What Is Payroll?

The activity of providing salary to employees and workers is called payroll, and it is a must for every employer. Different pay methods include hourly wages, weekly payments, and monthly salaries. Freelancers require a separate set of measures to be followed for accurate payments — usually, they are paid on an hourly basis, whereas full-time employees are mostly paid monthly.

Processing payroll is one of the most essential activities for a business. But with great importance, here comes the responsibility. Any error here can be fatal for the company in the form of penalties or fines by the IRS or government body.

How Is Payroll Performed?

An effective payroll processing includes wage calculation based on worked hours and days, attendance management, appraisal management, PF, Professional Tax calculation, and a lot more. All these payroll terms first need to be calculated and updated. Then, the final payable amount is calculated and processed to the employee’s account.

Committing to payroll is not a kid’s game for a business. It requires a professional accounting management team and a software solution that abides by legislative requirements and keeps errors at bay. Even a small error at payroll processing could bring you several penalties under the Income Tax act. With ever-changing amendments and rules, it becomes difficult for the payroll department to keep everything under control.

A dedicated payroll system can be helpful here.

There are several intuitive HR and payroll solutions, which help you streamline activities and automate major parts of payroll calculation. With the arising need of performing payroll safely and unmistakably, companies have already started adopting reliable payroll software to automate monthly leave calculations, deductions, and payments.

What 8 Features Should Be Present in Payroll Software?

Let us discuss the most necessary features of payroll software and the benefits they bring:

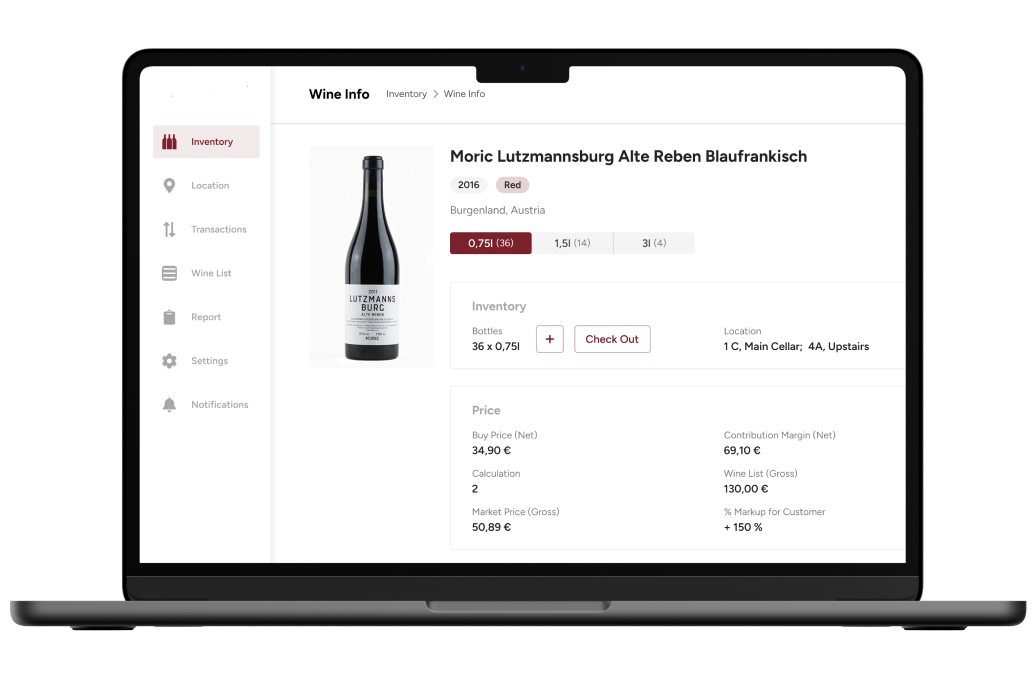

- Integration

Integrated modules and features of payroll software help HR and accounting departments in calculating crucial payroll parameters. The integration of attendance and payroll modules makes the final pay calculation easier. The attendance management module assists in tracking total worked hours. Data integration brings all required data in one place, resulting in a smooth calculation-free payroll for the business.

The automated pay calculation due to integrated system modules makes the job of admin easier and keeps all errors to the side. Calculations based on employee timesheets and pay structure take less time to complete and eliminate human intervention. Automatic payroll in a few simple clicks makes payroll easier than ever before.

- Tax management

A well-tailored payroll system has its own dedicated tax management module. Automated tax parameter calculation leaves no room for errors in payroll. A cloud-based payroll system ensures taxes are filled in time by employees and employers. You can save your company from getting drowned in tax fines by implementing an automated payroll solution.

- Compliance management

An effective payroll software solution will make your payroll more accurate and law-obedient. It makes sure that you do not get stuck in penalties and law violations. The rules keep changing every now and then, which makes compliance management the trickiest. Thus, you have to pay a great deal of attention to make sure that the payroll software of your choice is law-compliant and regularly updated. Picking a trustworthy software development partner or a reliable ready-made payroll system can keep you safe from fines. A software must keep you updated on allocation rules, latest tax law changes, government tax guidelines, and much more.

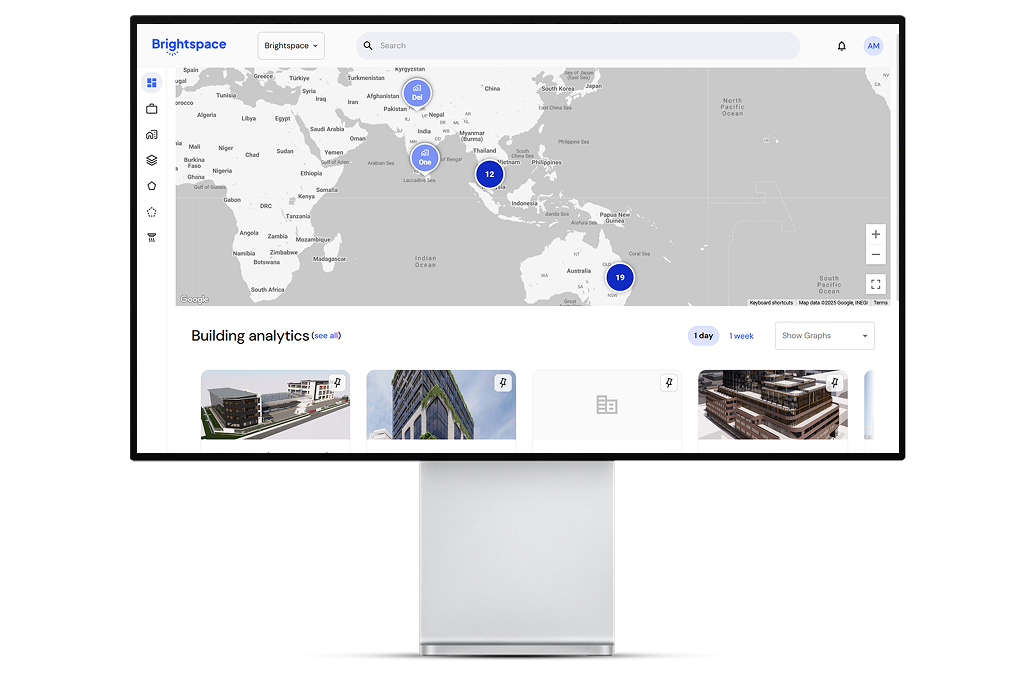

- Cloud compatibility

A system available on a cloud server does not only make your job easier but also provides a high level of data security. The third-party server provides the best data backup and ensures data safety in any instance. Your payroll data in office PC drives will not remain safe for a long time, but a cloud-based HR and payroll system can promise you the utmost data safety.

Another benefit of a cloud-based payroll system rests in the facilitated generation of payslips and invoices. Employees can simply download the reports through their mobile phones. After all, businesses are continuously looking for remote work solutions to track their remote employees. A cloud-based payroll system integrated with a self-service portal allows employees to provide attendance data, access HR data, download payslips, process reimbursements, and so on through their mobile phone itself. Also, the portal helps employees request for leaves by phone without bothering an HR manager. This is why a cloud-based payroll system must be the best pick when tackling remote workforce management and keeping employees engaged with an integrated self-service portal.

- Invoice management

Invoice management and expense handling are the two most important features of payroll software. Keeping a track of your requests on reimbursements and credits becomes easy with an organized payroll solution. Expense management is now so simple that an HR manager can proceed with invoice generation and grant approvals on the go. Automated expense management offers liberty to all its stakeholders, including employees. It makes reimbursements for remote workers very quick and error-proof. Remote employees or client-facing personnel can now easily request credits and reimbursements through the provided portal.

- Customization

An efficient payroll system is the one that comes up with customizable templates and parameters. Such set parameters as Professional Tax, PF contribution, basic salary, and other features can be customized at any point in time. Flexible tools support the scalability of an organization. While the business is growing, management tools need to be scaled accordingly. Customizable reports, payslips, design templates are some extra great points of an effective payroll software.

- eTDS submission

Innovative payroll solutions make the process of generating Form 24Q and TDS declaration easier. A payroll system lets you generate almost any reports and documents in a few clicks while managing compliance with tax laws. A payroll department can now easily commit to taxation and payroll processing for businesses with well-designed tools.

- Calculation accuracy

To get accurate results, you have to make sure that your payroll software properly implements all the calculation algorithms and formulas. This way, there is less chance of a human error. Preventing such mistakes lets you save a lot of costs. Third-party cloud payroll systems are performing payroll activities with the latest tax rules and national laws in mind. You can bid farewell to business administration errors with intuitive payroll tools.

Bottom Line

Such payroll software features as tax deductions, updates and reminders, auto-reporting, exemptions, compensations, and so on are mandatory. Before developing your own payroll solution, make sure that your project includes the development of all the mentioned above features.

Be it a small business or a high-performing business, the importance of a reliable payroll system remains the same. Choosing the right tool in the gamut of choices available could be difficult. If you consider the points I mentioned here, I believe, you will be able to find your perfect payroll solution.

Our professional will be happy to help you. Business Administration is one of the major industries we serve. We develop not only solutions for payroll, but also for HR management, ERP, CRM, task management, business analysis & report, marketing & SEO, and business security. Check our Web Development services page to learn more!

Thank you to Ritik Singh for contributing this article. Ritik Singh writes about HR (Human Resource) software, cloud and enterprise technology. A dynamic content writer who writes for Pocket HRMS, a leading provider of cloud-based HR software with inbuilt AI-powered HR Chatbot (smHRty) to small and mid-sized businesses across India.