In this article, we discuss how to build a neobank from scratch. Read further to learn about the key aspects of creating high-quality products.

Do you want to build a neobank? The Internet is one of the most disruptive technologies in the history of humankind. Firstly, it offers an opportunity to create new services: social media has revolutionized communication. Secondly, it provides a pathway to transform the already traditional services. Neobanks belong to the second phenomenon: they involve the evolution of banking services towards a novel model. In this article, we’ll look at the ways to create a neobank. We overview the market and describe some key steps you need to take to create a banking facility with novel features. How to start a neobank? Read further, and you’ll learn.

What’s a Neobank and How Does It Work?

Neobank is a banking facility operating solely online, without using any physical locations. One can perform every imaginable financial activity within them without major barriers. It’s possible to manage savings accounts, take out loans, and transfer money, for example. Some neobanks offer their users physical credit cards. Others go for novel smartphone-centric bank technologies and make their cards fully virtual. Regarding the functioning of such banks, they usually cooperate with some large-scale banking organizations. Using their infrastructure, they allow the users to enjoy the services of a neobank within a safe framework. Neobanks differentiate themselves from traditional banks by leveraging technology and innovative features to give a more streamlined and customer-centric banking experience. They typically have user-friendly interfaces, real-time transaction notifications, and advanced financial management tools.

Why Create a Neobank: Overview of Market Opportunities

The key market opportunity related to neobanks has to do with the downsides of the traditional bank model. What are the key problems with them? The key one is that traditional banks require physical locations for their functioning. Let’s imagine you live in a rural location and need to create a credit card for some Internet transactions. Many traditional banks would require a personal visit to enable the creation of any accounts. This means you have to waste a lot of time to start some purchases. The situation can worsen: disabled people may find even more difficulties going to banks. In this respect, disability organizations report problems with the accessibility of banks. Neobanks are of interest because they solve the presented problem. You don’t have to visit any bank locations. Instead, you can create a bank account from home within several minutes (all that’s necessary is to offer some of the identifying documents). And what about cards? They’re not a problem too. Using virtual solutions or having a physical one delivered home is possible. That’s where the market opportunities come in. Many people find traditional banks inconvenient. Why build a neobank? The key reason is simple: it’s a perfect niche attracting many people alienated by traditional banks.

Examples of Popular Neobanks

Here are some major neobank companies that dominate the current market:

Revolut

Revolut is a UK-based neobank offering a range of banking services through its mobile app. It provides multi-currency accounts, international money transfers, spending analytics, budgeting tools, and investment options. Revolut has gained popularity for its competitive exchange rates, low fees, and innovative features like round-up savings and cryptocurrency trading. If you have ever wondered about the reasons to develop a neobank, Revolut is a perfect example to analyze. The success of the platform is undeniable in the current conditions.

Chime

Chime is a US-based neobank focusing on providing fee-free banking services. It offers checking and savings accounts, early direct deposit, automatic savings features, and a user-friendly mobile app. This bank highlights the key audience that wants investors to build a neobank. It includes young people who like traveling and no longer tie themselves to one location due to the distance work model. These individuals end up in situations where they don’t have access to the physical locations of traditional banks. The “bank-in-pocket” model of the neobanks solves their problems once and for all.

N26

N26 is a German neobank that operates across multiple European countries. It offers mobile banking services with features such as no-fee accounts, contactless payments, savings goals, and budgeting tools. N26 is known for its sleek design, user-friendly interface, and fast and easy account opening process. Among the key features of this bank is its international nature. It’s perfect for digital nomads: one doesn’t have to worry about problems with managing their funds within any European country.

Monobank

Monobank is a Ukrainian neobank that has gained significant popularity in its home market. It offers various mobile banking services, including fee-free accounts, instant payments, expense tracking, and personalized financial insights. Monobank’s mobile app has a user-friendly interface and provides real-time transaction notifications. The neobank has differentiated itself through its customer-centric approach, responsive customer support, and focus on delivering a seamless digital banking experience. Today, the bank is considering expansion into other markets (for example, the Polish one).

Neobanks vs. Traditional Banks: A Comparison

Here are the key features of neobanks and traditional banks. If you’re interested in the reasons to build a neobank, this review opens up insights into some of the key motivations:

Neobanks

Digital-first experience

Neobanks concentrate all their resources on online experiences. In this light, they have a major advantage over traditional banks: their services presuppose the maximum convenience of the customers. While traditional banks create banking apps as side projects, neobanks must deliver ideal experiences from the get-go due to relying on them.

Streamlined account opening and onboarding processes

Neobanks don’t have any physical locations. This means they have to provide an alternative process for opening a banking account. In this regard, they make it possible to open accounts without leaving one’s home. In traditional banks, one has to visit a real location before starting any financial activities. In the case of a neobank, all one needs to do is offer some key identification documents and fill out several small forms. Traditional banks may require several hours for the traditional registration process.

Innovative features like real-time notifications and financial management tools

A notable advantage of many neobanks is that they allow users to use advanced features. In this regard, neobanks pioneered the use of real-time notifications. Another vital innovation is the provision of advanced financial management tools: neobanks tend to offer more financial information than traditional banks. Why? Due to the absence of physical locations, the users have no alternative data sources. In this light, delivering maximal insights is the best way to achieve user satisfaction. Revolut, for instance, is notable for offering advanced budget planning frameworks.

Lower fees and better interest rates

Since neobanks don’t have physical locations, they save significant funds on service. Fees for traditional banks involve payment for the labor bank workers have to perform. In this respect, neobanks automate and digitalize the relevant tasks, lowering the traditional fees. Many users like neobanks because their services aren’t just convenient but cheap.

Traditional Banks

Physical branch presence

Traditional banks differ from neobanks due to the presence of physical branches. Among the key reason to build a neobank is the need to avoid the expenses associated with office upkeep. Physical branches are both a problem and an advantage. They limit banks to certain locations and are expensive. However, physical locations are crucial for working with complex customer requests. Neobanks are good at general bank activities but fail regarding advanced requests due to often using bots and pre-scripted solutions.

Established reputation and long-standing history

Traditional banks tend to have strong institutional history. The majority of the players are well-established and engage in safe investments. This means you risk less. Many traditional banks are under strong governmental supervision and have multiple safeguards for crises. Even such banks fail, of course. Credit Suisse, one of the oldest banks on the planet, has recently failed. The probability of failure is still lower than for the neobanks, which base themselves on an untested business model.

Wide range of financial products and services

Traditional banks have more resources to provide diverging financial products and services. No neobanks offer credit programs that are as diverse as in the case of traditional banks. If you’re looking for the best deals on the market, it’s better to analyze the offerings prepared by traditional banks. Traditional banks have more resources to promote low-interest property loans, for instance. Neobanks go for short-term loans with aggressive interest policies.

Regulatory oversight and stability

Traditional banks have been on the market for multiple hundred years. This means the governments had enough time to close many loopholes connected to common abuses perpetuated by the banking facilities. Neobank development has begun in recent years. In this light, the lack of regulation can backfire. This aspect is especially notable in connection to other innovations, such as cryptocurrencies. Neobanks are a perfect environment for various scammers, as data development company Shield notes. In this light, large savings are likely to be safer in traditional banks. Still, we must remember that this advantage of the traditional banks is temporary. In the future, neobanks will likely become as regulated as traditional banks.

Key Considerations Before Creating a Neobank

Before creating a neobank, here are four key considerations to keep in mind:

Regulatory Compliance

Understand and navigate the complex regulatory landscape for banking and financial services. Get the necessary licenses and approvals to ensure compliance with legal and regulatory requirements, such as anti-money laundering (AML) and know-your-customer (KYC) regulations.

Technology Infrastructure

Neobanks work fully online. In this light, they need more productive servers than traditional banks to guarantee stable work. When creating a neobank, you should answer the following question: does your region offer net infrastructure that can sustain long-term use by many clients?

Strategic Partnerships

Consider forming strategic partnerships with fintech providers, payment processors, or traditional banks to enhance your product offerings, expand customer reach, and leverage their expertise in specific areas. Collaborations can accelerate your time-to-market and help you navigate the complexities of the financial ecosystem. How to start a neobank that’s reliable? You have to cooperate with the existing players in the market to ensure a long-term guarantee for the clients.

Market condition

Opening any business in conditions when the key niches are already under the control of competitors is dangerous. The only reason to do this is the weakness of the potential competitor (for instance, the low quality of services). If you want to achieve reliable success, it’s better to compete in a field without much competition. If your country doesn’t have a well-established neobank, opening one is a perfect opportunity. The choice doesn’t make sense if there are several options on the market already.

How to Start a Neobank: Step-By-Step Guide

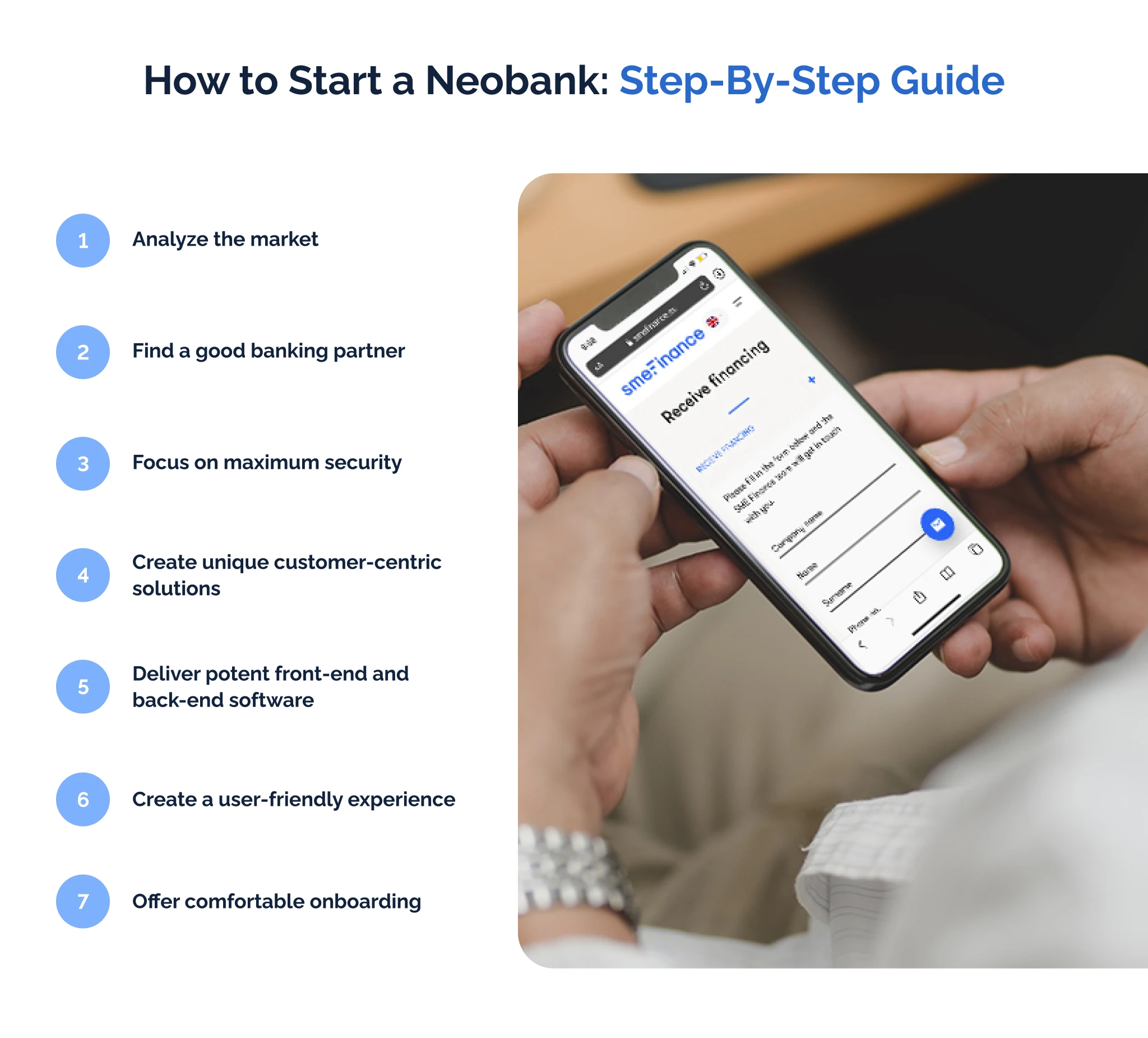

How to start a neobank? Here are some of the key strategic steps you need:

Step 1: Analyze the market

The first thing to do for any business is to look at the market. You should analyze if a niche for your product exists at all. Competing against well-established projects makes no sense.

Step 2: Find a good banking partner

All neobanks require help from traditional banks to function. They create an Internet-based infrastructure based on the existing solutions. Many traditional organizations may be interested in such a cooperation. Neobanks deliver them an opportunity to diversify their income flows. In this regard, you should look for an organization with the lowest banking fees.

Step 3: Focus on maximum security

The key problem of neobank development is the focus of the technology on the Internet. It offers many possible pathways for the disruption of the relevant service. In this light, you should make maximum investment in security. Your servers must have strong anti-DoS capabilities and encryption. Users should have access to fingerprint and two-factor identification. Banks that can’t ensure maximal security are the most likely to fail in the current market.

Step 4: Create unique customer-centric solutions

How to start a neobank? You need to offer your potential customers something unique. For instance, they should get comfortable opportunities for payday loans. To succeed, you need to give your customers something beyond the comfort of using the bank via the Internet. It should also give unique features to the average client.

Step 5: Creating potent front-end and back-end software

You need to choose scalable platforms. In this regard, we recommend concentrating on the languages such as JavaScript and platforms such as Node.js. They can allow a company to expand without creating long-term barriers if the number of users grows.

Step 6: Create a user-friendly experience

A big aspect of a neobank is the comfort of use. Many people hate banks for their non-friendly services. It’s difficult to understand how a particular financial service functions. How to build a neobank with a successful service? You should, above all, focus on the ease of use. Any customer should have no problems with using your service. One should test an app not only among young individuals but also among older adults.

Step 7: Comfortable onboarding

You should minimize the number of steps one needs to perform while creating a bank account in a neobank. The registration process should be as simple as possible. Moreover, the procedure for creating a credit card should be user-friendly. In this regard, one must be able to either get an electronic version of the card or get a plastic product delivered to their home.

What are the Methods Through Which Neobanks Generate Income?

Do you want to know how to monetize a neobank? Here are some of the key frameworks you should consider:

Transaction Fees

Neobanks charge transaction fees for certain services, such as international money transfers, ATM withdrawals, or expedited payments. These fees contribute to their revenue streams. How to build a neobank? You should consider the rational strategies of monetization first.

Interchange Fees

Neobanks earn revenue through interchange fees, which are fees charged to merchants for processing card payments. They receive a percentage of the transaction value when customers use their debit cards.

Subscription or Premium Plans

Some neobanks offer subscription or premium plans that provide additional benefits and features for a monthly or annual fee. These plans include perks like higher ATM withdrawal limits, cashback rewards, or premium customer support, generating recurring revenue for the neobank. A good example of such a service is the Iron Bank of the Ukrainian Monobank. This service offers a premium credit card made out of metal and multiple elite travel services to the average customer.

Neobank Trends: What to Watch Out For

Here are some of the key trends to look for when you consider the neobanks:

High level of security

A major factor for the neobanks is ensuring the safety of the customer funds. Neobanks work with the most vulnerable user information. In this light, they should do everything to prevent any data leaks or potential attempts to steal from clients. We recommend considering encryption, two-factor identification, and strong anti-DoS capabilities.

Maximal transparency

Many traditional banks are well-known for being discrete about their activities. A common practice is to obscure the conditions of the loans, for example. How to start a neobank that’s popular? You should break away from the presented trend once and for all. Transparency about the things you offer is essential for guaranteeing customer loyalty.

AI Integration

Many people are impressed with the progress of modern technologies, such as ChatGPT. In this respect, we recommend considering such technologies for neobanks. Machine learning tools help users better understand their spending patterns and, for instance, answer their questions about the service.

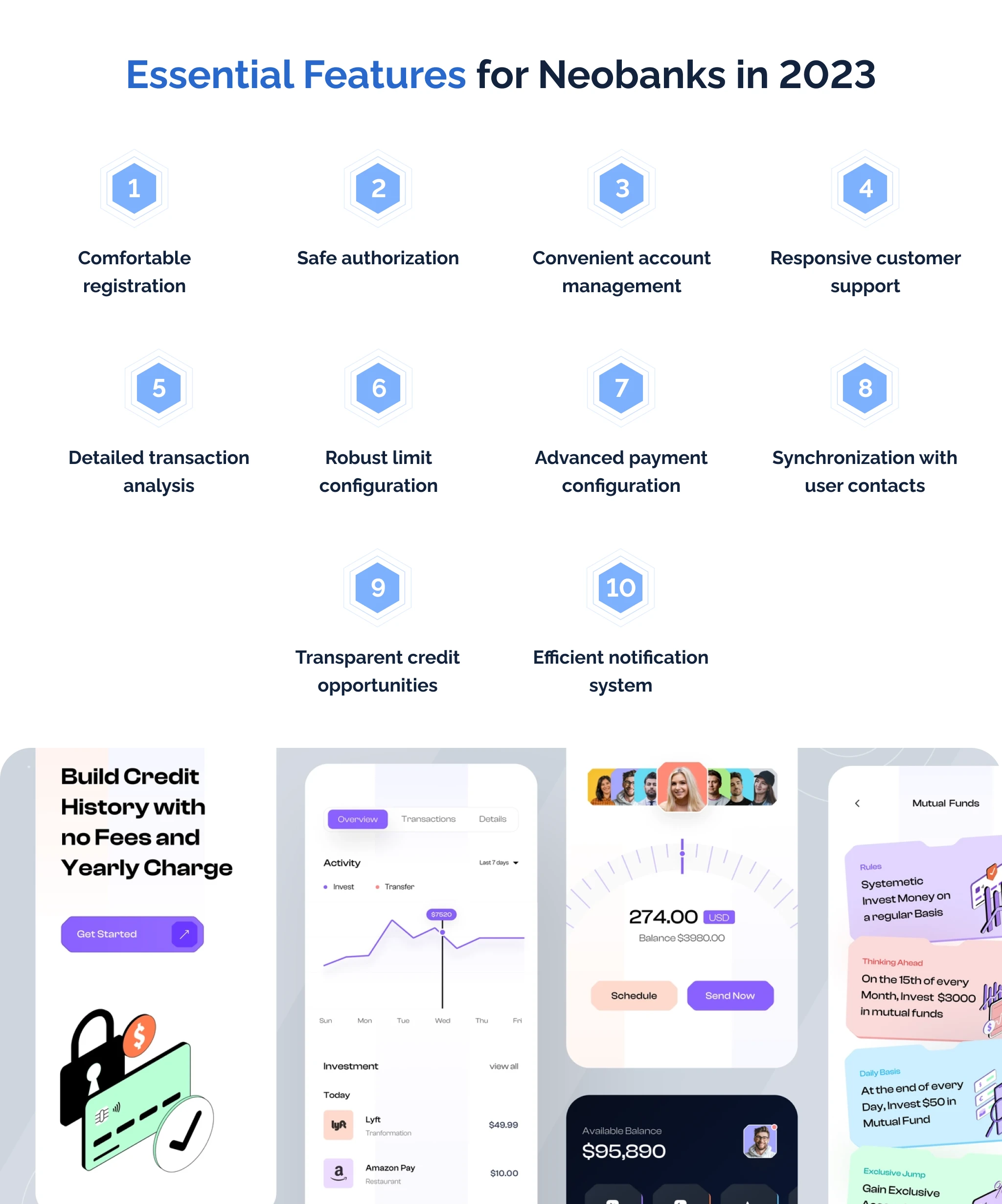

Essential Features for Neobanks in 2023

How to build a neobank? What features to include? Let’s review some of the key ideas:

Comfortable registration

The users should have the ability to register within your service without major barriers. You should minimize the number of steps and key documents to enable a high-quality service.

Safe authorization

When you develop a neobank, creating tools for safe authorization is central. If a non-owner authorizes into a banking account, the situation can result in stolen funds. We recommend creating password systems and two-factor identification frameworks to guarantee safety.

Convenient account management

Users should have the ability to control their accounts in diverging ways. This includes the ability to change interface elements and even delete one’s account.

Responsive customer support

Questions about your service are inevitable. Some people may encounter bugs. Others may want to know about the loan opportunities. To guarantee comfort for the users, you should offer them a chance to reach customer support without barriers. There should always be a person who can answer their request. Responsive customer service is the backbone of support for many companies. The success of Apple in the technological field is, as experts at Retently note, an outcome of its focus on outstanding customer help. Neobank development should integrate this aspect.

Detailed transaction analysis

The users of a neobank can’t go to a physical location to learn more about various transactions. In this light, you should offer as much information as possible about transactions. This is crucial for preventing fraud, for instance. The more data you provide, the lower the need to address the support of the bank.

Robust limit configuration

To prevent fraud or undisciplined spending (for instance, if you give a credit card to children), one should have instruments for configuring limits on a credit card. This option should be as open as possible.

Advanced payment configuration

Making a mistake during payment is easy: one wrong number leads to a significant loss of funds. You should offer advanced payment options: the users should have the option of saving some regular payments and checking if a card belongs to the right person.

Synchronization with user contacts

Many people are using neobanks. In this light, it makes sense to deliver integration with the user contacts. For example, if one user already has a neobank account, it’s easier to send money in this way. All one needs is to highlight the contact and their phone number to start a transaction.

Transparent credit opportunities

Many people prefer to cooperate with banks because they allow them to go beyond available funds. If you want your neobank to succeed, offering credit opportunities is essential. The less obscure factors they include, the better.

Efficient notification system

A problem of many traditional banks is that they don’t provide enough information about the aspects having to do with the functioning of one’s account. Notifications solve this problem. Using them, you can effortlessly warn the customers about changes in your business model or, for instance, attempts to break into their accounts.

Top Neobank Development Problems

Do you want to create a neobank? A vital factor is to consider obstacles that can arise in your way. Here are the core mistakes of the modern neobank businesses:

Failing to find a user niche

Some banks offer services without any unique features. It’s not enough to be a neobank. You should provide something other businesses can’t. Concentrate on customers that travel or play video games a lot.

Poor analysis of the market and competitors

The neobank market is becoming increasingly saturated. When you create a neobank, it’s crucial to understand if you can beat your competitors. It’s not enough to have a niche: one should also understand if the customers would bother to change their current neobank for your option. We recommend entering only if the market is competition-free. As the blue ocean strategy proclaims, you should not go into fields with high competition.

Uncomfortable UX and UI

The key reason to use a neobank is comfort. They’re supposed to offer a better experience than a traditional bank. Some companies on the market fail to understand this factor. They deliver a banking service with a bad interface. This approach is a recipe for a major failure.

Lack of idea testing

A big problem for many neobanks is that they don’t test if their idea works at all. If some niche seems good on paper, it won’t necessarily work. How to create a neobank from scratch? You should first test it in different environments. Begin with a minimum viable product.

Development team without experience

The most successful neobanks belong to people with experience in the banking sector. If you don’t know how to create a traditional bank, why do you think you know how to create a neobank? A strong neobank development effort should include people with real experience in the banking sector.

Developing a Neobank From Scratch: Main Challenges

What are the main challenges to consider when developing a neobank from scratch? Here are the key aspects

User safety

Any leak of personal information from a neobank can end in reputation damage or fund losses. This means you should maximize investments into user safety if you want to create a high-quality neobank.

Know Your Customer

People use banks for particular reasons. Some need discounts for particular services. Others want high-quality credit card opportunities. In this light, you should understand why people choose your service. Many banks fail because they make choices alienating their potential customers.

Payment speed

Neobanks are popular for their convenience. In this light, people expect aspects such as transactions to be more convenient within neobanks. You should choose the partners offering the best payment speed on the market.

Navigating regulations

Modern governments have strict requirements for banks. In this light, you should consider all possible obstacles you may encounter regarding government interventions. It’s essential to hire specialists who ensure the compliance of your service with government regulations.

How Much Does It Cost to Build a Neobank?

The development costs for neobanks depend on the scope of your needs. A small app can start with rather small prices (from 15000 dollars). Larger and more high-quality solutions can go to hundreds of thousands and even millions of dollars. Our company offers services at the following rates: between 25 and 50 dollars per hour of developer’s time. If you’re interested, don’t hesitate to contact us. We know how to create a neobank: our company already has experience in the financial sector.

Conclusion

To summarize, creating a neobank is a difficult process. Nonetheless, it’s far from being impossible. As this article shows, one must follow several clear rules to succeed. If you want to create a neobank, we recommend contacting specialists. In this regard, our company may be of interest to you because we have experience with multiple fintech products.

FAQs

What aspects do you need to analyze before starting a neobank?

Before starting a neobank, you need to analyze market demand, regulatory requirements, technology infrastructure, competitive landscape, customer acquisition strategy, and financial sustainability.

How to prevent a neobank from failing in the early stages?

To prevent neobank failure in the early stages, focus on market research, robust risk management, strong customer acquisition strategies, and adequate funding.

What banking partner do you need to pick?

When starting a neobank, it’s crucial to carefully choose a banking partner that can provide the necessary infrastructure, regulatory compliance, and operational support.

Can a person without banking experience start a neobank?

No, starting a neobank typically requires significant banking experience or partnering with individuals who possess relevant industry knowledge and expertise.

Are neobanks profitable?

Neobanks have the potential to be profitable, but they depend on factors such as their business model, revenue streams, customer acquisition, and cost management.

We’re here to help. Address us, and we’ll review all the key options available for you!