Many open APIs for banking and payments appear on the market these days. In this article, we’ll help you choose one.

The development of independent APIs for banking has both major advantages and disadvantages. On the one hand, you receive full control over your banking activities. On the other hand, you reinvent the wheel by recreating the instruments that already exist in open banking APIs. In our opinion, external tools are better than internal ones because they have a stronger level of security. Ultimately, banking APIs benefit everyone. They’re great for lending organizations and online retailers. Clients are also big winners: they get access to a much larger choice of time-saving products. After all, these tools automate many payment-related processes. If you have a small bank, an open banking API can be a blessing from a financial standpoint, too. A small bank can cooperate with larger ones to provide a full range of services. Considering how massive these advantages are, this article reviews what open API banking is and how to use it.

What is Open Banking?

Let’s start with a definition of open banking. Open banking interconnects banks and other financial organizations through APIs. These APIs deliver different types of services for banks and outside organizations. Some provide access to international transactions. A good example of such an API is Western Union. It offers tools for sending funds across borders. This function is important both for international banks and retail organizations. Other APIs offer lending assistance. LendUp, a Californian payday loan business, is among the organizations delivering an open banking API of this type. The idea is to cut risks for the banking service and retail site users.

Ultimately, open banking APIs (both bank- and fintech-centric) are valuable because they strengthen bank interconnection. The international transaction services of Western Union or MoneyGram boost cross-border banking. In turn, the cooperation of banks with lending services through open APIs minimizes loan risks. By sharing information, they can better control credit ratings and prevent fraud. Gambling prevention is a good example of the relevant benefits. Data on the gambling habits of loan service clients can prevent losses for all stakeholders.

Important Open Banking Regulations

Currently, no unified international law on open banking APIs exists. The only organization targeting multiple countries in this regard is the European Union. Most international banks must follow its regulations, since it’s a de facto economic superpower. Yes, the consequences of the presented laws aren’t universal. But, they have a big impact on the global economy because American and Chinese businesses must follow EU regulations to trade with it. The organization has two major regulations for the discussed technology:

- PSD2. This regulation directly targets open API banking. According to it, banks must give customer account data to authorized third-party providers. This may sound threatening to user privacy, indeed. However, we recommend paying attention to the word ‘authorized’ in the description. The idea behind the law is to create and regulate a unified network of banking data. Before the rise of the regulation, banks already provided numerous APIs for third-party users. PSD2 sets up clear rules for them. Firstly, all banks must join this network. Secondly, they must work only with user- and government-authorized organizations. How does authorization work? The clients receive warnings about the use of their data when contacting outside APIs. To proceed, they have to offer their direct consent in an online form. Local EU governments also directly control all the relevant firms providing and using APIs. This means you at least need a valid business permit to work with a bank.

- GDPR (General Data Protection Regulation). GDPR is a law setting major regulations for user data protection. It promotes the use of encryption among all services dealing with sensitive information. What does this regulation imply for open banking API standards? It means financial organizations must use strict data protection for such APIs.

What is a Banking API?

A banking API is a set of rules and protocols for operating with the software of a particular bank. For example, this set of rules helps simplify the integration of account balances. A retail website may use it to check if the customer can pay for their services. Banking APIs open access to many types of data. Apart from account balances, they also inform about transactions, loans, and different payments. Why do banks make investments in these platforms? The reason for this choice is simple. An API makes it more likely that outside companies will use its services. Many retailers benefit from the integration of payment options. If a bank doesn’t offer such an integration, it’s useless for their goals.

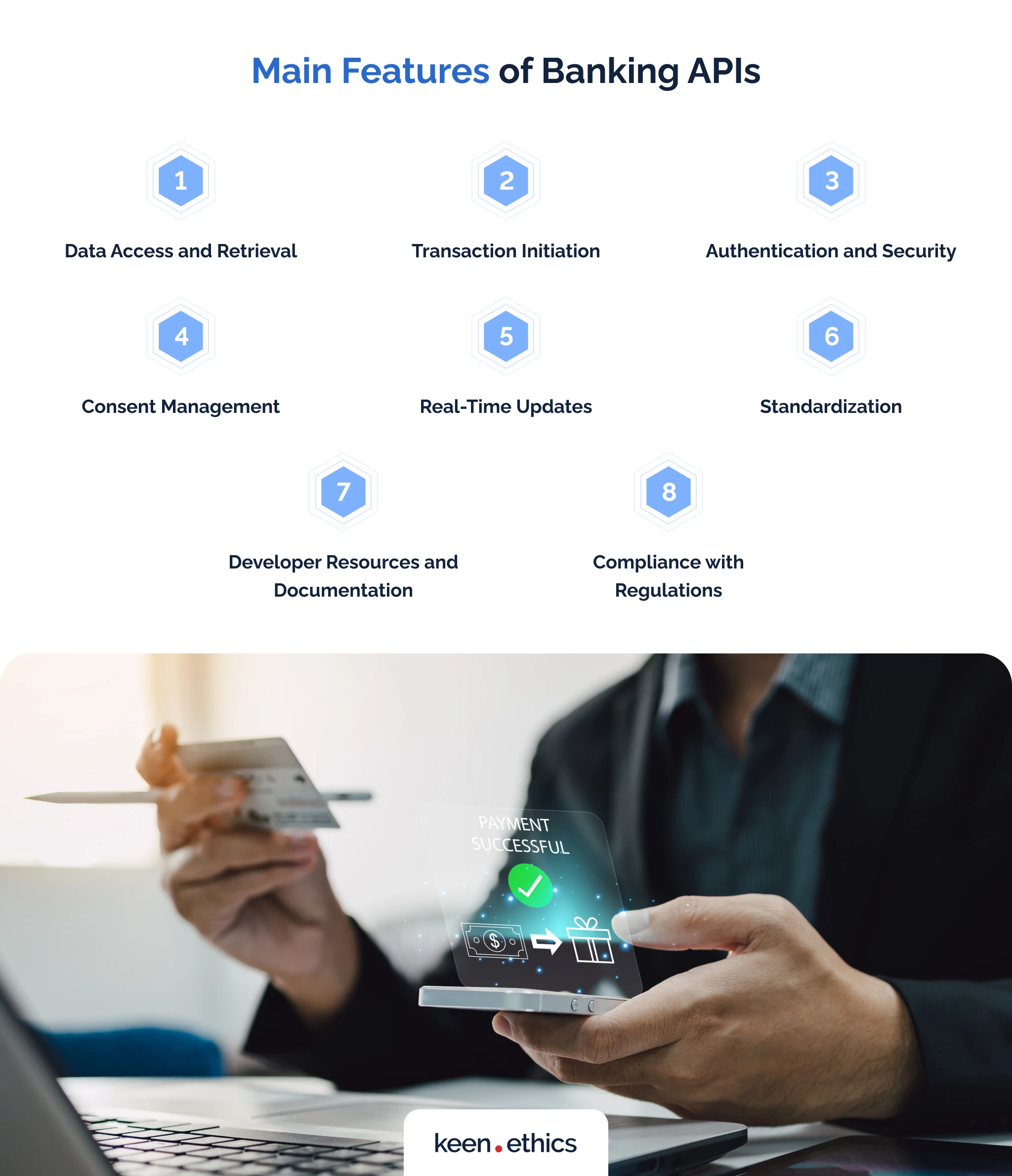

Main Features of Banking APIs

Let’s discuss the core features of open banking APIs. This is the best way to know how this technology functions in the modern world. Here are the core features to consider:

1. Data Access and Retrieval

To function at all, an open banking API must be able to collect data. For this reason, the first feature of all banking APIs is data access and retrieval. They must have tools for processing information from the user servers. In this way, they interconnect banks and different organizations cooperating with them. To help loan organizations, for instance, banks must also collect data about their services. Otherwise, there’s a risk of fraud or hidden fees for the clients. Data access and retrieval touch upon the banks themselves, too. APIs give their partners access to bank information. All in all, the information transfer path must be two-fold.

2. Transaction Initiation

In the past, payment was a major problem for retail organizations or subscription services. Users liked (and continue to like) seamless experiences that minimized effort. With online payments, however, the task was difficult. The users had to provide links to their payment accounts. More importantly, these links had to be correct. Even experienced users always risked entering the wrong data. For many people, buying from physical stores was easier. Online transactions required two things that are always in short supply on the Internet: technical knowledge and time. Modern open banking APIs solve the problem once and for all. Using them, one can connect their banking account to a retail service with one to four button presses. This approach facilitates seamless and secure transactions for the average user.

3. Authentication and Security

Security was the key issue pre-API systems encountered. Many businesses used to ask for the users’ credit card number without specialized encryption. This was a sure path to information leaks that could lead to financial losses.

An open banking API functions differently. Firstly, a correct approach is to only allow trusted organizations to use APIs. Secondly, all data in APIs is in an encrypted format. As a result, retail or loan organizations can now enjoy bank-grade encryption measures. As long as these businesses care about data safety on their side, the opportunities for criminals are minimal.

4. Consent Management

PSD2 and GDPR focus on the concept of consent. The problem with APIs before the regulations was the lack of control. Theoretically, this factor allowed for major loopholes regarding user data. New regulations highlight that users have full ownership of their information. No API can function without the direct approval of the clients. In this respect, all legal banking APIs ask users to grant and revoke consent for data sharing. This empowers customers to maintain control over who can access their financial information. Why is this important? Some user data is too sensitive. For example, a leak about purchased medication can lead to bullying or even imprisonment. Users should understand all the risks before they transfer their data to third parties. No API can function without informing them about these issues.

5. Real-Time Updates

A common use case for banking APIs is to provide information for investment sites. Many people who sell cryptocurrencies and other assets connect their bank accounts to exchanges. In some cases, the ability to earn money depends on split-second decisions. Exchange rate fluctuations sometimes involve minutes and even seconds. These platforms have to offer fast transactions to guarantee equal chances for all clients. Open banking APIs deliver this function. They allow the relevant organizations to gain data in real time. These sites can scan a user account for funds in milliseconds through APIs and end a transaction as fast. According to Investopedia, this function is ultimately one of the factors behind the rise of Bitcoin millionaires. Reaction speed to market changes is the basis of success in the cryptocurrency market.

6. Standardization

Standardization is crucial to ensuring interoperability among different banks and third-party providers. A big problem with past platforms was their inability to standardize data. Every bank and every retail store offered its internal solution. Open banking API laws solve this problem once and for all. They open a path for clear standards in the industry. Yes, all banks will have their own code for the internal apps. But, this code now follows the requirements of the EU and other countries. This means the majority of the APIs should be generally compatible. Integrating one or more banks into payment services or investment apps is simple.

7. Developer Resources and Documentation

All APIs apply similar standards, but they use unique code. In this light, creating clear guidelines is essential. Delivering high-quality documentation is the key factor for any open banking API. Users should also receive code samples and support from the API developers. Without this help, there’s always a risk of encountering major problems. Security functions or basic transactions can fail to work well. A good banking API must have strong support resources to function.

8. Compliance with Regulations

The inability to follow the banking regulations will likely end in massive issues for the perpetrators. The EU and outside countries have extremely strict banking laws. Banks attract attention due to GDPR violations and difficulties with APIs. Between 2008 and 2020, they paid 36 billion dollars in fines for mishandling user data and other regulatory violations (source: Business Insider). Big fines also hit other organizations. TikTok and Facebook had to pay well over $300 million and $1.3 billion for GDPR violations, respectively.

Open banking APIs are crucial because they minimize risks for small organizations. These APIs are under strong scrutiny from various governments. As a result, you can be sure the risk of regulatory problems is minimal. Ultimately, we fully agree with the logic of the EU (and any other) government. Compliance ensures that data sharing is secure and meets privacy requirements.

Benefits Offered by Open Banking APIs

Modern open banking APIs offer many benefits. Let’s review the key advantages you get from them:

1. Access to Comprehensive Financial Data

The key problem many businesses face is the inability to access financial data. Imagine you have a money lending service. Without financial information, checking data on credit history or fraud is difficult. This issue leads to risky decisions. For example, it heightens the chance of giving money to irresponsible clients. Open bank API technology solves this problem once and for all. It provides banks and other organizations with a vast supply of information. As a result, the technology lowers risks for all stakeholders.

2. Streamlined Payment Processes

In the past, payment was a big problem for Internet stores. Often, their users had to manually send money to some accounts. This approach was error-prone and enabled many types of credit card fraud. With open banking APIs, every process is safer. Firstly, sending money to a wrong account is impossible because payments are automatic. All the customers have to do is enter their credit card numbers. Secondly, fraud is difficult because banks control all funds. A user can easily ask for a refund if they don’t receive a promised product from a business and prove this. The fraudulent organizations, in turn, lose access to banking after several violations.

3. Personalized Financial Recommendations

We’re seeing an increasing number of financial advice apps on the market. For instance, a popular player in this field is You Need a Budget (YNAB). According to the YNAB website, its users save 6,000 dollars during the first year of their subscription. Without open banking APIs, this innovation would have been impossible. YNAB builds its entire business model on the ability to scan banking accounts. Apart from budgeting apps, the market is also full of loan and investment assistants.

4. Encouraging Third-Party App Development

Open banking API standards have created the budgeting app market. Now, it’s a lively and competitive field with many unique products. This observation allows us to be optimistic. Banking APIs will create even more great solutions. Access to bank data enables third-party experts to develop unique apps. For instance, Meersens scans various food purchases to offer nutrition recommendations. The developers believe it can even reduce cancer risks. How? The app warns its users about recalled products and processed foods based on their purchases.

5. Creating Customer-Centric Solutions

Modern banks are some of the most regulated structures in the world. It’s not surprising why: their instability ends in massive crises. For instance, the Great Recession resulted from legal but reckless loan policies. Lehman Brothers bank failed because it used to offer house loans without major background checks. In the 2010s, strict laws arose to prevent such situations from repeating.

This information means banks no longer provide bold financial solutions for common users. A person without a good credit history can’t take out a loan. Banking with open APIs solves this problem. It opens the path for many great non-bank services. Migrants can use them to send money home for a low fee. People with low credit scores can borrow money from microcredit organizations for emergencies. In short, banking APIs enable new solutions. At the same time, they cut risks and costs for banks. Risky activities such as payday loans have their isolated sector now. Its failure won’t destroy the entire economy.

6. Boosting competition and expanding market choices

Before open banking API standards, banks used to control all financial activities. This issue led to stagnation in the market because it wasn’t offering any new solutions to the customers. Banks were growing increasingly complacent. Having a monopoly over international payments or loans, they could set exorbitant fees. For example, sending money to other countries through banks was so costly that MoneyGram and Western Union arose as solutions. SMS banking (a technology from the 1990s) was the only mobile choice some major banks gave in the 2010s. Moreover, banks had no incentive to upgrade their infrastructure due to monopolies and oligopolies. Technological stagnation was evident in the sector.

Banking APIs solve this problem once and for all. They give financial data to all capable businesses, enabling new products. Investment and budgeting apps can deliver great money management insights with this information. Microfinance organizations get to offer bold services for small businesses. With these competitors on the market, banks can’t be complacent anymore. They have to develop new solutions to preserve their clients. Boosted competition leads to more diverse and better products for everyone.

7. Driving Down Costs

Strong competition also drives down costs across the banking industry. Gulf Business reports that MoneyGram motivates cost reductions in international payments. This aspect is especially important for the remittance sector. Remittances are funds sent by migrants to their home countries. The UN wants to lower transaction costs for them to 3% of the delivered sums by 2030. MoneyGram puts massive pressure on old banks because they have 6.3% fees per transaction. Simultaneously, MoneyGram’s fees amount to 1.5% of the remittance sums in the Middle East. It’s superior in other regions, too. Such fintech organizations are going to push banks towards innovation in all services. They give better investment and even loan options to users. All this will decrease the average cost of banking services. Moreover, they’ll have to digitalize to survive the competition.

8. Improving the customer experience

The key goal of every open banking API platform is to automate financial processes. Retailers and investment businesses no longer have to spend several days checking user data. There’s no need to ask bank employees to analyze everything personally. All services are automatic now. This tendency inevitably ends in an improved customer experience. Firstly, basic payments and loan management are fast and seamless. Secondly, new services appear on the market. You get access to countless investment and budgeting apps. All this makes the financial sector user-friendly.

9. New Revenue Streams

Banks get to earn more money by investing in open APIs. Why? Many types of data in banks’ possession remain unused. Obviously, banks can’t capitalize on everything because an overextended business may be too difficult to control. As a result, it makes sense to release this data for a certain fee. Other organizations can come up with genuinely original ways to monetize it. Banks, in turn, receive a part of their revenue with such a business model. This approach is fair, since banks spend significant resources collecting the data. Open APIs benefit everyone: both banks and their partners enjoy profits.

10. Improved Risk Management

Open banking APIs also bring regulation to formerly semi-legal financial services. In the 2000s, many microfinance organizations used to work without proper government control. Connection to the banking sector through APIs brings them into the spotlight. This approach helps reduce risks for all stakeholders. Proper regulation prevents illegal fees and decreases pathways for fraud.

Automation also decreases the risk of human errors. This factor is crucial for better compliance in the financial sector. API design is standard-centric, minimizing compliance risks. Now, GDPR standards must be built into APIs, or they won’t get approved. This means there’s no need to worry that some employees will fail to uphold them.

Challenges of Implementing Open Banking APIs

An average open banking API also creates major challenges for banks. Here are the key problems:

1. Protecting sensitive data and minimizing cybersecurity threats

The key challenge of any online technology is security. By exposing an app to the web, you open it up to millions of people. Some of them will likely have bad intentions. Security Intelligence, a security analysis publication, notes that financial organizations lose 6 million dollars per data breach. This figure grows yearly, showing rising risks for banks and their users.

Two types of risks exist for the average user. The first one is the problem of data leaks. Having access to transaction data, perpetrators can use it against a person. For example, if a politician buys a mind-altering medication, criminals can blackmail them into illegal activities to prevent a scandal. Another concern is that hacking is a perfect way to steal funds. Olivia Powell, a writer at Cyber Security Hub, reports that hackers have recently managed to steal 20 million dollars from Revolut. The criminals have found a bug in the company’s international payment system. In this light, it’s obvious that modern banks must invest a lot in security. Any open banking API platform raises cybersecurity costs. These technologies expose banks to more threats. Why? They spread their services across the Internet. One now has to consider both internal security and API safety.

2. Navigating Complex Regulatory Frameworks

Open banking APIs are already attracting regulators. Regulation in the European Union is only the beginning. Restrictive policies will inevitably appear in the U.S. and China, two other key markets. This factor creates risks for various banks and API users. They have to test their services for compliance with the governmental standards. Otherwise, there’s a risk of encountering massive government fines. The need to navigate complex regulatory frameworks is likely to raise spending. Banks and their partners now have to hire compliance specialists and train their coders accordingly.

3. Bridging Legacy Systems

We know many banks rely on legacy frameworks. Occasionally, it’s possible to find firms using Windows 2000 or Windows XP in their tech stack. For example, TechRadar reports that ATM security apps require those operating systems. These legacy systems are often custom. They cover specific problems for banks. Removing them altogether isn’t an option; too many processes depend on these systems. Two ways to solve the problem exist. One can either redevelop those systems or integrate them into new ones. Both choices have significant downsides. On the one hand, redevelopment is expensive and lengthy. On the other hand, old systems still need new code for integration and have major security flaws. The creation of open APIs always requires investments in legacy system bridging. This process is costly, regardless of your choices.

4. Ensuring interoperability

Modern EU regulations for open banking API projects go beyond promoting their adoption. They also demand interoperability: different APIs should be interchangeable. For instance, a retail company must be able to integrate several banks without changing site code. This action is possible only if all these platforms follow similar standards. Development costs for banking APIs will rise in this situation. It’s not enough to find development specialists. They must also know how to follow the key government standards. We at Keenethics understand how to ensure interoperability thanks to our extensive fintech experience. You can hire us to work on your API project. We’ll be able to deliver solutions that follow government standards and maximize security.

5. Minimizing Service Disruptions

Relying on the Internet too much can be dangerous. This technology needs safe hubs and, often, electricity. Even the most reliable Internet technology, Starlink, will likely fail during a large disaster. A war between major powers or a large solar outburst can destroy this network. If bank managers rely on APIs too much, they risk losing control of their businesses. Any investment in an open banking API platform presupposes infrastructure investments. Primarily, you must ensure all covered locations have good main and backup servers.

Moreover, legacy solutions should remain a viable option. Guides for working without electricity or the Internet must be available. Ukrainian banks learned this the hard way last year. Russian terrorist strikes against Ukrainian energy infrastructure paralyzed some of them. Remember: you must never put all your eggs in one basket. Companies that rely too much on APIs render themselves vulnerable to unexpected events.

6. Guaranteeing Data Quality and Accuracy

APIs are also far from being a panacea for data quality and accuracy. This aspect is two-fold, considering the rise of AI. Firstly, the need for employees to review data doesn’t disappear with banking APIs. Banks still have to invest large sums in training and quality assurance. Secondly, a major issue is that algorithms and AI are nevertheless prone to errors. You need to understand where these problems manifest and assign human specialists to them. Open banking APIs have an aura of reliability. As a result, they can expose non-banking organizations to major errors due to a lack of caution. The best way to prevent this is to consider data accuracy before development.

10 Leading Open Banking APIs: Examples of Open Banking

Let’s review some open banking API examples. Many organizations (both fintech and banks) have developed their solutions:

1. Plaid

Plaid is a leading API for Internet payments. Two major aspects make the platform potent. Above all, it provides an easy-to-integrate payment framework for banks and retailers. With it, one can pay for some services or send money to others using credit cards from any Western bank. Another vital feature is its vast data network on partner reliability. With this information, the users can be sure about the safety of their money. Wayflyer, Paysend, and Wise use this API to power their services. Plaid is the most reliable framework in Western Europe and the US.

2. Yodlee

Yodlee is a financial data aggregation platform. It helps users access and manage financial information. Yodlee allows individuals and businesses to securely link their various accounts. The app connects bank accounts, credit cards, and investment profiles in one place. Yodlee developers enhance all these functions with various APIs. Banks and non-financial organizations can access different types of data about their clients by using them. For example, these APIs include data on transactions or credit history. In this way, Yodlee allows different stakeholders to make reasonable financial decisions.

3. Open Bank Project

This project is a major open API. It offers pre-built solutions for banks and other fintech organizations. Using them, one can quickly set up an independent API and connect their bank to non-financial organizations. The project has significant advantages that make it interesting for developers. OpenBankProject is open-source and follows the EU PSD2 format. This information means one can use it for free. Moreover, you can be sure about the platform’s reliability due to the chosen standard. Lastly, OpenBankProject has been in development since 2010. Its developers are among the most experienced API specialists on the market.

4. MoneyGram

MoneyGram is an open banking API platform for international transactions. We’ve already noted that the platform is among the cheapest remittance services. MoneyGram achieves these results through a complex network of government and private contracts. Its API allows banks to provide an impeccable service for international transactions everywhere. For instance, MoneyGram enables one to send money in a digital format and receive it in cash. Small organizations can connect to MoneyGram APIs to improve their customer experiences. Considering mass migration and globalization, this is a perfect way to boost small banks.

5. Western Union

Western Union is another major player in cross-border payment services. Its functions are similar to MoneyGram’s but feature a stronger web presence. The corporate website of Western Union provides a thorough outline of its API. It allows one to create independent money transfer services and connect them to Western Union payout. The company even offers UI/UX development solutions. One can build their service on the Western Union’s technologies.

6. Figo AI

Figo is a platform offering APIs and tools for independent financial solutions. What sets it apart from other open banking API examples is its no-code and AI capabilities. Figo provides tools for creating payment interfaces without any development experience. This approach is perfect for retail stores that don’t have funds for coding experts. The APIs of Figo also enable robotic process automation. Clients of the firm can create complex banking solutions automatically. In our opinion, this service sets a standard for user-friendliness.

7. Finbox

A major factor in safe bank transactions is partner reliability. Finbox offers a solution to this problem. According to its website, it provides “the toolbox to outsmart the market.” What does Finbox do? It collects data on thousands of publicly traded companies around the world. The database of Finbox is large. It covers more than 130 exchanges with thousands of listed companies. Using its API, banks and non-financial organizations can make safe investment decisions.

8. Privatbank LiqPay

In Eastern Europe, the API of the Ukrainian Privatbank is among the leading solutions. The company claims that it was the first bank in the world to open a public API (September 2009). The company now offers its in-house payment solution, LiqPay. It targets Ukraine and neighboring countries, enabling payments for multiple companies. Besides, many businesses in Ukraine use Privatbank’s API as a fund management solution.

9. Bank of America

Bank of America also delivers a high-quality API. It offers account information for bank partners and provides a full-scale treasury platform, CashPro. CashPro is a framework that allows businesses to manage money through Bank of America services. In short, the APIs of this bank are great both for payments and money management. It’s an internal solution that works perfectly for partner businesses.

10. LendUp

Lending platforms are also great open banking API examples. These platforms are notable for their major security risks. Nonpayment is a common issue for lending businesses. In this light, LendUp has developed its API for managing lending. Why is it important? This platform allows small banks to promote comfortable lending at minimum prices. Moreover, the relevant API enables LendUp to check user information independently. It gives more control and opportunities for the business, minimizing risks.

Current and Future Open Banking Trends

In our opinion, the outlined open banking API examples already highlight several current trends. We’ll discuss them and future approaches in detail here.

Current trends

1) Wide adoption. More and more organizations are using these APIs. In fact, any bank that wants to be successful must use them now. If you don’t exist on the Internet, you don’t exist on the market. Allied Market Research predicts that the open banking API market will grow from $25 billion today to $217 billion in 2032.

2) Innovative fintech solutions. High-end solutions rely on open-source APIs. YNAB depends on bank information to function. Lending organizations such as LendUp also need banking APIs to check credit scores. All in all, every bank and fintech API creates numerous secondary markets. No modern investment or budgeting tools would have been possible without open banking innovations.

3) Regulation. In the 2010s, the European Union created PSD2 and GDPR regulations. They show an increasing interest of the global governments in regulating the API sector. We’re likely to see more interventions in the future. APIs that aren’t regulated can be unsafe and pose a danger to privacy. We agree that regulation increases development costs. However, it also brings major standards to the sector.

4) API standardization. Early API developers didn’t have clear guidelines for their projects. Consequently, early solutions featured a high risk of incompatibility. Now, PSD2 changes everything because it requires interoperability. In this situation, developers have to consider compatibility with other APIs. The inability to achieve it means the death of a project, since it won’t be able to find users.

Future trends

1) Blockchain integration. The first future trend we’re likely to see is blockchain integration. Why? The cryptocurrency market is growing at an impressive rate. According to CoinDesk, one Bitcoin costs 27500 dollars as of October 4, 2023. In its infancy, one Bitcoin used to cost several American cents. Cryptocurrency is large today, so its integration is essential for successful APIs. Soon, most people will have some cryptocurrency assets.

2) AI and machine learning. Modern APIs help mine and generate tremendous amounts of data. This means many interesting insights about the clients likely hide within it. We expect to see AI and machine learning tools that will analyze this big data. Some solutions are already on the market. For instance, Cleo is the world’s first financial AI assistant. It can offer personalized recommendations based on your financial data. The tool even has a ‘roast mode’ that shames its users for bad financial decisions.

3) Decentralized finance. Decentralized finance is a financial system operating without traditional intermediaries like banks. It uses blockchain technology to enable peer-to-peer lending, borrowing, and trading. A good example of this trend is Lending Club, which offers big loans without banks. Cryptocurrency lending also exists. Bybit, a major cryptocurrency trading platform, gives Bitcoin loans. We’re likely to see many similar small- and large-scale services in the future.

4) Better privacy control. Modern standards for the fintech sector demand strong accountability concerning user data. These demands are great for average users. Banks can’t give your information to third parties without your consent. In this way, you can control who gets your data and who doesn’t. If you want to remain private, modern APIs and relevant regulations are on your side.

Conclusion

What is an open banking API? It’s both a necessity and an opportunity in the current market. On the one hand, this technology is now essential for banks if they want to work in the EU. We’re sure other countries will create similar regulations for banking APIs, too. They will become a global standard as a result. On the other hand, a good API is a perfect opportunity to earn money. Two options are present here:

- an API can enable some services (for instance, international payments) in your bank. This approach offers a low-cost way to improve customer experience for a small bank.

- your API can give other organizations vital information for their offerings. Monetize every API request, and you’ll be able to create a steady revenue stream.

Do you want to develop your API? In this case, the best option is to address professionals. Keenethics has been developing fintech, edtech, and healthtech solutions for more than eight years. You can address us to get a free cost estimate for your project. We can then deliver your API using our core tech stack if you like our approach. The relevant frameworks include JavaScript-centric technologies, such as Node.js and React.js. These technologies are great for online-based APIs due to targeting modern web browsers.

FAQs About Open Banking APIs

What is an open banking API?

An open banking API is a standardized interface provided by financial institutions. It complies with regulations like PSD2. They allow secure access to customer financial data for third-party providers.

What are the products using open banking APIs?

Products using open banking APIs include these solutions:

- budgeting apps;

- payment services;

- personal finance management tools;

- lending platforms.

These products leverage secure access to customer financial data. In this way, they offer enhanced financial services and experiences.

Are open banking services available to everyone?

Open banking services are typically available to customers of participating banks. However, accessibility can vary by region and financial institution. Regulatory frameworks, like PSD2, aim to promote wider availability, but it may not be universal.

Are open banking APIs free-to-use?

Open banking APIs may have associated costs. They vary by financial institution and region. Some banks may offer limited free access, while others charge fees based on usage. As a result, their users should review the terms and pricing of specific APIs before integration.

Join this future with the help of Keenethics!