Do you want to create an investment app? In this article, we look at the key approaches necessary for creating such a product.

Many people are interested in investments. We live in an era of massive technological growth. In this light, it’s reasonable to expect that investments can offer significant long-term returns. In this article, we’ll look at the process of creating an investing app. What are we going to analyze? Our goal is to review the definition of an investment app, its types, and some of the key features one should consider for such software. How to create an investment app? Let’s find out!

What is an Investment App?

An investment app is a kind of software helping its users direct investments. For instance, imagine you want to invest some of your funds into Apple. What’s the most convenient way to do so in the modern world? You can download an investing app and proceed to make investments based on the information this software provides. There are many types of investment apps; the majority target diverging parts of the market. So, to understand what to do when creating an investing app, it’s essential to review some additional introductory information about the relevant technology.

Types of Investment Apps

Multiple types of investing apps exist on the market. Here are some of the key frameworks you should consider if you want to achieve success:

App type 1. Banking investment app

Banks are one of the best ways to invest. Why? They’re typically the safest place to store funds in. With a banking investment app, you’re likely to attract a large audience. Many people are willing to invest in this sector. If you’re interested in creating easy investing apps, these options are the best.

App type 2. Stock exchange investment

Stock exchange investments are typically more risky, but they offer better long-term incomes. Many people consider such options as perfect secondary directions for investments. This means you can attract many people to an app if you give some unique fund management opportunities. The stock exchange represents the most popular direction for long-term investments in the current market.

App type 3. Independent apps.

Most apps in the investment sector offer users services through cooperation with some large-scale investment platforms. In many cases, these platforms openly belong to particular organizations. Standalone apps in the investment app market refer to apps providing investment services independently, without requiring integration with other platforms or services. Why such an investing app may be preferable to other options? The reason is simple: the existing platforms create some significant limitations for the investors, making investments a difficult and confusing process. An independent app can resolve these problems and make every aspect of work much more comfortable.

Process for Creating Investment Apps

Creating an investment app involves several key steps to ensure its successful development and deployment. Here is a simplified overview of the process:

Idea and Planning

During the idea and planning stage of creating an investing app, you need to focus on the following steps:

1) Define the purpose and target audience of the investment app. Every app has a clear group of core users: you should have a good understanding of the people who are the most likely to use your app constantly. Without such an understanding, you risk disrupting the ability of your business to profit in the long-term scenarios.

2) Research the market and identify competitors. We recommend starting a business only if you can capture a particular niche. Starting a business in the field with many competitors is irrational: you’re likely to fight an uphill battle against a competitor with a well-established basis. Blue Ocean strategy claims that the most potent businesses succeed in areas without major competition. This means your goal should be to understand what are the fields with a minimal amount of competition regarding the investment sector.

3) Outline the app’s features and functionalities. Once you understand your potential customer and the relevant niche, it’s crucial to start outlining the design of your investing app. Why is it so important to understand the features of an app? This approach will help you analyze the feasibility of the idea and the approximate costs of the investments.

Design and User Interface

Easy investing apps are the most likely to succeed in the modern market. In this section, we look at some of the tips that can help you create a high-quality product:

1) Create wireframes and prototypes to visualize the app’s structure. A big aspect of success for investing apps is the maximum level of usability. You should focus on creating wireframes and prototypes to understand what features can maximize it in the long-term scenarios. Multiple prototypes are crucial for testing if a certain idea makes sense and if the users would be willing to accept it.

2) Design an intuitive and user-friendly interface. Creating wireframes and prototypes mentioned above is essential to ensure the user interface is as friendly as possible. One needs to plan the interface early on to guarantee its usability. Create multiple solutions and then test if some of them make sense from the standpoint of the end users. Few things are as potent for app success as several user interviews aimed at finding the best possible solution for interfaces. As Eleken company outlines in its blog, the absolute (above 80%) majority of users judge apps on the basis of first impressions.

3) Ensure compatibility with various devices and screen sizes. During the design phase, deciding what devices you will target with your investing app is essential. In our opinion, the key idea is to prepare solutions for multiple types of devices. You shouldn’t focus on one technology: modern apps tend to be cross-platform, and your development process must reflect this aspect.

Development

With a clear understanding of the app you will build, it’s essential to transition toward developing the investing app in question. Here are some tips that can help you with this process:

1) Choose a suitable technology stack and development platform. It’s not enough to have great code. Often, the quality of an app depends on the platform you’re using. The key goal here is to find a framework fitting your use area perfectly. In our case, we specialize in developing high-quality web and mobile solutions via Node.js and other JavaScript technologies. Address us if you want to try out the services of a company that knows how to deliver scalable solutions for its clients.

2) Implement the app’s front-end and back-end functionalities. Upon choosing the relevant technologies, it’s time to create the basis of your app. We recommend hiring separate specialists for tasks related to user interface and the internal basis of your app (for instance, calculations). In this respect, you may once again find the services of our company to be of interest. Why? We specialize in Node.js development. This platform is notable for enabling one to develop both the front- and back-end of an app in JavaScript. If you’re willing to create an investing app, such an option can be great because it’ll decrease development and maintenance costs.

3) Integrate APIs for real-time market data and trading functionalities. How to create an investment app that’s popular? You need to deliver maximal integration for the users. One should have the ability to get real-time market data and connect to key banking and trading platforms. The only way to achieve this is to integrate the central APIs. In this case, your goal is to start thinking about API integration as early as possible to achieve success.

Security and Compliance

Safety is essential for a successful business. Here are some aspects you should consider:

1) Implement robust security measures to protect user data and transactions. Investment apps tend to contain some vital user data. In our opinion, the best retail investment apps aren’t those that provide the maximum number of features but those that combine safety with many possibilities. Internet greatly raises the probability of fraud, creating massive dangers for the average user. To deal with this issue, at the very least, you should invest in encryption and two-factor identification.

2) Comply with financial regulations and standards. Some threats may also stem from the nature of transactions. Certain organizations use legal apps and even transactions to launder funds. You should focus on following and implementing all key financial regulations and standards to prevent such situations. This is the best way to avoid negative government sanctions (such as the ones Binance currently encounters).

Testing and Quality Assurance

After finishing the development of your app and ensuring its security, there’s still a lot to do. What should you focus on? Testing and quality assurance, of course. These are key steps you need to consider during this stage while creating an investing app:

1) Conduct comprehensive testing to identify and fix bugs or issues. You should have a dedicated team that can analyze all the potential problems of your app. Never leave the bug analysis to the customers: they won’t appreciate being beta testers for investment software.

2) Ensure the app performs well across different scenarios and devices. It isn’t enough to test an app for bugs. There’s an additional challenge: sometimes, problems arise due to the unique characteristics of certain platforms. You should test on several devices to ensure the users of an investing app get positive results in many scenarios.

Deployment and Launch

The final step in creating an investing app is deploying and launching the key software. Here are the key steps you need to consider if you want to achieve maximal success:

1) Publish the investment app on app stores like Google Play or Apple App Store. You should strive to meet all the standards for apps created by the relevant publishers. We believe the best way to promote simple investing apps is by targeting these two core platforms. Why should one create software with these marketplaces in mind? Apple and Google hold 95% of the global app market (except China).

2) Promote the app through marketing and advertising channels. With a full product prepared, you should start marketing it in as many channels as possible. We recommend focusing on the Internet channels that are central to your core audience (social media such as LinkedIn or even messengers such as Telegram). Most potential clients will likely be present there rather than in traditional marketing venues (for instance, TV and streets).

Maintenance and Updates

In the end, you should also consider the long-term existence of your apps. We believe the following actions are necessary for the financial investment apps:

1) Monitor user feedback and address any reported issues promptly. Testing is likely to remove many problems with your app. However, no amount of testing covers all the potential user problems. In this light, you should monitor the user feedback and try to understand their issues. Listen to what the users have to say: this information can be vital for the success of your project.

2) Continuously update the app to introduce new features and improvements. If you actively review the demands of the average users, updates will become essential to long-term success. Our recommendation here is simple: one needs to continuously update the relevant apps to introduce new features and improvements. An app without updates is an app that is likely to die.

Tips to Create an Investment App

Do you want tips for creating an investment app? Here are some of the key recommendations we can give our readers:

Identify your target audience

Understand the specific needs and preferences of your target users, if they’re novice investors, experienced traders, or a specific demographic. Tailor your app’s features and functionalities accordingly. There’s a market for both easy investing apps and some advanced options. You should analyze as many opportunities as possible.

Streamline user experience

Design an intuitive and user-friendly interface simplifying complex investment processes. Provide clear navigation, easy-to-understand language, and well-organized information to enhance user experience. A complex interface that makes most basic functions confusing for the clients is the easiest way to fail at promoting an app. The rule is simple regarding any type of app: the easier, the better.

Ensure data security

Investment apps tend to feature extremely sensitive information regarding the relevant users. How to create an investment app satisfying a maximum number of individuals? You should, above all, implement robust security measures to protect sensitive user information and transactions. Use encryption protocols, secure authentication methods, and regular security audits to maintain trust and credibility. Safety is the key to maintaining a positive reputation in the modern investment product market.

Integrate real-time market data

A major feature of the modern investment sector is the presence of changes in the key markets. If you can’t deliver reliable updates, there’s a risk your clients can fail to make high-quality decisions regarding their investments. What should you do? We believe you must incorporate reliable APIs to provide users with up-to-date market information, including stock prices, news, and financial data. Timely and accurate information enhances user decision-making and improves the overall user experience.

Offer customization and personalization

One constant defines our society: every person has a unique understanding of concepts such as comfort and user-friendliness. In this light, developers should allow users to personalize their investment preferences, portfolios, and notifications. Customizable features allow users to tailor the app to their specific investment goals and strategies, fostering a sense of ownership and engagement. An app that can be customized to fit the unique needs of the customers is the most likely to succeed in the modern markets.

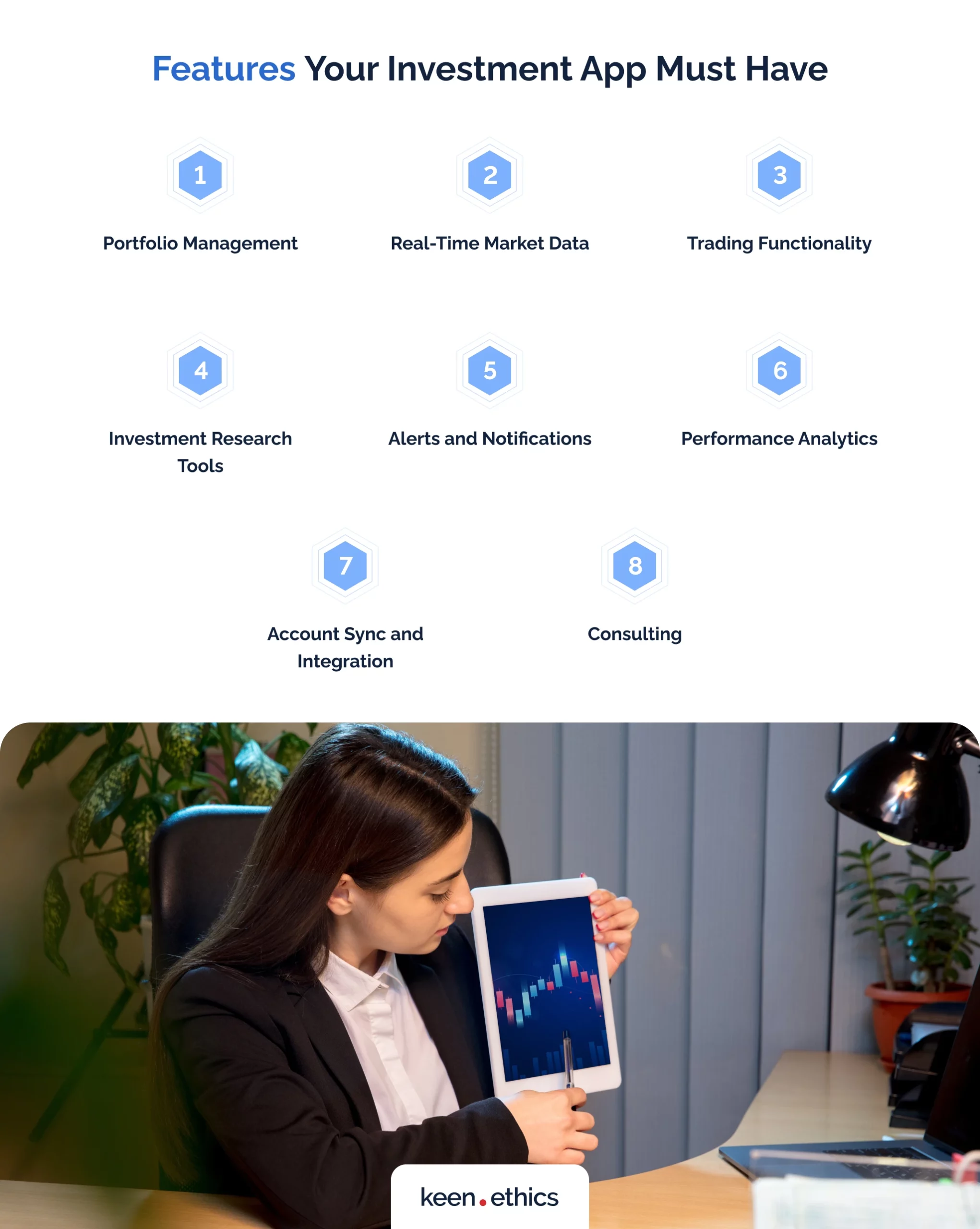

Features Your Investment App Must Have

Are you interested in the features an investment app must have? Here’s the list of the key things to consider for a high-quality solution:

Portfolio Management

Enable users to create and manage investment portfolios, track performance, and view holdings. Provide a clear overview of asset allocation and individual investment performance. The more information you offer, the better. The best apps deliver all-in-one solutions regarding the management of relevant resources.

Real-Time Market Data

Integrate live market data, including stock prices, indices, and financial news, to inform users about market trends and make rational investment decisions. Modern markets are changing: as United Fintech notes, to guarantee that users can choose reasonably, you should consider real-time data updates in an investing app.

Trading Functionality

Allow users to buy and sell stocks, bonds, mutual funds, and other investment instruments directly within the app. Provide a seamless and secure trading experience with order placement and execution. This feature is the core of investment apps: without it, you won’t be able to attract any users.

Investment Research Tools

Offer comprehensive research tools, such as company profiles, financial statements, analyst ratings, and stock screeners, to assist users in conducting thorough investment research. The more information you offer, the better choices the average users can make. Information is power in modern markets. Your users will appreciate the ability to maximize their influence by analyzing the key information.

Alerts and Notifications

Enable users to set personalized alerts for price changes, news updates, and other important events related to their investments. Timely notifications keep users updated and engaged with their portfolios. For many investors, investments are a side activity (even if it significantly impacts their lives). This means they should have the ability to respond to emergencies as fast as possible without having to personally monitor the relevant app all the time.

Performance Analytics

Provide detailed performance analytics, including charts, graphs, and interactive visuals, to help users analyze the performance of their investments over time. In this case, the logic is similar to real-time data: the more information you give, the better. Understanding one’s performance is crucial to defining a long-term investment strategy. Without proper statistics, many people may misjudge their investments and think that certain unprofitable investments are profitable.

Account Sync and Integration

Many investment apps don’t provide many options for managing a high-quality portfolio. In this light, allowing users to sync their investment accounts from different financial institutions and consolidate all their resources in one place makes sense. Integration with external platforms or brokers simplifies the management of multiple accounts. The best retail investment apps allow users to maximize investment from multiple sources.

Consulting

A major problem for many people using investment apps is that they can get carried away by their illusions. Few things are as potent as human greed, for example. It can push both experts and novices toward irrational investments. A good way to prevent such a scenario is to offer consultations. Input from other people is among the best approaches for preventing personal bias. What can you give to the customers in this situation? Options are diverse? Firstly, it’s possible to provide live consultations with specialists. Secondly, roboconsultations based on modern AI technologies can also be a great option if a person wants to save money. The more analytical options of this kind you offer, the better.

Related Services

MOBILE APP DEVELOPMENT SERVICES

How to Monetize an Investment App?

There are several ways to monetize an investing app. Here are some common methods:

1) In-App Purchases: Offer premium features or additional tools users can purchase within the app. This includes advanced analytics, personalized investment recommendations, or access to exclusive content. Such a module-based structure can be beneficial because it allows the users of an investing app to choose only those needed features.

2) Subscription Model: Implement a subscription-based pricing structure where users pay a recurring fee to access premium features or receive enhanced services. Different subscription tiers can be offered with varying benefits. Investors who work constantly may find an investment in the most expensive tier rational. Other users may want simpler options.

3) Commissions and Fees: If your app allows users to trade securities, you can generate revenue by charging transaction fees or commissions on each trade executed through the app. Many financial organizations build a significant amount of their revenue on transaction fees of various kinds.

4) Advertisements: Incorporate targeted advertisements within the app. Advertisers can pay to display their products or services to your app users, and you earn revenue based on the number of impressions or clicks. This approach perfectly works in conjunction with other types of monetizations: the users may offer funds for premium access to remove advertisements.

5) Partnerships and Referrals: Collaborate with financial institutions or brokers and earn referral fees or commissions for directing users to their services or products. This can include referring users to open brokerage accounts or invest in specific funds.

Remember to carefully consider your target audience and the value proposition of your app to determine the most suitable monetization strategy. It’s also important to balance monetization efforts with providing a valuable and user-friendly experience to retain and attract clients. A free version of an app should offer enough options to make at least a basic investment. Users hate apps they can’t try in action.

Related Service

NODE.JS DEVELOPMENT COMPANY

Examples of Successful Investment Apps

Here are examples of high-quality investing apps. We recommend using them for learning what practices one should pursue and some of the main errors to avoid:

- Robinhood: Robinhood is a popular investment app known for its user-friendly interface and commission-free trading. It allows users to easily buy and sell stocks, ETFs, options, and cryptocurrencies. Robinhood gained traction by appealing to younger, tech-savvy investors and providing a seamless mobile trading experience. It offers real-time market data, customizable alerts, and a social community feature for users to discuss investment ideas.

- Acorns: Acorns is an investment app focusing on micro-investing and aims to help users save and invest their spare change. It automatically rounds up everyday purchases to the nearest dollar and invests the difference in a diversified portfolio. Acorns simplifies investing for beginners by delivering pre-built portfolios based on user preferences and financial goals. It also provides educational content and financial advice to promote financial literacy.

- Betterment: Betterment is a roboadvisor app offering automated investment management and financial planning services. It uses algorithms to create and manage personalized investment portfolios based on user goals and risk tolerance. Betterment provides a hassle-free investing experience with features like automatic rebalancing, tax-efficient investing, and goal-based savings. It delivers low fees, a user-friendly interface, and a range of investment options, making it appealing to beginners and experienced investors.

Cost of Investment App Development

The cost of development an investing app primarily depends on the unique needs of your company. Some projects can cost 20000 USD. Others may require hundreds of thousands and even millions of dollars for development. We can’t say what project you have in your case. If you want to understand the approximate price of your project, the best option is to address the professionals and ask them to offer a full-scale analysis of your app and its potential costs. In this case, you can address us, for instance. Keenethics gives free estimates for various projects. Ultimately, we can tell you the app development price in our service. One hour of developer’s labor costs between 25 and 50 dollars (depending on the expertise of an individual and the complexity of the project). To calculate the average cost of your project, one should start the analysis with these figures in mind.

FAQ

What’s necessary to create an investment app?

To create an investment app, you need a clear idea, market research, design, development skills, market data integration, and robust security measures.

Is it rational to create an investment app?

Creating an investment app can be rational, considering the growing demand for digital investment solutions and the potential for revenue generation through various monetization strategies.

What’s the cost of an investment app?

The cost of an investment app can vary significantly depending on factors such as complexity, features, development platform, and design requirements. Contact us to make a free estimate of your project costs.

What are the types of investment apps on the market?

There are various investment apps on the market, including stock trading apps, roboadvisors, portfolio management apps, and financial news apps.