AI is one of the most discussed technologies these days. In this article, we look at the ways to apply it in finance and banking.

Artificial intelligence is one of the key trends in the modern world. This technology allows us to automate tedious tasks and boost productivity in relevant firms. The financial field is notable for the tremendous scope of information that is present within it. In this light, artificial intelligence in finance offers a perfect opportunity to optimize a huge amount of data. This article looks at the key benefits of such a transformation and analyzes some key examples of AI technology in the current finance-oriented field.

What is AI in Banking and Finance?

AI in banking and finance refers to the application of artificial intelligence technologies and techniques to enhance various processes and operations within the financial industry. It involves the use of machine learning, natural language processing, and data analytics to automate tasks, improve customer experience, detect fraud, provide personalized recommendations, optimize risk management, and make more accurate predictions. Artificial intelligence in banking and finance helps leverage large volumes of data for better decision-making, efficiency, and innovation.

The Role of Artificial Intelligence in Finance

What’s the role of artificial intelligence in finance and banking? In our opinion, artificial intelligence is vital due to its ability to make the work of many people easier. How exactly does it achieve this? Firstly, artificial intelligence tools lower the amount of work one has to perform: for example, they can help with calculations or even offer some advice to clients. Secondly, such tools are notable for their ability to serve as advisors for humans. We’re all prone to some errors: in this light, artificial intelligence in finance and banking can help relevant users discover major problems in their thinking. It’s a perfect tool for checking the input of human professionals and preventing mistakes on their part.

Benefits of AI Use in Banking and Finance

What are the benefits of using AI in banking and finance? Let’s look at the following positives you can get from the use of artificial intelligence in finance:

1. Reducing costs and risks

The first reason to use AI in banking and finance is the reduction of costs and risks. Primarily, AI can act as a perfect substitute for human labor. Manual tasks related to financial consulting, for example, can be automated. Of course, some complex cases may require human input, but the majority of requests for advice are simple: the clients want to know how to perform a certain action in a financial app or what options companies offer in terms of credit opportunities. The reduction of risks is also a significant aspect of the presented case. How exactly? AI tools can serve as perfect instruments for double-checking customer data.

2. Improving customer experience

Communication with relevant customers is a common problem for many banks and financial organizations. For instance, our experience shows that reaching customer support is often problematic. Many banks go so far as to hide the option of calling the support department behind various menus and automatic call software. An AI can solve this problem by offering benefits to both customers and companies. For example, clients can get high-quality answers to their questions from an AI tool. The companies, in turn, save funds on the workforce. Besides, AI instruments have other uses too: they reduce errors and make the long-term experience of the customers better by delivering them a more precise service.

3. Improving fraud detection and compliance with regulations

In what way do many criminals who perform fraud stay undetected? They use the weaknesses of various companies in terms of analyzing the data. It’s simply impossible for humans to review all the key information and prevent certain illegal actions from happening. AI offers an opportunity to analyze the so-called Big Data, large patterns and tendencies that may manifest from small bits of information. Using it, one can boost security levels by improving the ability to detect long-term threats, as IBM notes on its website. This approach is also central to better compliance with governmental standards. Why? It raises security levels and allows monitoring the potential breaches of key regulations.

4. Upgrading the loan-related decision-making

The key function of financial organizations in the modern world is the provision of loans. They’re crucial for the very fabric of our society: loans allow businesses to maximize the use of their profits for internal investments and enable the workers to purchase their homes and avoid exorbitant rent payments. What’s the problem with this system? If one doesn’t pay enough attention, a bank can give funds to unreliable partners. Such an issue resulted in one of the largest financial crises in human history, the 2008 Great Recession. Many banks were giving out home loans without checking the status of their clients. An AI system can help overcome this problem and prevent human bias. Such a framework can analyze the user score in seconds and offers a full-scale judgment on the ability of the relevant individual to pay. In fact, one can even raise the scope of the system and transition to open-source non-financial data to make informed decisions.

5. Automating investments

What’s the key problem of investing? It’s a time-consuming process if you want to optimize the majority of the decisions. More importantly, many investment choices are formulaic: what matters is strategy rather than tactics. The most successful investors earn by having a logical investment framework: they don’t avoid losses per se but focus on maximizing wins. AI systems are there to help users overcome this problem. What can they do? They offer an opportunity to automate tactical decisions on the market. With this factor in mind, one can focus on the strategy, investing more time into analyzing the relevant industries and insider information rather than reviewing the individual investor decisions at a particular time frame.

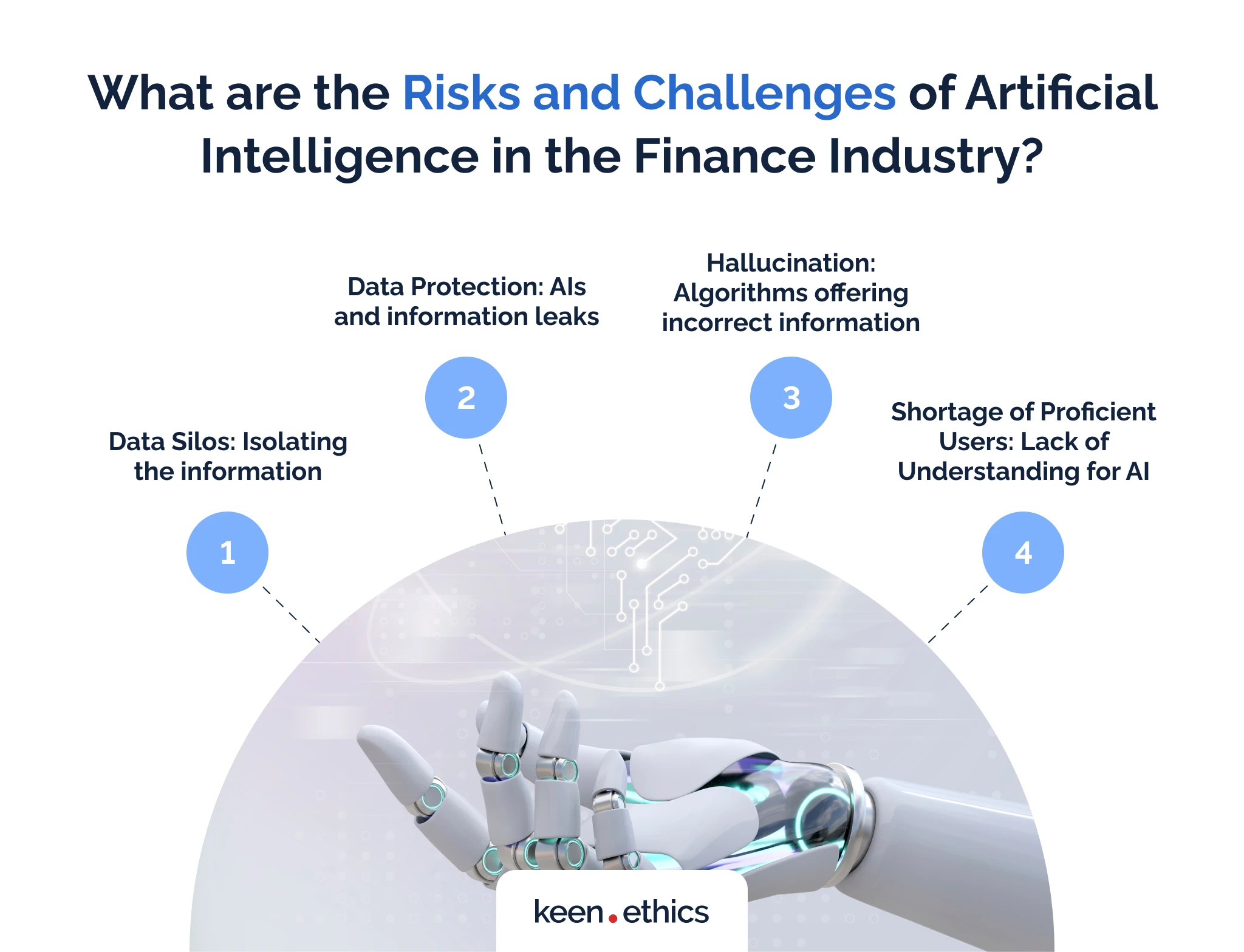

What Are the Risks and Challenges of Artificial Intelligence in the Finance Industry?

Let’s look at some of the key risks of artificial intelligence in the finance industry. Here are the key factors you need to consider:

Data Silos: Isolating the information

The first problem of AI in banking and finance is the probability of creating so-called data silos. A data silo refers to a situation where data is isolated and inaccessible to other parts of an organization. It occurs when different departments or systems store and manage data separately, hindering sharing and collaboration. Data silos can impede effective analysis, decision-making, and the development of a comprehensive view of an organization’s information. What may happen in the case of AI? The relevant system can produce so much data from interactions that it’ll be impossible to analyze everything. In this light, there’s a significant danger: AIs can make irrational and biased decisions without anyone noticing.

Data Protection: AIs and information leaks

A big problem with AIs is that they can potentially leak some vital information if one approaches them ‘properly.’ For example, there are many reports of users finding a way to push apps such as ChatGPT toward hypothetically illegal actions. Using clever prompts, a user managed to force the system to produce fake license codes for the new versions of Windows, according to Alex Blake at Digital Trends. With proper hacking tools, the perpetrators can use chatbots as an entryway into the banking systems. This means that modern decision-makers must actively consider making a major investment in the security of AI. There should be several systems in place that can analyze if the decisions of the relevant framework make sense.

Hallucination: Algorithms offering incorrect information

As we know from the current research, a big aspect behind modern AIs is their ability to ‘hallucinate.’ What does this mean? Modern artificial intelligence systems have a negative tendency to produce false information sometimes and present it as reliable. Some ways to overcome this problem exist. It may be possible to create reward systems for the AI frameworks favoring accuracy over confident presentation. Nonetheless, such a solution is far from being complete yet. How does this issue influence the AI sector? It means that all AI systems require human supervision. When a large tech site CNET tried to use an AI to produce articles without human supervision, the project ended in a reputational disaster. AI provided a lot of fake information, offering users misleading advice, according to Paul Fahri at Washington Post. They’re fine for small-scale decisions, but all major choices should receive a full human review.

Shortage of proficient users: Lack of understanding for AI

The final challenge modern AI poses for the market is the lack of specialists who know how to work with it properly. Many developers create such systems, but what about the users? As we’ve mentioned before, AI requires supervision. In this light, finding people who know how to deal with all the quirks of AI systems professionally is a challenge. If you want to maximize the utility of artificial intelligence, our recommendation is simple: start training people who can work with this technology as soon as possible. The revolution coming from AI in banking and finance is, more or less, inevitable. We recommend preparing for it.

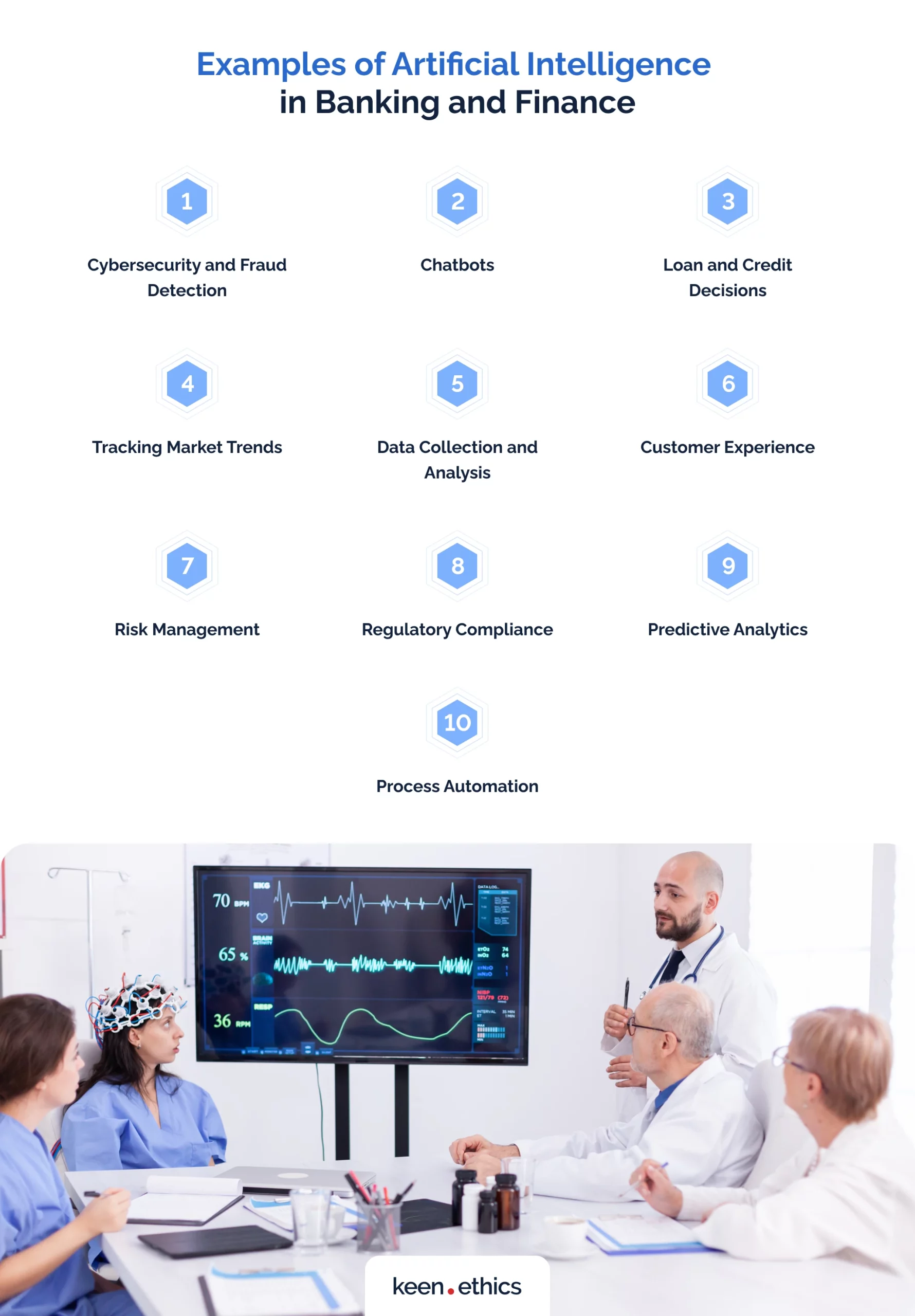

Examples of Artificial Intelligence in Banking and Finance

What are some examples of AI in banking and finance? Here are some key features you should pay attention to in your app.

Cybersecurity and Fraud Detection

AI helps banks detect and prevent cyber threats and fraud, such as identifying unusual transactions and unauthorized access attempts. Why is this approach important? It saves time for workers by improving the detection rates. Besides, such technologies boost efficiency too: AI algorithms are more efficient than the rather predictable frameworks that can’t learn from their mistakes.

Chatbots

AI-powered chatbots assist customers in banking tasks, such as balance inquiries and account transfers. A chatbot based on AI may serve as an automated private assistant that can advise clients. This approach is interesting because it saves a lot of time for customer support specialists. One can dedicate these experts to important cases rather than some minute issues. As Haptik, an AI-centric development company, notes, several AI chatbot options already exist on the market.

Loan and Credit Decisions

We can use AI algorithms to analyze customer data and determine loan eligibility. Such platforms offer a perfect framework for assessing credit risks. Why are they so important for the financial sector? In our opinion, the key advantage stems from the ability to analyze larger amounts of information. With modern AI algorithms, one can go beyond financial data and study open-source client information. Moreover, an AI can give a high-quality justification for its decisions. Such a tool may be a perfect framework for assisting the banking managers who decide if one should give out a loan or not.

Tracking Market Trends

AIs analyze market data to provide real-time insights into stock prices and existing trends. Moreover, it’s possible to even use AI tools to make some small-scale decisions on the market without the owner’s input. This framework is perfect both for improving data analysis in the relevant firms and boosting the ability of investors to make high-quality investment decisions.

Data Collection and Analysis

AI can automate data collection and analysis, enabling banks to make data-driven decisions. Such tools analyze millions of transactions and showcase different trends within them. We believe future AI tools will even be able to give out high-quality recommendations for decision-makers.

Customer Experience

AI enhances customer experiences by providing personalized recommendations and improving response times. With AI, everyone gets an assistant who is ready to answer at any time and place. This approach alone can reduce the number of questions one gets about a certain bank.

Risk Management

We’ve already mentioned the ability of AI to find fraudulent activities, for instance. Using this information combined with market analysis capabilities, you get an opportunity to minimize risks. AI makes many negative trends much more visible due to analyzing tremendous volumes of data.

Regulatory Compliance

AI helps banks comply with regulations by monitoring transactions for suspicious activities and ensuring adherence to compliance requirements. If you want to have a tool that will analyze any transaction, AI is perfect. This technology enables you to have a virtual assistant who can be present in multiple places at once.

Predictive Analytics

Modern AI uses historical data and algorithms to predict customer behavior and make accurate forecasts. This means you can clearly outline what features your customers will require with such a system. This approach offers a perfect opportunity to add features that fit the needs of the average customer.

Process Automation

AI automates manual tasks, such as data entry and document verification, improving efficiency and reducing errors. Automatic systems are faster and more reliable than human operators. Businesses that install them guarantee the highest level of productivity and a strong competitive edge in banking.

Artificial Intelligence in Banking and Finance Future

We believe the use of AI in banking and finance is more or less inevitable. In ten to twenty years, all companies on the market will use this technology in one way or another. What can we expect regarding features? In our opinion, the future of artificial intelligence in banking and finance holds tremendous potential. It’ll revolutionize customer experiences with personalized recommendations, advanced chatbots, and seamless transactions. AI will enhance risk management, fraud detection, and regulatory compliance. Predictive analytics and automation will optimize decision-making and operational efficiency, shaping the future of the industry.

To Wrap Up

AI in finance will likely become the key trend in the upcoming years. In this article, we’ve shown all the key aspects you need to consider if you decide to proceed with this technology. Are you interested in our services? Then, don’t hesitate to contact our company: we are here to provide high-quality consultation and development services.

FAQs

How do modern banks use artificial intelligence in finance?

Modern banks utilize artificial intelligence in finance for tasks like fraud detection, credit scoring, chatbot customer service, and personalized recommendations.

Why should I use AI in finance?

Using AI in finance can enhance efficiency, improve decision-making, automate processes, detect fraud, provide personalized experiences, and gain valuable insights from data.

Are there some examples of AI in finance and banking?

Yes, examples of AI in finance and banking include fraud detection algorithms, roboadvisors, chatbots, credit scoring models, and algorithmic trading systems.

Are you interested in this technology? Contact us to get an estimate of your AI project cost!