Fintech is a rising trend for modern banks. In this article, we review how fintech impacts banking.

A bank that works from any place. An ability to approve a home loan via a smartphone. These things seemed impossible a mere 15 years ago. Today, they’re a reality of banking due to innovative technology. Banking fintech (financial technology) is a major trend in digital technologies. More and more banks are using informational technology to transform their business models. For example, a common strategy is to create web banking for financial services industry. Banks use modern web interfaces to transfer most activities to the Internet. Another important approach is credit approval automation through AI. In short, the number of ways in which banks and fintech interact is tremendous. In this article, we’ll look at the interaction of those sectors. Our goal is to understand how fintech changes banks and the future of finances.

I. What is FinTech?

Let’s review the terms before looking at the interaction of banks and fintech. We know what banks are. It’s impossible to live without them in our society. But what about fintech? Many people in the business world hear about this term all the time. Still, few individuals fully understand what it means.

Definition

In our opinion, this term is easy to explain. It means the use of technology to improve the existing services in the financial industry. These technologies are usually digital. For instance, if you use modern generative AIs to create bank chatbots, your service will be a part of fintech. This tech fills all the parts of the relevant definition.

On the one hand, it upgrades banking. On the other hand, it uses novel technologies in, for example, mobile applications. Consequently, fintech and banking have a simple interaction. Fintech improves modern banks.

Key technologies transforming the banking field

Multiple technologies are currently transforming the operating costs in the banking field. Here are some of the fintech innovations you should consider if you want to create digital banks or upgrade traditional banking institutions:

Mobile banking

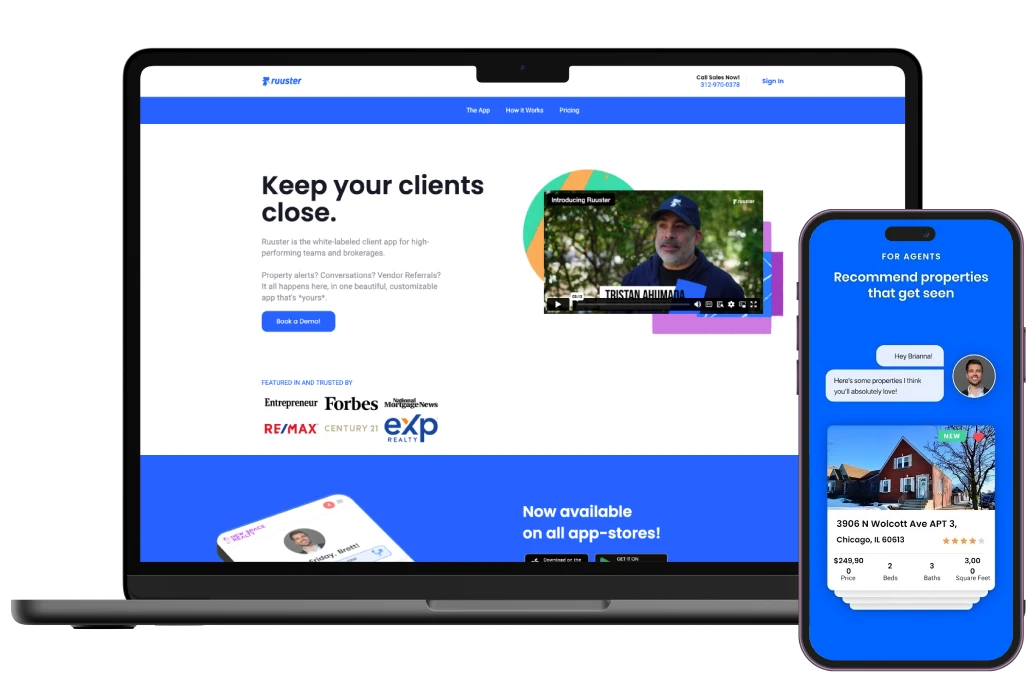

This technology allows one to perform all banking activities in their smartphone. Most banks have some form of a mobile app these days. Many of them use portable web apps, too. This innovation isn’t difficult: it uses the power of the modern Internet. What’s the key limitation here? In our opinion, many banks should work more actively on UI/UX for mobile platforms. Mobile apps are created as an afterthought by many banks. Instead, it’s more rational to focus on actually creating platforms that are mobile-centric from the onset.

Algorithmic decision-making

Another big use of fintech is in decision-making. In this regard, we have many technologies. One can use machine learning algorithms to, for example, calculate the best investments. Sometimes, it’s great for understanding if a certain person is eligible for a loan. In short, algorithms (often AI) can ease the lives of investors and bank executives. A subset of this technology is robotic advising. In this respect, algorithms can assist investors with making high-quality financial decisions.

Automated chatbots

Many activities in fintech involve client interactions. People often have major questions about their finances. For instance, situations when someone tries to access their financial account aren’t uncommon. All those interactions demand a major investment into an advanced workforce. This workforce has to know all the key regulations in banking. Consequently, the costs of maintaining it tend to be high. Ultimately, AI chatbots can solve this problem for various banks. How can they do this? Large language models produce high-quality text that is human-like. If we teach those models about the core regulations, automating many of the interactions with the clients will be possible.

Many other technologies are of great interest. Nonetheless, these are some core innovations you should consider. Fintech for banks is transforming many traditional approaches in this sector.

II. The Impact of Fintech on the Financial Sector

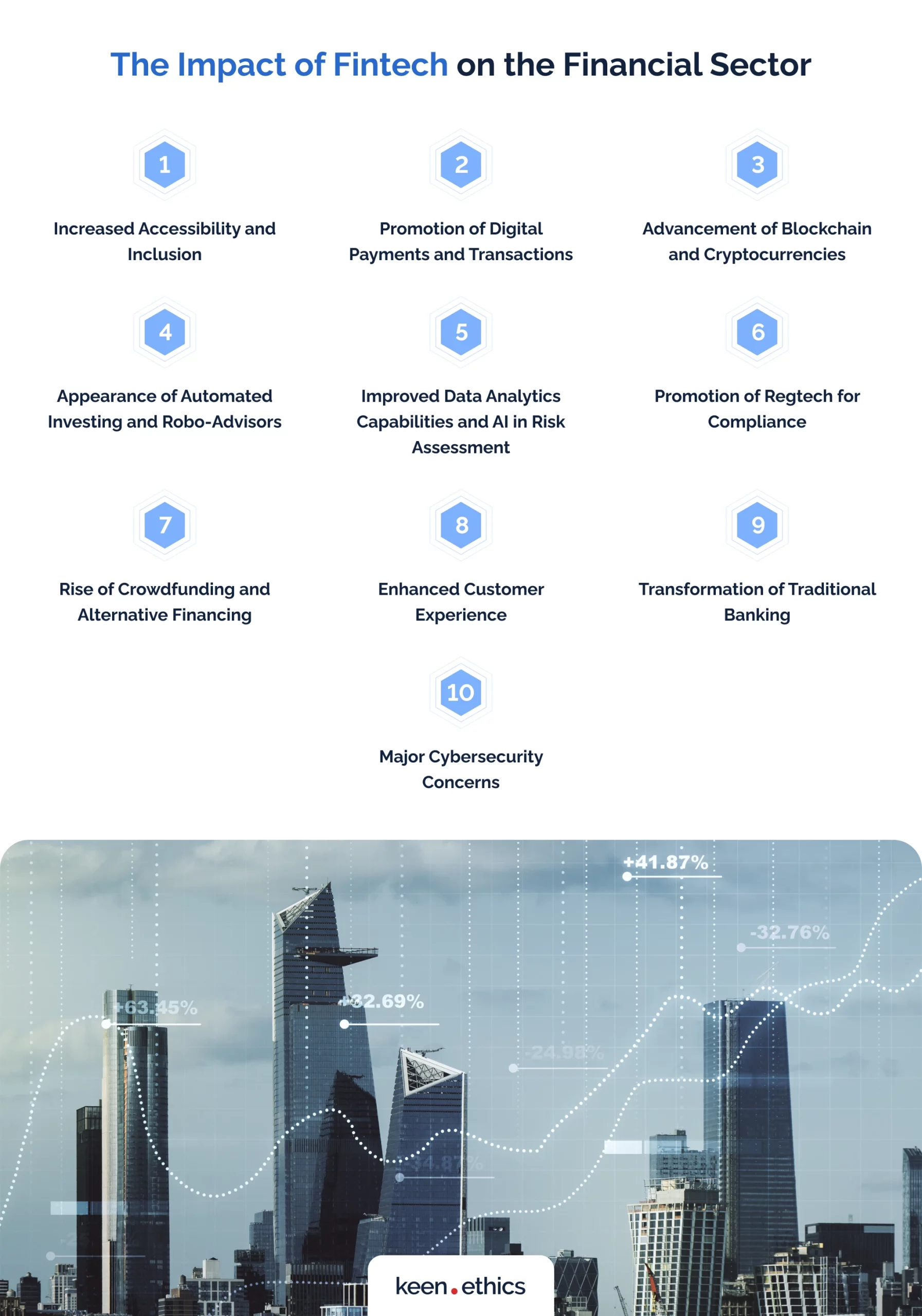

Modern fintech has a tremendous impact on the financial sector. We believe the best way to understand it is to look at all the key influences in isolation. How is fintech changing banking? Here’s the list of the core ways in which this transformation occurs:

Increased Accessibility and Inclusion

Fintech has significantly increased access to financial services. This impact is especially visible in underserved and unbanked populations, who have trouble accessing the traditional banking sector. Mobile banking has made it easier for individuals to manage their finances. There is no longer any need for traditional banking infrastructure, which is represented by the model of a commercial bank. For instance, online lending platforms allow people to get loans in a few clicks. Many online fintech microfinance organizations also enable people to take money without a good credit history. As a result, small businesses in rural areas, for example, now have more opportunities. They don’t need to have banking facilities near them. More importantly, they can find funding even if their community is marginalized.

Promotion of Digital Payments and Transactions

Ten years ago, many people were still using cash en masse. The rise of fintech has led to a shift from traditional cash transactions. Most people use credit cards or mobile devices (wearables or smartphones) with NFC devices today. Why did that shift occur? On the one hand, there’s a wider availability of payment devices.

On the other hand, the majority is getting used to digital finance. Mobile phones allow many individuals to manage their funds without banks. More importantly, they enable them to perform various online transactions. This process is so strong in some countries that most transactions are now digital. Some experts openly deem China a cashless society. Even street vendors are using services like WePay. Mobile payment systems, peer-to-peer transfers, and digital wallets have become mainstream there. In China, we can see the future of finance across the globe. Thanks to fintech, our society is becoming progressively more cashless.

Advancement of Blockchain and Cryptocurrencies

Fintech has played a crucial role in popularizing blockchain technology and cryptocurrencies. In the early 2010s, this technology was marginalized. For many people, blockchain was a street legend. One had to possess significant technical expertise to start using it. Fintech is finally changing attitudes towards this technology. In our opinion, this happens via two pathways.

Blockchain as a revolution

Firstly, blockchain, the underlying technology of cryptocurrencies like Bitcoin, has the potential to revolutionize financial transactions. How can it do this? Blockchain will be able to make all transactions transparent and safe. It records all the data independently and has strong encryption. As a result, we may see the rise of digital money that people are no longer afraid to use.

Cryptocurrency as a revolution

Secondly, cryptocurrencies are also likely to transform international transactions. Today, most international transactions are costly. If you’re transferring large sums, they can also attract the attention of the regulators. Cryptocurrencies have minimum fees for money transfers. Consequently, platforms like USD Tether can transfer big sums across different markets. In the future, various currencies will have their cryptoversions. They’ll also enable cross-border transfers without any fees. The only downside is processing time: for now, those platforms aren’t as fast as bank-enabled digital transactions.

Fintech has a positive impact on cryptocurrencies due to making them mainstream, too. In the past, banks and fintech ignored cryptocurrencies. As a result, this technology turned out to be an outcast. Most financial regulators weren’t taking it seriously. The negative attitude continues even today. Still, the appearance of cryptocurrency exchanges in platforms like Revolut is changing the situation. Even if blockchain has no impact on fintech, fintech will influence it. Above all, it’ll influence cryptocurrencies by making them mainstream. It’s now possible to buy the majority of cryptocurrencies easily. Doing some basic transactions with them has never been so easy.

Appearance of Automated Investing and Robo-Advisors

Fintech has introduced automated investment platforms and robo-advisors. These platforms use algorithms to provide financial advice and manage investment portfolios. Often, their advice is high-quality. These platforms can easily review long-term trends. Consequently, their predictions on the stability of companies like Apple make sense. If you don’t intend to create advanced investment strategies and instead care about stability alone, these platforms are sufficient for putting your money to good use. Investopedia openly reports that they work great in “set-and-forget” scenarios.

What are some of their core advantages? These tools offer lower fees compared to traditional financial advisors. This means investment services become more accessible for the majority of the population. Yes, they lack the human touch in communication. Nonetheless, they’re also less prone to risk and human errors.

We don’t expect robo-advisors to create massive incomes. Still, they’re perfect for outlining stable long-term strategies for people who don’t like risk.

Improved Data Analytics Capabilities and AI in Risk Assessment

Most financial organizations have to deal with risk in one way or another. For example, an inability to properly assess repayment risks during financial management led to massive challenges for property companies like Evergrande in China. The Chinese government managed to prevent the collapse of the whole property sector in 2021. In this regard, it used the 2008 strategy of large monetary investments into the financial system. Its banking sector suffered from a common problem. Banks were giving loans to too many people.

The rise of data analytics will help prevent such issues in the future. Fintech companies leverage advanced data analytics and artificial intelligence to assess risk. This enables better credit scoring, fraud detection, and personalized financial services. It’s difficult for a human to create a 10-year model for assessing risk. However, an AI can do this analysis. This data is often sufficient to make massive predictions on the long-term risks.

Promotion of RegTech for Compliance

Regulatory technology, or regtech, is another area where fintech has made significant contributions and where it makes sense to hire a financial software development company. Modern banking is full of regulation due to money-laundering and fraud. For instance, it’s facing regulations like PCI-DSS and even GDPR as well as AML (anti-money-laundering) laws. In many situations, making errors with their management is simple. They can lead to massive damage for involved companies. Reports on fines for banks are becoming common today.

There are reports of major banks like BBVA facing GDPR fines. Big banks can easily survive a fine of, for example, 300000 euros. However, smaller ones can easily become bankrupt due to several fines of this type. In this light, any error in banking processes is unacceptable. Ultimately, automated systems help financial institutions comply with regulations more efficiently. They reduce the costs and risks associated with regulatory compliance. Why is this important? Fintech and banks interact positively because the former technology decreases reliance on humans. The number of human errors is becoming increasingly lower.

Rise of Crowdfunding and Alternative Financing

The early 2010s proved to be a major era of crowdfunding and mobile banking app development. After a series of failed projects, this sector faced a slowdown in the late 2010s. Nonetheless, stronger controls are arising on platforms like Kickstarter. Consequently, we’re bound to see the resurgence of this sector. More and more people are making major investments in interesting projects online. Allied Market Research reports that the crowdfunding sector will grow from 1.9 billion in 2021 to 6.8 billion dollars in 2031. It’s possible to start a new project by asking outsiders to fund it. In this respect, major video games and, more importantly, even cryptocurrencies appeared due to crowdfunding. Some of the most notable projects include Undertale, Star Citizen, and EOS cryptocurrency.

What was the key factor behind the rise of crowdfunding and alternative financing? In our opinion, this key factor came from fintech platforms. Fintech platforms have facilitated alternative fundraising methods in response to online payments. Small businesses and individuals can access capital outside traditional banking channels. In the past, crowdfunding required too many steps. People had to personally visit banks to fund certain projects. Today, it’s no longer necessary to visit any locations. Instead, a person can provide investments for certain projects from the comfort of their homes.

Enhanced Customer Experience

Fintech drives improvements in customer experience. Traditional banks used to create major issues for many types of customers. On the one hand, they were creating large obstacles for underserved people. Sometimes, people had to travel several miles to visit a small bank. On the other hand, they were also suboptimal for disabled individuals. Many people had trouble reaching traditional banks. Getting services in them was difficult because of the low-quality infrastructure and distance.

Fintech solves these problems by offering user-friendly interfaces, personalized services, and faster processing times. More importantly, modern fintech has made banking accessible from any location. This has raised customer expectations and pushed traditional financial institutions to enhance their services. Consequently, banks in Germany are seeing massive consolidation. Various organizations using outdated practices can no longer compete with businesses like Revolut.

Transformation of Traditional Banking

The impact of fintech on banks is especially visible concerning traditional banking. Fintech companies, particularly neobanks, challenge traditional banking models. How exactly do they achieve this? They offer digital-only services with lower fees and more customer-centric approaches. This competition has forced traditional banks to innovate and adapt. How will fintech change banking? In our opinion, we’ll see even more traditional banks accepting the new behavior models. As a result, every sector in banking will start accepting the key paradigms of fintech. Banking will become a full fintech sector in the upcoming years.

Major Cybersecurity Concerns

Cybersecurity concerns are rising en masse due to fintech. Like every computer technology, cybersecurity raises the probability of major hacks. Yes, digital transformation is improving our ability to process information. However, its complexity also raises the chance of major errors. The more complex certain processes are, the greater the space for human errors.

Consequently, major vulnerabilities are arising en masse in processors. For example, a large error in processors during the 2010s was Meltdown. Using it, one could escalate their access rights to the root level in minutes. With the increasing reliance on digital platforms and the storage of sensitive financial information, banking is becoming more dangerous. Fintech companies and traditional financial institutions must invest in robust cybersecurity measures. Only this approach will help you protect your organization against cyber threats.

III. The Driving Factors and Pre-Conditions for the Growth of FinTech in Banking

Many factors and pre-conditions influence the growth of fintech in banking. Here are five key driving factors:

Technological Advancements

The availability and adoption of advanced technologies create a foundation for fintech growth. What are some of those technologies? They include artificial intelligence, machine learning, blockchain, and data analytics. How do these technologies drive change in fintech? Fintech companies leverage these technologies to enhance efficiency and reduce costs. For example, it’s possible to use AI to minimize the reliance on the human workforce. Ultimately, this approach provides innovative financial services that outpace traditional banking systems. The users get access to robo-advisors and banking-in-a-pocket.

Consumer Demand for Convenience

A major factor these days is the changing consumer preferences. An increasing reliance on digital solutions for everyday tasks boosts fintech growth. More and more people are no longer accepting traditional financial services. They find them uncomfortable, for instance. As a result, fintech responds to the demand for convenient and accessible financial services. Mobile banking allows access to banks from the comfort of one’s home. Digital wallets enable people to spend less time managing multiple credit cards. Lastly, online payment platforms help pay for various services online fast. Ultimately, all these frameworks are examples of services meeting the demand for digital transformation.

Regulatory Support and Open Banking

A regulatory environment that encourages innovation and competition is crucial for fintech development. Many countries are investing in such an environment these days. For example, the EU has created a strong environment for fintech through PSD2. This regulation pushes more and more organizations to accept fintech standards. In this regard, it creates an environment within which businesses that don’t accept fintech will get fined. We also have supportive regulations, such as open banking initiatives. All these factors enable fintech companies to integrate with traditional banking systems. This aspect fosters collaboration and allows for the creation of new financial products.

Data Security and Privacy Measures

Initially, online technologies were known for their low reliability. The 1990s and early 2000s were full of hacking scandals. Today, more advanced cybersecurity algorithms are arising en masse. They raise the long-term reliability of modern fintech. More importantly, we’re bound to see even more complex algorithms. Frameworks like quantum encryption will make many projects much safer. Robust cybersecurity measures and a commitment to data privacy build trust among users. Ultimately, they create a secure environment for financial transactions with a new cybersecurity culture. As fintech relies on data, ensuring the security of user information is paramount. Companies that prioritize these concerns gain the trust of consumers. Consequently, we are likely to see the long-term growth of their services.

Financial Inclusion and Accessibility

Gaps in traditional banking services create an opportunity for fintech. These services can address financial inclusion challenges for underserved or unbanked populations. For instance, they’re great for various minorities and people with disabilities. Fintech can reach a broader audience by providing accessible and inclusive financial services. What are some of those services? They involve microfinance, peer-to-peer lending, and mobile banking. All these aspects are perfect for driving growth through increased market reach. More people can get loans or even access banks in the first place.

IV. How Does Fintech Impact the Banking Industry?

What’s the impact of fintech on the banking industry? In our opinion, it’s primarily transformative. In one way or another, fintech creates new opportunities and challenges for the sector. We’ve already outlined some key transformations above. Let’s summarize them in terms of the changes they will bring about.

Better accessibility

Firstly, fintech and banks interact by making most services more accessible. It’s now possible to make most banks portable. An average user can start using bank services without visiting any locations. We live in an era of banking services in a pocket. As a result, two groups of people face major benefits.

On the one hand, more and more underserved individuals get access to banks. For example, people living in rural areas can now openly use banks without major barriers. There’s no longer any need to go to cities and search for banking services there.

On the other hand, many special needs people face fewer issues with banks. Before the fintech revolution, many banks were not suited to people with special needs. Smartphone banks no longer face this problem. Modern smartphones have many tools for all types of special needs people. Consequently, banking is now accessible to almost the entire adult population.

Lower reliance on the human workforce

Secondly, the banking industry now has to rely less on the human workforce. Various automated tools are decreasing the need to hire many individuals. In this regard, robo-advisors satisfy the majority of the investors. More importantly, modern AI tools enable bank owners to substitute customer support services. There’s no longer a need to invest in advanced workforces dealing with small user requests. Instead, one can invest in small mobile teams that target the most complex requests of the average customers. All this means that banks can genuinely lower the average cost of their services. Many online services no longer take significant funds for transactions. Why? They don’t need large workforces and focus on self-management.

Improved decision-making

One of the core findings of the Austrian School of Economics is that the market is too complex to calculate. Humans are advanced beings that require too many resources to understand. In many ways, this factor forces constant renewal in the market. Companies that create a better model of reality have a great chance of survival. Practice shows that creating an ideal model of reality is often impossible. Even the largest corporations fail eventually. This prospect is highly negative for the majority of banks. As a result, they need an alternative that can prolong their existence.

In our opinion, this alternative comes in the form of analytical algorithms. Yes, they still can’t describe the whole society adequately. It’s impossible to predict how innovations, for example, will disrupt the markets. Still, they make our predictions more accurate. In this light, firms using modern AI-centric algorithmic predictions are more likely to survive. For instance, it’s now possible to create high-quality models for decisions on the market. Using them, one can chart the course for their company longer. Yes, these models can’t defend against black swans. Still, they’re more than sufficient to ensure that a business exists for a longer time.

V. The Effects of Fintech on Banks

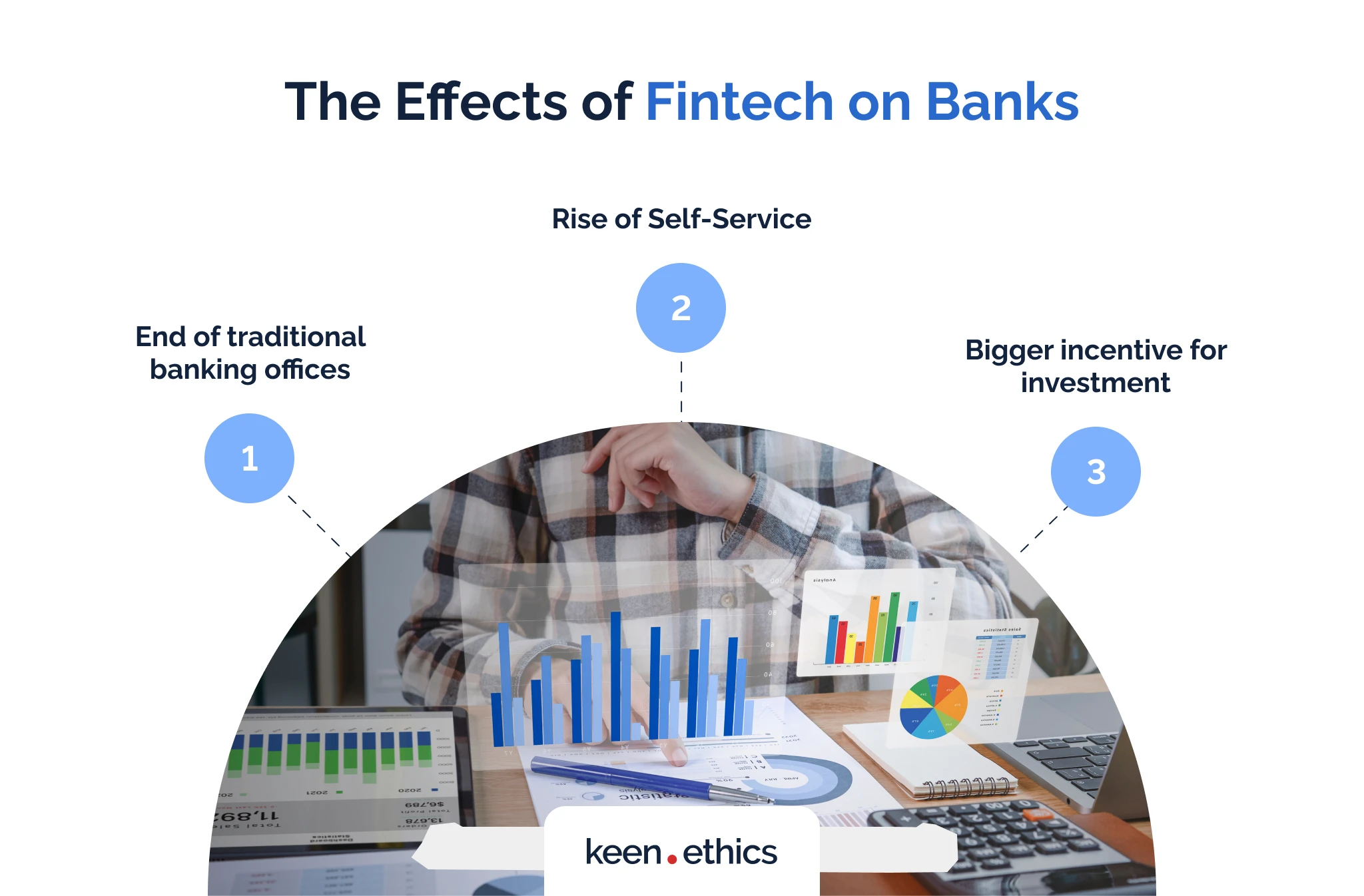

How will fintech change banking? In our opinion, it’ll transform the way we interact with various financial services. We looked at the way fintech influences banks in the preceding sections. Here, we aim to understand how fintech will impact the average user.

End of traditional banking offices

Above all, we’re likely to see the end of the traditional banking office. Reliance on physical departments with large personnel can decrease. This information means most people will get their financial services through smartphones. We’re already seeing this model of banking in action. More and more young people are avoiding traditional banks. Instead, they choose services that don’t require one to visit any locations. In Europe, a strong example of this service is Revolut. This company offers banking in multiple developed countries at the same time. One doesn’t need to visit any real locations to use it. In our country, we also have a similar service. Monobank is notable for its lack of physical departments. One can do all banking activities through a smartphone app.

Rise of Self-Service

Most users will have to rely more on self-service. The overall technological knowledge of the average user is growing these days. Banks can use this aspect to profit more. They’ll substitute support workforces for the average users with AI. As a result, the users will have to show more autonomy while solving some problems. Is this change good or bad? In our opinion, it has both positives and negatives. For older generations, it’ll be damaging. Why? The reason is simple: they’re less tech-savvy. Younger users, however, will drive this change. Yes, sometimes, certain configurations will require personal effort. At the same time, self-service will decrease the average cost of services in banks. Services like financial transactions will cost significantly less in the new system.

Bigger incentive for investment

In the past, investment was reserved for the richest people. Usually, an investor had to be at least middle-class to hire a valuable manager. Modern services are changing this trend once and for all. It’s now possible to make high-quality investments in stocks without hiring brokers. Modern robo-advisors enable people to create relatively low-risk portfolios. This approach is a great model for spreading higher economic awareness across the population. More and more people will finally be able to make investments and earn money. Fintech is making investment accessible to the majority of people. There’s no longer any fear that you can make an incorrect investment and lose all your funds. Modern robo-advisors have sufficient information on the safest stocks on the market.

VI. Why Should Fintech and Banks Strive for Collaboration?

We believe that fintech and banks should undoubtedly strive for collaboration. Both sectors have some major benefits for each other. Fintech for banks can enrich both banking organizations and fintech startups.

Benefits for banks

The modern banking sector is encountering major losses in response to the rise of fintech. If banks don’t accept the new rules of the financial game, they’re bound to fail. As we’ve mentioned before, German banks are consolidating. What’s the reason? Many of them are using outdated techniques. It’s not uncommon to see fax technologies in local banks.

Consequently, the rise of fintech makes them extremely vulnerable. Companies like Revolut are completely taking over the attention of the younger generations. In this light, many banks are consolidating into larger organizations to avoid failure.

Ultimately, that’s the reason modern banks should accept fintech innovations. Younger generations (Millennials and Gen Z) want technological innovations in their banks. They no longer tolerate banks without mobile apps or costly fees. In this light, adopting fintech technologies is a matter of survival for banks. If they want to continue existing, they must start offering at least basic fintech technologies. What are some of those technologies? They include mobile banking, AI, and robo-advisors. It’s also crucial to enable cryptocurrency banking and easy international access. Without those transformations, most people will eventually join companies like Revolut. It’s not surprising why consolidation occurs. It’s easier for larger banks to start driving major innovations in the sector. A small bank can’t buy fintech companies to enhance their services. A larger one can do this.

Benefits for fintech

Yes, fintech is seeing a major wave of approval from younger people. Nonetheless, it has some significant problems that traditional banks can solve. Firstly, physical locations are sometimes necessary. Why? Certain transactions are simply too large or include a lot of cash. In such situations, having a physical bank that collaborates with your fintech organizations is beneficial. Yes, mobile banking decreases reliance on physical locations.

Nonetheless, this doesn’t mean that most people don’t need them. For example, many significant businesses prefer physical copies of agreements with loan givers. Assessing partners in person is often an essential aspect of business acumen. The issue of banking license is present, too: in many cases, cooperation with famous banks is the only way to get proper licenses. Secondly, major banks have a high level of government support. They’re well-regulated. As a result, these banks have greater contact with businesses and face fewer government intrusions. A fintech organization can stabilize its reputation by interacting with a traditional bank. We’ve already mentioned that Ukrainian fintech bank Monobank does exactly this. It has an agreement with Universal Bank. Consequently, the company has reached a positive reputation in Ukraine. If fintech organizations want to capture the attention of modern business, they must interact with banks.

We have one major expectation for the future of banking. In our opinion, future banks and fintech will likely merge. Larger banking organizations will eventually consolidate all innovations. This will allow them to create a new technology-centric banking sector.

VII. How Has Fintech Triggered a Shift in the Traditional Banking Industry?

We believe fintech has triggered a shift in the traditional banking industry by showcasing how static this sector is. In one way or another, banks were stagnating in the 1990s and 2000s regarding customer services. Instead, they started to offer many speculative financial services. Ultimately, some of them led to the 2008 crisis. Simultaneously, the comfort of the average user was falling all the time. People started to encounter increasingly complex terms of usage. At the same time, it was not uncommon for banks to focus on “traditional” technologies.

Outdated technology in banking

In fact, this challenge continues to be relevant even today. Top Fax, an organization dedicated to high-quality faxing solutions, notes that the banking industry still uses faxes even in 2023. In the 2000s, this focus on outdated technology was especially strong. Consequently, a need for major transformations started to arise. More and more people have access to computers. The early 2010s involved the rise of smartphones, too. It became obvious that it was necessary to completely transform the existing field.

Key reasons for an interaction between fintech and banking

Banking and fintech started to interact exactly due to this reason. Fintech organizations appeared as a reaction to problems in traditional banks. They started to offer banking in a pocket, for example. Many people got an opportunity to invest without going to any physical locations. Consequently, younger individuals received a major incentive to leave traditional banks. For instance, fast banking solutions like Monzo made it possible to travel without major barriers. In this light, banks had to start adapting. As a result, some of the top American banks are making major investments in fintech. They offer robo-advisors and, more importantly, provide high-quality mobile banking tools. For instance, Bank of America delivers a comfortable tool for robo-advising. More importantly, this tool features the ability to add human input. In one way or another, modern fintech pushes a new model of interaction with customers for banking organizations.

VIII. What Makes Fintech a Potential Risk to Traditional Banking?

In our opinion, the impact of fintech on banks can sometimes be negative. Fintech creates several risks to traditional banks. In our opinion, they include the following issues:

Traditional banks have problems competing with fintech organizations

In this way, they start losing traditional customers. As a result, we’re seeing a market in which only the largest organizations survive. Why do they survive? Those businesses typically have enough resources to invest in fintech. This factor will inevitably lead to major oligopolies in the banking sector. The overall quality of services for the customers can fall.

Fintech innovations are creating major security threats

Yes, fintech innovations have significant positives. For instance, they promote banking-in-a-pocket, which we’ve mentioned before. It’s impossible to access most of the banking services from the comfort of one’s home. What’s the challenge here? Stealing money from those systems is also easier. Regrettably, modern fintech innovations create tremendous cyber threats for the average client. They come in different forms. Some people may encounter issues like phishing. Social engineering is also a popular vector of attack.

However, certain situations may be outside the user’s control. Particular problems can easily start occurring in response to, for example, breaches in package security. We’re seeing an increasing number of critical bugs that lead to long-term issues with safety. Spectre or Meltdown can easily affect the integrity of top corporations. As a result, situations in which people can lose all their life savings are becoming common. The only way to avoid them is to completely remake the existing security mechanisms.

Fintech can create a false sense of security

A major challenge for various traditional banks can also come from the false sense of security. What do we mean by that? Modern robo-advisors often give high-quality recommendations. At the same time, we should note that those robo-advisors aren’t conscious. They can’t adapt to non-conventional situations in the market. Consequently, major errors occurring due to the lack of adaptability are possible. Regrettably, we can imagine a situation in which a robo-advisor will push an individual towards incorrect investments. In this light, we’re likely to see some major bankruptcies occurring in the future due to robo-advisors giving low-quality advice. Particular articles already indicate that people lose money with these platforms. They aren’t a silver bullet of financial success. You need to trust your judgments and common sense while investing via them, too. Robo-advisors are great, but they need human input to function well.

IX. How Fintech is Transforming Financial Services

How is fintech impacting the banking industry? Here are some top impacts we should consider:

Accessibility

Fintech is making financial services more accessible and affordable for consumers. This factor is especially strong for those who are underserved by traditional banks. It’s now genuinely possible to access banks from any location. You no longer need to drive several hours to get to a bank. In those cases, all a person needs is a good Internet connection.

Better payment processing

Fintech is enabling faster and more efficient payment processing. As a result, such systems are managing to reduce transaction times and costs. How exactly do they achieve this? Above all, by automating most processes, including fraud analysis. Modern fintech startups don’t have many resources for advanced workforces. This means they need to get inventive with how they process user information. In this regard, the top solution is to use advanced algorithms. Their use allows saving the majority of the resources.

New management frameworks

Fintech is providing new ways for consumers to manage their finances. We’re seeing a large influx of budgeting tools and investment platforms. On the one hand, one can now connect their banking accounts to high-quality budgeting platforms. There are solutions like You Need a Budget that genuinely helps people save money. On the other hand, many banks offer robo-advisors. Yes, as we’ve mentioned above, they aren’t always reliable. Still, those services make investment easier for the majority of the clients. Consequently, we expect more people to start investing in the upcoming years. In the 2010s, the share of Americans investing in stocks was low. This result turned out to be an aftereffect of the 2008 financial crisis. Fintech is changing this trend. 61% of Americans now invest their funds in some form of stock.

Fintech is also improving risk management and fraud prevention. How exactly? It promotes the use of advanced analytics and machine learning. Those technologies easily highlight the most suspicious transactions. At the same time, we should note that fintech is also raising cybersecurity problems. Regrettably, it has never been so easy to break into bank systems as today.

Innovation promotion

Fintech is driving innovation in areas such as blockchain technology. They have the potential to revolutionize the way financial transactions are conducted. Blockchain will make the majority of the financial transactions transparent and immutable. In this light, fraud will become increasingly difficult for most criminals.

New business models

Fintech is creating new business models and disrupting traditional financial institutions. We’re seeing the rise of budgeting apps and robo-advisors. It’s not unlikely that AI in banking will also force the rise of automated customer support. In this light, fintech forces banks to adapt to changing consumer demands. It’s no longer possible to be complacent in the modern markets. They require an ability to create high-quality innovations. Fintech organizations will gradually take away your market if you can’t offer a comfortable bank-from-home with advanced robo-advisors.

X. Conclusion

As you can see, the impact of fintech on banks is tremendous these days. These innovations push banks towards mobile solutions and the adoption of AI. We’re also likely to see that blockchain and cryptocurrencies will become genuinely mainstream. In this situation, any bank must consider major investments in fintech. Are you interested in the fintech transformation of your business? In that case, addressing professionals is the best choice. Keenethics can develop advanced fintech solutions for you. We have over eight years of experience developing fintech, health tech, and edtech frameworks.

FAQs about Banks and Fintech

How are banks using fintech?

Banks leverage fintech to enhance customer experience, streamline operations, and mitigate risks. They deploy technologies such as mobile banking apps and digital wallets. Blockchain for secure transactions, AI for fraud detection, and robo-advisors for personalized financial advice are also popular. Fintech collaborations facilitate quicker and more efficient payment processes, too. Ultimately, these factors greatly improve overall financial services.

What is the relationship between banks and fintech?

Banks and fintech companies often form collaborative partnerships. What’s the key goal of those partnerships? They seek to capitalize on each other’s strengths. Banks integrate fintech innovations to enhance services and reach a wider audience. Fintechs benefit from banks’ regulatory expertise and established customer base. The relationship is evolving, with both sectors adapting to the changing financial landscape.

Are banks considered fintech?

Banks aren’t inherently fintech but increasingly incorporate fintech elements into their operations. Traditional banks adopt financial technologies to improve services, enhance efficiency, and remain competitive. Fintech refers to technology-driven financial services. While banks are distinct entities, their integration of fintech practices blurs the lines between the two.

Why are banks partnering with fintech?

Banks partner with fintech firms to leverage technological advancements. This allows them to enhance the customer experience and stay competitive. Collaborations enable banks to adopt innovative solutions and address emerging challenges. Fintechs benefit from access to established customer bases and regulatory expertise.