A digital wallet is a potent tool for users who use multiple payment methods. This article offers insights into creating such instruments.

Our world is becoming increasingly Internet-based. In the upcoming years, the majority of people will likely face big obstacles if they decide to live without online-based payment systems. In this regard, a major problem arises for many people: the Internet, while convenient, opens up endless opportunities for cybercriminals. Digital wallet app development is a solution to this problem that can help people boost security. This article reviews the benefits of creating digital wallets and some steps one needs to deliver high-quality solutions for the market.

What’s a Digital Wallet?

What are the essential things necessary to secure a digital wallet? Before we describe them, let’s start with a basic definition of a digital wallet. A digital wallet is a secure virtual tool for storing and managing payment information to make online transactions easier. You can see it as an additional layer of security for all your activities. The rise of the Internet and related payment technologies often creates situations when people use multiple payment methods. For example, a person can have several separate credit cards for different goals and even a cryptocurrency account. In this light, two problems arise. Firstly, it’s difficult to manage all those accounts without forgetting one of them. Secondly, there are major risks regarding one’s bank account being hacked. When you have multiple accounts, it’s easy to leak information or miss some anti-fraud messages from your service provider. As the “Security” organization notes, 65% of all Americans have at least once been the targets of credit card fraud.

The relevant tool collects all the information about payment methods and makes it possible to pay through this framework rather than directly via a credit card or a cryptocurrency wallet. This approach creates advantages both for the people who want order in their credit card list and those who are concerned about long-term security.

Benefits of Creating a Digital Wallet

Before we learn how to build a digital wallet, it’s time for us to review why do this. Some of the key benefits have an outline above: let’s look at additional motivations.

Boosting customer engagement and loyalty

If you’re a head of a banking organization, the issue of customer engagement and loyalty is likely to be critical for you. Many people, in reality, tend to hate the credit card system. Why? Reasons are diverse but lack of comfort is a common motive. Every bank offers its own credit card (and it’s not uncommon to see situations when banks give out multiple credit cards). In this light, managing the myriad of payment tools is difficult. By giving people a digital wallet to use, you provide an opportunity to lessen the chaos of managing credit card usage.

Saving costs

A big factor when creating a digital wallet is that it’s a perfect framework for saving costs. By giving people an opportunity to manage all their activities in one place, one offers more flexibility during payment. Different cards and services have diverging approaches to various fees. If you’re willing to benefit from fee-free purchases, a digital wallet is a perfect tool. Why? You can choose between various cards and even payment means (for instance, traditional currencies and cryptocurrencies) without any barriers.

Having more insights

When you have multiple payment tools, a major problem is their management. For instance, many young people have to simultaneously manage college payments and bank loans for housing and transport. Life is stressful, and it’s easy to forget about the financial obligations one has. Digital wallets can help a user better control all the payments on their credit cards, preventing situations in which a client forgets about some obligations.

Improving security

As we’ve mentioned before, a major reason to use digital wallets is cybersecurity. Traditional payment methods expose the financial data of a user in a direct manner. For example, many sites require the CVV of your credit card. Digital wallets solve this problem at least partially. Why? This technology is more secure because it uses encryption, tokenization, and biometric authentication during the payment process, reducing the risk of fraud and unauthorized access.

Top 4 Digital Wallet Features

What are the key features of the digital wallets? How to create a digital wallet satisfying the maximum number of users? Let’s look at the things one should add to their service.

Secure Encryption

Digital wallets employ robust encryption algorithms to protect sensitive payment information, ensuring secure transactions and preventing unauthorized access. Even if the hackers receive access to the digital wallet database, this feature ensures that they won’t get any information.

Tokenization

As Tokenex notes, digital wallets should use tokens instead of actual card details, adding an extra layer of security by keeping the original payment information hidden during transactions. This means it’ll be impossible to steal your credit card data even if someone hacks the site where you, for instance, perform some purchases.

Biometric Authentication

Many digital wallets offer biometric features like fingerprint or facial recognition, making it harder for unauthorized individuals to access and use the wallet. Since digital wallets are present on smartphones, it’s possible to imagine a situation in which someone steals the device in an unlocked mode. Biometric protection on a digital wallet can prevent a situation in which the perpetrators compromise the security of your account.

Transaction History and Management

Digital wallets provide detailed transaction records, enabling users to track their spending, manage budgets, and easily review past purchases. The management of multiple credit cards tends to be confusing: in this light, a good transaction history and its management help prevent the presented problems.

3 Challenges of Creating a Digital Wallet App

It’s not enough to know how to create a digital wallet. One should also know about the potential mistakes during the creation of this technology. In this regard, we look at the key challenges one can meet on the path to creating a digital wallet app:

Compliance laws

Digital wallets may involve multiple countries and industrial sectors. This means the developers of the product in question need to consider different legal frameworks. Laws can differ between countries and sectors. For example, cryptocurrencies may have diverging regulations in comparison to traditional ones. Before starting any development, it’s essential to review all the potential regulatory barriers.

Hacking risks

Digital wallets possess vulnerable information about people. In this light, any hack can lead to serious problems for the users. The perpetrators can steal all the life savings of the individual. In this light, security should be your key goal during development. Why is this such a challenge? You have to prepare for an ‘armed race’ with the criminals. It’s not enough to concentrate on one security method: everything gets hacked eventually.

Technological issues

A major factor you need to review is the digital wallet technology. It’s crucial to use frameworks that not only are efficient but offer high security and scalability. In this regard, we recommend using frameworks such as Node.js. Our company concentrates on developing projects with the use of this framework.

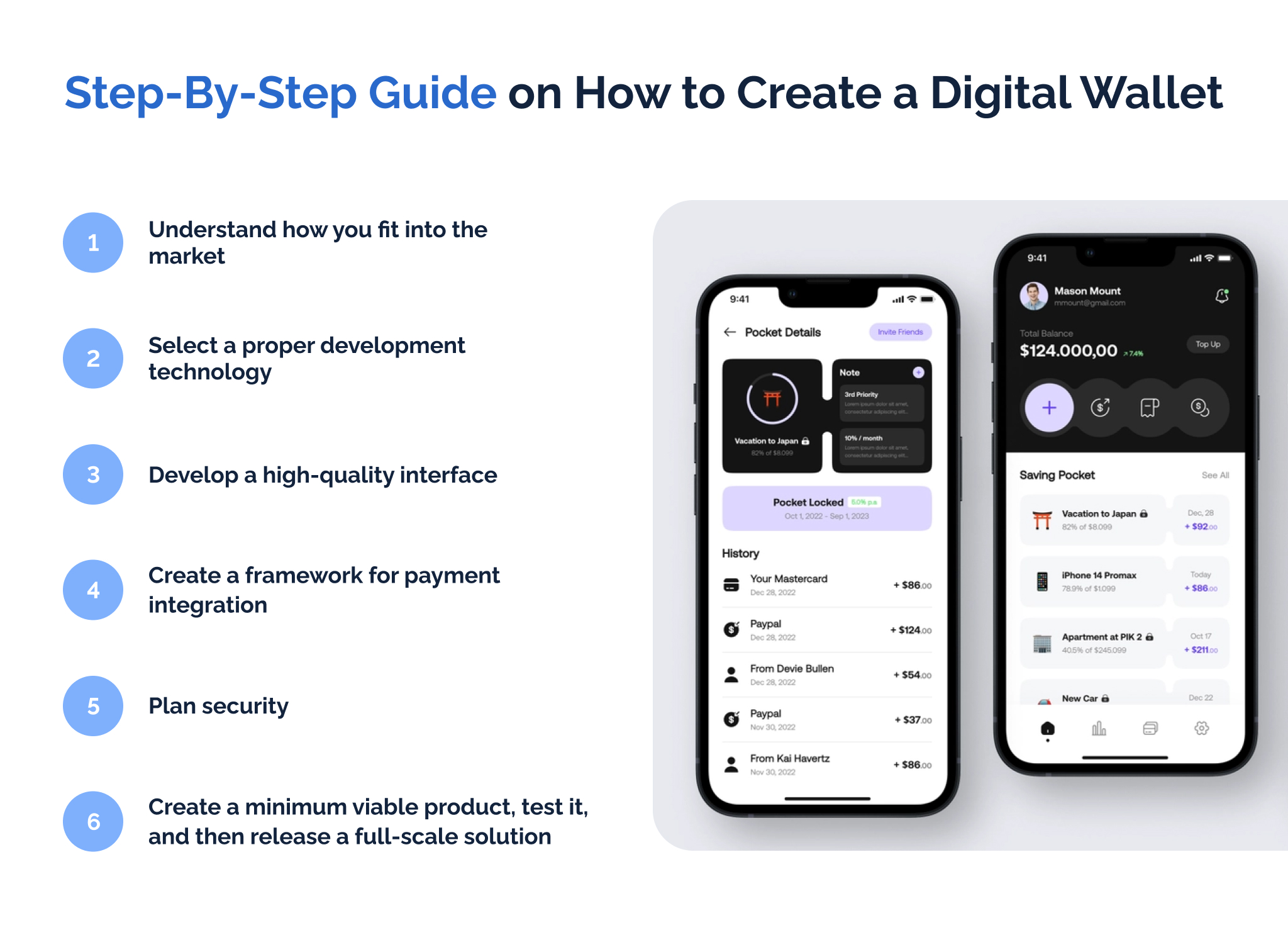

Step-By-Step Guide on How to Create a Digital Wallet

How to create a digital wallet on a purely strategic level? Here’s our guide:

Step 1: Understand how you fit into the market

Many digital wallet products are appearing on the market. You have to clearly understand what difference an app will deliver. In this light, our recommendation is to define your features before you start developing. You should understand what you’re doing if you want to succeed.

Step 2: Select a proper development technology

How to set up a digital wallet offering the highest quality to the users? You have to choose a technology minimizing bugs and maximizing performance. Payments must be as reliable as possible. What technology do we recommend using? Node.js is a perfect choice in this case due to its strong scalability and the ability to work among multiple platforms.

Step 3: Develop a high-quality interface

Payment technologies are used during the most serious events in human lives. In this light, any discomfort or lack of clarity regarding the services can push the users away from the relevant app.

Step 4: Create a framework for payment integration

How to set up a digital wallet that is useful for a maximum number of people? You have to ensure your service has a connection to multiple different payment frameworks. In this light, it’s essential to have specialists who know how laws in your country work and what standards for integration exist within different payment frameworks.

Step 5: Plan security

An insecure payment wallet is one of the worst things that can happen to a client. It may genuinely lead to the loss of all savings. In this light, we recommend focusing on security. You should present as many frameworks for preventing the loss of user funds as possible.

Step 6: Create a minimum viable product, test it, and then release a full-scale solution

Once you have everything in place, development itself must occur. We recommend creating a minimum viable product first and only then going for the creation of a full-scale product. One should test an idea before releasing it to the public in a full-scale manner.

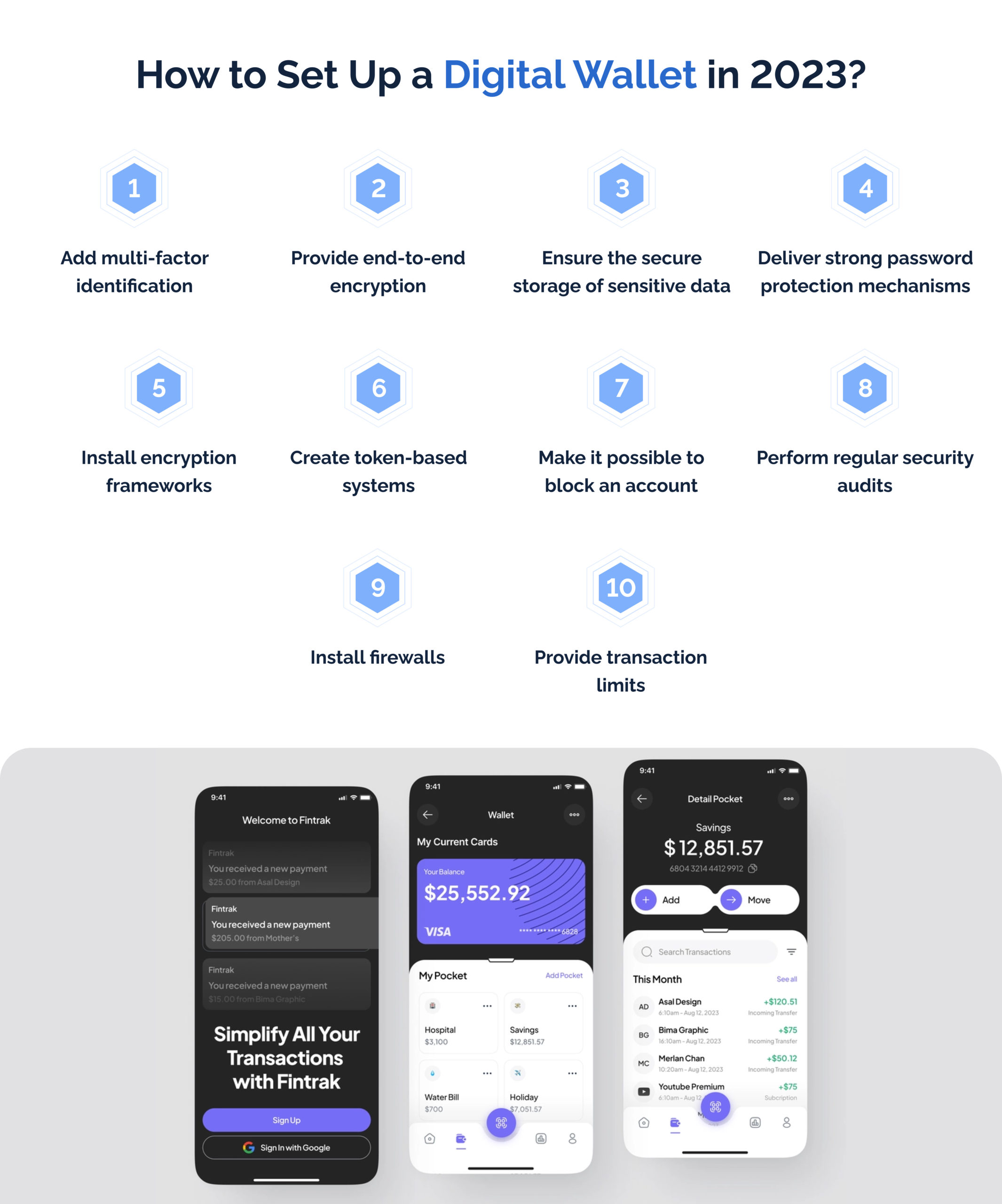

How to Set Up a Digital Wallet in 2023?

Digital wallet app development requires multiple steps regarding technology. Here are the key factors you need to consider:

Add multi-factor identification

Implementing multi-factor authentication is crucial for digital wallets as this step adds an extra layer of security, requiring users to provide multiple credentials like passwords and biometrics. This approach makes it harder for unauthorized individuals to gain access. How to make a digital wallet that respects the needs of its users? You have to minimize all security liabilities.

Provide end-to-end encryption

Utilizing end-to-end encryption is vital to protect sensitive data during transmission and storage. It ensures that only authorized parties can decrypt and access the information, safeguarding user privacy and preventing data breaches.

Ensure the secure storage of sensitive data

Storing sensitive information securely is of utmost importance to prevent unauthorized access or data leaks. By employing robust security measures like encryption and access controls, digital wallet apps can ensure that user data is protected from potential threats.

Deliver strong password protection mechanisms

Implementing strong password protection mechanisms helps fortify digital wallets against unauthorized access. By enforcing password complexity rules, implementing secure password storage techniques, and offering password recovery options, you safeguard user accounts. How to build a digital wallet that’s as reliable as possible? It has to minimize the possibility of breaches.

Installing encryption frameworks

Using point-to-point encryption (P2PE) is crucial for digital wallets as it encrypts payment data from the moment it’s captured until it reaches the intended destination. This prevents interception and ensures sensitive payment information remains protected throughout the transaction process.

Create token-based systems

Implementing tokenization is essential for digital wallets as it replaces actual card details with unique tokens. This minimizes the risk of exposing sensitive information during transactions, as tokens are meaningless to potential attackers even if intercepted.

Make it possible to block an account

Enabling account blocking features in digital wallets allows users to quickly and remotely block or freeze their accounts in the event of suspicious activity, loss, or theft of their device. This approach helps prevent unauthorized access and protect their funds.

Perform regular security audits

Conducting regular security audits is crucial to identify and address vulnerabilities or weaknesses in the digital wallet app. By performing systematic evaluations, app developers can ensure security measures are up-to-date and effective, providing users with a secure environment for their financial transactions. Remember: financial app security is about a constant state of alertness because you’re in a perpetual arms race with hackers.

Install firewalls

Using a firewall is vital for digital wallets as it acts as a barrier between the app and external networks, monitoring and controlling incoming and outgoing traffic. This helps prevent unauthorized access and protects against potential cyber threats, adding an additional layer of security to the app.

Provide transaction limits

Implementing transaction limits is necessary to mitigate potential financial losses and fraud risks. By setting limits on transaction amounts or frequencies, digital wallets can prevent excessive or unauthorized transactions, providing users with control over their spending and enhancing overall security. Even if every security method fails, this framework offers an opportunity to minimize damage.

Popular Wallet App Examples

When reviewing how to build a digital wallet, it’s crucial to understand some success cases. They can point out how to create a high-quality product:

- PayPal: PayPal is a popular digital wallet app allowing users to securely send and receive money, make online purchases, and store payment information. It offers buyer and seller protection, easy money transfers, and accepts various payment methods.

- Google Pay: Google Pay is a widely used digital wallet app enabling users to make payments, send money to friends, and store loyalty cards. It’s integrated with Google services, provides fast and secure transactions, and supports contactless payments through NFC technology.

- Apple Pay: Apple Pay is a widely recognized digital wallet app exclusive to Apple devices. It allows users to make secure payments using their iPhones, iPads, or Apple Watches. With biometric authentication and tokenization, the service offers convenient and safe transactions at supported retailers and online stores.

Why Invest in Digital Wallet App Development in 2023?

Now that we understand how to make a digital wallet, let’s look at the reasons to invest in them in 2023. Investing in digital wallet app development in 2023 is a smart choice due to the following reasons:

Increasing User Adoption

More people are embracing digital payment methods and seeking convenient and secure ways to manage their finances. Developing a digital wallet app enables you to tap into this growing user base and cater to their needs. Digital wallet app development is a perfect opportunity to showcase that you consider the maximal comfort of the users in your service.

Enhanced Customer Engagement

Offering a user-friendly and feature-rich digital wallet app can improve customer engagement and loyalty. By providing seamless payment experiences, personalized offers, and reward programs, you can attract and retain customers, fostering long-term relationships.

Future-Proofing Business

As the world continues to shift towards digital transactions, having a digital wallet app positions your business for the future. By staying ahead of the curve, you can adapt to changing customer preferences and ensure your relevance in the increasingly digital economy.

Conclusion

To summarize, a digital wallet app is a worthwhile investment. We hope this article offers enough insights into the ways to develop one. Do you want more information? In this case, don’t hesitate to contact us. We can provide you with high-quality recommendations for developing technology of this type. Our company has multiple years of experience in creating products in the financial sector.

FAQs

How to monetize digital wallets?

Digital wallets can be monetized through transaction fees, partnerships with merchants for promotional opportunities, or by offering premium features for a subscription fee.

What’s the development cost for a digital wallet?

The development cost for a digital wallet can vary based on the complexity of features and platforms, ranging from thousands to hundreds of thousands of dollars.

What technological frameworks are good for a digital wallet?

Some popular technological frameworks suitable for digital wallet development include Flutter, React Native, and Xamarin for cross-platform compatibility, and native frameworks like Swift and Kotlin for platform-specific development.

Contact us to get a free estimate of your business idea.