24/7 process execution and can integrate with existing IT systems, enhancing data accuracy and compliance. RPA in finance streamlines routine tasks, freeing human employees to focus on more strategic, value-added activities, ultimately leading to cost savings and better service delivery.

What are the main uses of an RPA?

RPA (Robotic Process Automation) finds diverse applications across industries. Its main uses include automating repetitive, rule-based tasks, such as data entry, invoice processing, and report generation. In finance, RPA can streamline accounting, reconciliation, and compliance processes. In healthcare, it aids in claims processing and patient record management. In manufacturing, it optimizes supply chain and inventory management. RPA also assists customer service by handling routine inquiries and supports HR with onboarding and payroll tasks. Its versatility extends to data extraction from various sources, improving data accuracy. Overall, RPA enhances operational efficiency, reduces errors, and frees human resources for strategic endeavors in various sectors.

Can you give great examples of RPA in finance?

Here are notable examples of RPA (Robotic Process Automation) in finance:

- Invoice Processing: RPA bots can extract data from invoices, validate it against purchase orders, and enter it into accounting systems, reducing manual effort and minimizing errors.

- Reconciliation: RPA automates bank and account reconciliations by matching transactions and highlighting discrepancies, boosting accuracy and saving time.

- Compliance Reporting: RPA ensures timely and accurate compliance reporting by automating data collection, validation, and generation of regulatory reports, reducing compliance risks.

- Customer Onboarding: RPA streamlines KYC (Know Your Customer) processes, verifying customer data and populating forms, expediting account opening while adhering to regulations.

- Expense Management: RPA helps track and process employee expense claims, ensuring adherence to company policies and speeding up reimbursement processes.

Does RPA affect accounting positively?

Yes, RPA (Robotic Process Automation) has a profoundly positive impact on accounting. It enhances accuracy by reducing the risk of human errors in data entry and calculations. RPA also streamlines repetitive accounting tasks, improving operational efficiency and allowing accountants to focus on more strategic financial analysis and decision-making. Additionally, it ensures compliance by consistently following predefined rules and regulations, reducing the likelihood of compliance issues. Furthermore, RPA accelerates financial reporting and reconciliation processes, enabling organizations to make more informed decisions based on up-to-date data. Overall, RPA transforms accounting by boosting the accuracy, efficiency, compliance, and the productivity of accounting professionals.

If yes, don’t hesitate to contact our company: we provide products of the highest quality for our clients.